Send Inquiry

We partner with institutional asset managers, hedge funds, single/multi-family offices, independent money managers, and fund houses.

We partner with full-service banks, regional banks, cantonal banks, NBFCs, and business and product strategy teams.

We partner with financial information providers, sector intelligence platforms, and ESG and sustainability data providers.

We partner with investment banks, ECM/DCM teams, independent brokers, institutional sell-side houses, and independent research providers.

We support large, boutique, and sector-focused private equity firms, venture capitalists, angel investors, private companies, and start-ups.

We partner with independent credit rating houses, ESG rating houses, and global exchanges across asset classes such as equity, bonds, commodities, etc.

We partner with advisory teams, discretionary teams, investment strategy teams, and independent wealth managers.

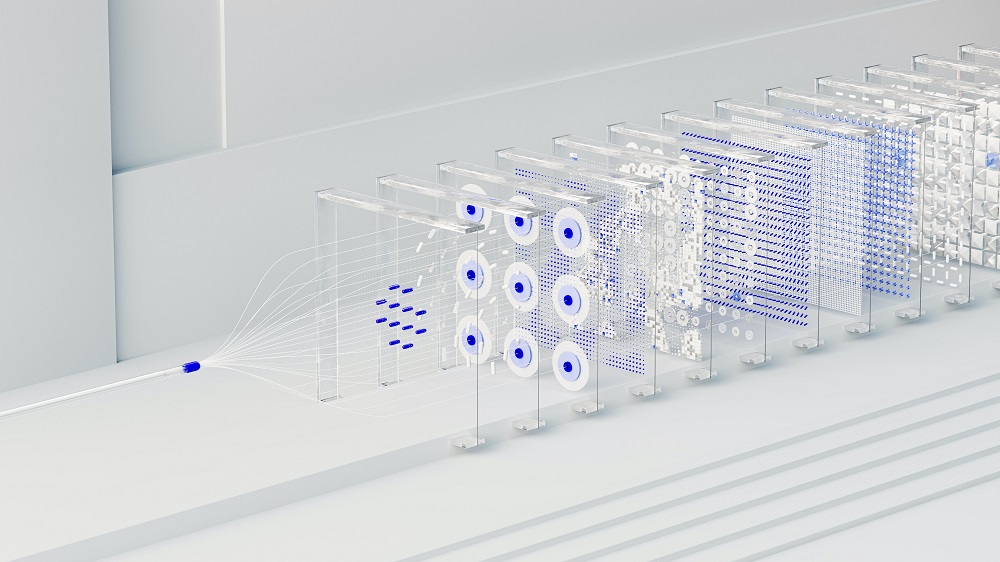

Cutting-edge Infrastructure

Able and secure pipelines for identifying, collecting, moving, analyzing, and communicating data

Industry Leader

Partner of choice for leading global private banks

Speed

Automation-driven solutions to ensure a quick turnaround and ready-to-send outcomes

Scalable

Highly customized, scalable, and flexible solutions to cover large investment universes

White Papers

China Real Estate - In Desperate Need of More Policy...

China’s real estate sector has been significantly impacted by the introduction of the three red lines policy, eventually leading to a liquidity crunch...

White Papers

The Super Cycle in European Defence Spending

Regardless of its errors in judgment, political blunders, and glaring lack of soft power, Russia will only be able to win in Ukraine if it has a military...

White Papers

China Real Estate Signs of Moderation in Free Fall

Since the announcement of China's three red lines policy in August 2020, the real estate sector has been heavily impacted by it, eventually leading to a...

CASE STUDIES

Insightful, relevant research combined with sophisticated technology solutions to help drive value-accretive decisions and run efficient processes.