Throughout 2023, the corporate world experienced several significant ESG and sustainability milestones. The Corporate Sustainability Reporting Directive (CSRD) came into force, and organizations started making their mind up about climate disclosures. While record-breaking temperatures and extreme weather events in 2023 dramatically highlighted the urgency of addressing the climate change crisis, businesses and investors are now recognizing that sustainability is not just a corporate responsibility but a critical factor for long-term success. With the proliferation of climate adaptation strategies and planning, organizations are witnessing a rise in demand for tech skills and the integration of financial planning within their carbon management platforms.

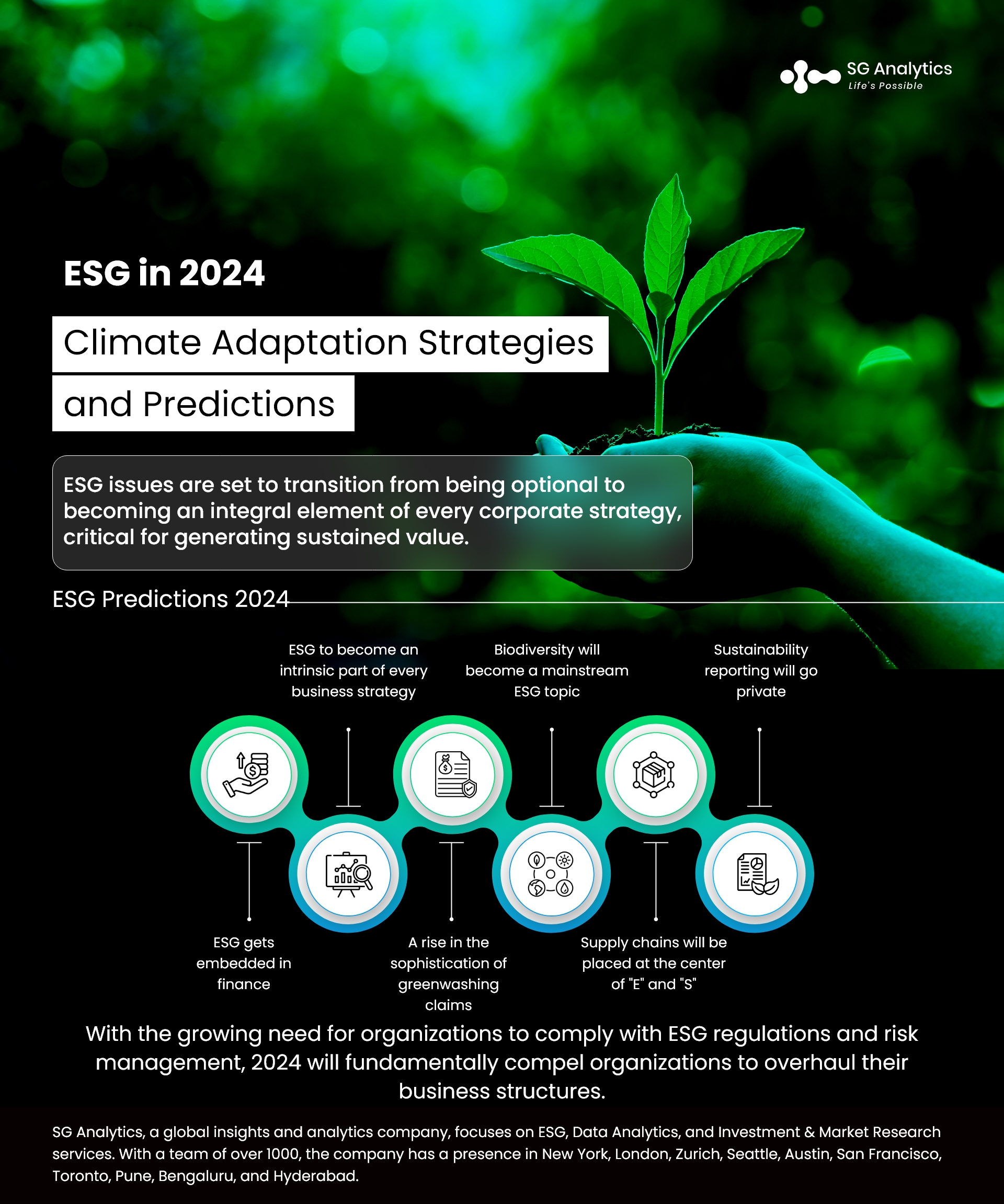

ESG issues are set to transition from being optional to becoming an integral element of every corporate strategy, critical for generating sustained value. With ESG breaking through into the mainstream despite the challenges, here are predictions that the landscape is likely to witness in 2024.

Read more: Navigating the Responsible ESG Marketing Landscape

ESG Predictions 2024

The sustainability landscape is set to evolve further. With confronting geopolitical uncertainties and slow economic growth heading into 2024, organizations are likely to witness the full spectrum of issues that will further influence ESG and sustainability strategies. Let's explore some of the most important ways that ESG will play an impactful role in 2024:

-

ESG Gets Embedded in Finance

In 2024, sustainability is set to be deeply embedded in the financial foundations of organizations. Nearly one-third of CFOs are examining the potential impacts of climate change on financial outcomes. Finance professionals take sustainability into consideration in the valuation of tangible and intangible assets. While the integration of ESG was already occurring, organizations were also creating ESG controller positions to manage the integration of ESG issues into an organization’s operations and financial reporting.

