Send Inquiry

Well-packaged

Well-packaged

In today’s ever-evolving data-driven world, the ability to extract critical insights from massive amounts of data is more...

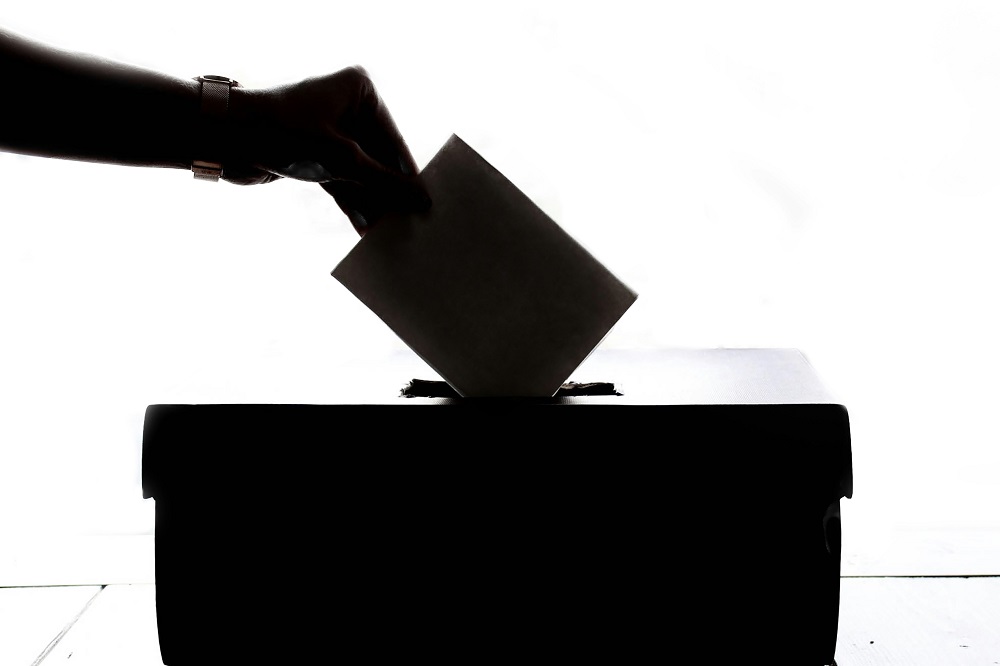

Decoding Election Dynamics in Major Economies and its Influence on Monetary Policy

Do elections dictate rate cuts? In recent times, there has been a captivating interplay between political events...

From Digital Transformation to AI Revolution: Navigating the Curve

Businesses have been undergoing profound changes. Under digital transformation, organizations are shifting significantly to...

Implementation of Strategic Framework to Foster Gender Equality in Workplace

In today's corporate landscape, gender equality in the workplace is an ideal and a quantifiable advantage. More and more...

Ultimate Guide to Power Your Organization's Sustainable Digital Transformation

For organizations today, becoming more digital drives sustainability and operational goals. The use of less energy helps drive...

The Future of Data Governance: Top Trends to Watch Out For

In 2024, organizations are likely to face a complex landscape encompassing data compliance and enablement. Organizations will...

Data Dynamics: Streamlining Operations, Boosting Quality

Reliable business ideas and performance insights empower leaders to accelerate market expansion to surpass competitors in the...

Data Management Tools: 2024 Outlook

An efficient toolkit can make capturing, transforming, and analyzing data easier. Therefore, data managers want reliable...

Climate Actions 2050: Setting a Competitive Path to Achieve Net-Zero Goals

Net zero goals must be aligned with broader sustainable development objectives. This will help imply an equitable net-zero...