This amalgamation of sustainability, finance, and business strategy is reflected in the growing recognition. It further illustrates that sustainability and financial stability are not opposing goals but are intertwined fundamentally. As a result, integration of finances and sustainability is set to grow as a priority for corporate finance and accounting professionals.

-

ESG to become an Intrinsic Part of Every Business Strategy

In 2024, organizations will witness a shift where ESG factors will become deeply ingrained in their core strategy. Companies will increasingly acknowledge sustainable practices essential for reputation management and long-term profitability.

ESG integration will become intrinsic, thus influencing decision-making processes across all sectors. Standardized ESG metrics will be important in 2024. The plethora of reporting frameworks available makes it challenging for investors and stakeholders to compare ESG performance across organizations. Industry leaders will start collaborating to establish a unified set of ESG metrics to simplify their reporting and enhance transparency.

Read more: Leveraging Technology to Meet Sustainability Targets

-

A Rise in Sophistication of Greenwashing Claims

Moving into 2024, the notion of greenwashing - a term employed to call out misleading sustainability efforts and disclosures - is likely to be defined legally and will carry weightier repercussions.

Greenwashing involves reputational, regulatory, and litigation risks, and with no consistent legal definition, the concept of greenwashing varies for different products, services, and jurisdictions. Meanwhile, the EU is also making considerable progress in eliminating greenwashing by encompassing the development of new rules to limit false advertising and offer consumers enhanced information.

-

Biodiversity will become a Mainstream ESG Topic

While the topic of biodiversity loss gained steam last year, the trend is set to continue in 2024. Nature and land use were included as 2030 global deforestation goals at the global environmental conference Cop28 in December. In addition, investment funds focusing on biodiversity and nature are rapidly growing in number and assets. Assets under management in European funds will be solely dedicated to biodiversity.

-

Supply Chains will be placed at the Center of "E" and "S"

Several recent laws have mandated Scope 3 reporting and are driving organizations to prioritize ethical material sourcing, adherence to fair labor norms, and initiatives aimed at reducing environmental damage across the supply chain.

In supply chains, the intersection of environmental and social concerns is taking shape, and the development is likely to accelerate in 2024. Indeed, EU regulation - the Corporate Sustainability Due Diligence Directive - if passed, will require EU and non-EU companies to undertake environmental as well as human rights due diligence across supply chains.

ESG assurance providers are likely to struggle to scale up their capacity, thereby affecting their ability to meet the set timelines. Assurance practitioners will also witness a massive influx of ESG data that will demand limited assurance in a short duration. This emerging skills gap and capacity challenges will further shrink the market in 2024.

-

Sustainability Reporting will Go Private

Sustainability reporting is set to expand and include private firms due to Scope 3 rules. This will require reporting organizations to monitor their indirect emissions throughout their supply chain and among third-party vendors. This implies that regardless of public disclosure, private firms of all sizes will need to initiate or enhance their greenhouse gas accounting methods.

Scope 3 requirements will further drive significant transformations across all sectors as enterprises strive to meet the standards set by the largest players in their industry.

The 2023 Taskforce for Climate-related Financial Disclosures (TCFD) status report identified the number of firms disclosing under the board has increased significantly in the three years. A similar trend is likely to continue throughout 2024, as board commitments and responsibilities will be mentioned in transition plans. However, this does not imply that there won’t be consequences in terms of reputational risk.

Due to new climate-related regulations, many firms will start publishing their transition plans, and their commitment to meet certain targets will be under greater scrutiny, thus opening the door to litigation and reputational risk.

Read more: Climate Disclosure Legislation to Drive Businesses into a New Era of ESG Investment

Final Thoughts

In 2024, companies will start taking environmental, social & governance (ESG) activities seriously, thus proving that ESG is finally here to stay. While it is true that the ESG trends started due to the growing need for organizations to comply with regulations and risk management, 2024 will fundamentally compel organizations to overhaul their business structures.

Businesses will embrace ESG criteria not just for compliance or risk management but to fundamentally transform their business models. By gaining a full understanding and acceptance of the need and accountability, they will be able to identify the increasingly complex external risks across operations.

Through the revision of design processes, financial management, and marketing practices, organizations can resolve several ESG-related issues. At the same time, ESG will transition from being a peripheral component to being a central element for successful business strategies.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose, merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

A leader in ESG Services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG (Environmental, Social, and Governance) integration and management solution provider to boost your sustainable performance.

About SG Analytics

SG Analytics is an industry-leading global insights and analytics firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company and has a team of over 1100 employees and has presence across the U.S.A, the U.K., Switzerland, Canada, and India.

Apart from being recognized by reputed firms such as Analytics India Magazine, Everest Group, and ISG, SG Analytics has been recently awarded as the top ESG consultancy of the year 2022 and Idea Awards 2023 by Entrepreneur India in the “Best Use of Data” category.