Do elections dictate rate cuts?

In recent times, there has been a captivating interplay between political events and monetary policy decisions on the global stage. As nations embark on electoral processes, central banks find themselves grappling with the intricate task of fostering economic growth while mitigating inflationary pressures. This complex relationship warrants a closer examination.

In 2024, several countries are gearing up for pivotal elections. Particularly noteworthy are the elections scheduled in seven of the globe's 10 most populous nations, encompassing the United States (U.S.), Mexico, United Kingdom (U.K.), Indonesia, India, Russia, and Taiwan. Additionally, the European Union (E.U.) is poised for parliamentary elections. These nations collectively account for over 40% of global Gross Domestic Product (GDP), underscoring the significance of this year on a global scale.

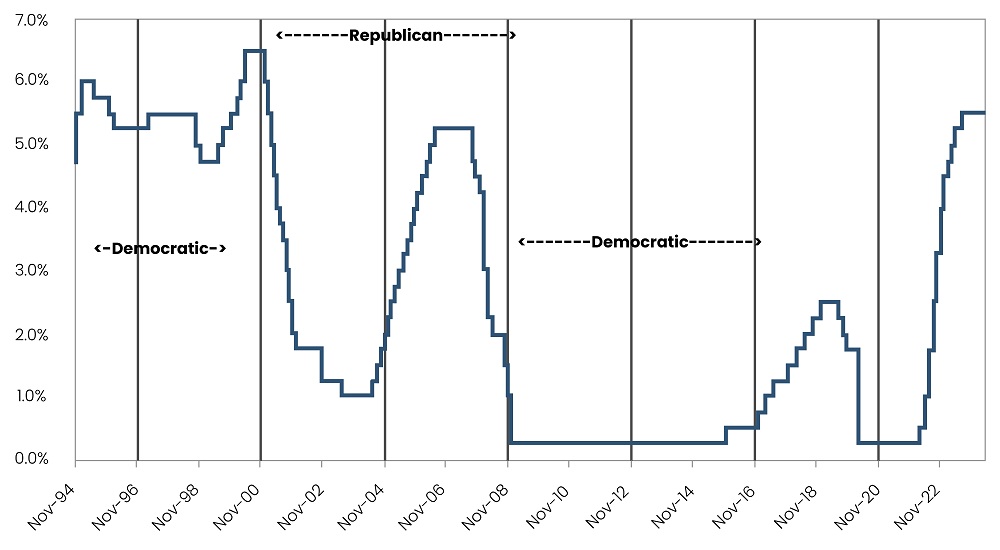

Figure 1: Major elections in 2024

Source: Electionguide.org, SG Analytics Research

Battle for America's economic future: Trump vs Biden in the 2024 election

All eyes are on the 2024 U.S. elections scheduled on November 5, featuring the likely Republican nominee Donald Trump against the incumbent Joe Biden. Trump focused on bolstering growth through substantial tax cuts and deregulations in his first term. As he looks forward to a potential second term, his agenda revolves around maintaining these tax reductions and advocating further measures.

Conversely, Biden champions tax hikes on corporations and high-income households, with the aim of financing expanded government investments in sectors such as clean energy, infrastructure, and social sectors such as education, healthcare, childcare, and social security. Democrats prioritize income redistribution as a core principle. Republicans emphasize fiscal prudence, intending to curtail government spending through planned reductions. Overall, the race is going to be tight as both parties will put effort into winning the presidency.

Soft Landing’ could result in multiple rate cuts by the Fed in 2024

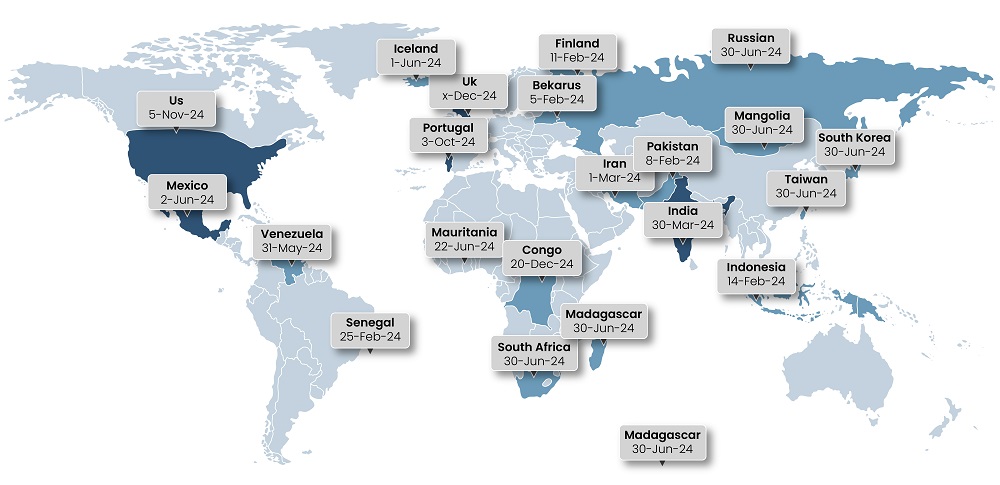

Turning to the monetary policy landscape, interest rates have generally remained stable under Democratic administrations compared to Republican ones. However, in 2020, the pandemic overshadowed policy decisions, prompting the Federal Reserve (Fed) to reduce interest rates to bolster the economy. Nevertheless, the near-zero interest rates and quantitative easing measures resulted in heightened inflationary pressures, necessitating a significant uptick in interest rates.

Looking ahead to 2024, forecasts indicate a ’soft landing’ for the economy in the election year, with the market anticipating multiple rate cuts devoid of political intervention. Presently, it is projected that the Fed will implement three interest rate reductions, each by 25 basis points (bps), totaling 75 bps in the latter half of 2024.

Figure 2: Fed rates vs U.S. election dates

Source: Federal Reserve, S.G. Analytics Research

Mexico's crossroads: USMCA violations, security crisis, and election autonomy in 2024

2024 is shaping up to be a pivotal year for Mexico, the U.S.’s most crucial trading partner. Under the current administration of President López Obrador, Mexico has violated several provisions of the 2018 United States-Mexico-Canada Agreement (USMCA). Additionally, escalating issues such as organized crime, corruption, and energy crises stemming from stagnant oil production have led to chronic underinvestment in vital sectors such as education, healthcare, and infrastructure. These factors have led to complications in the Mexican policy landscape.

On the opposing front, the Frente Amplio por México, led by Xóchitl Gálvez, has vowed to reform the electoral process for future autonomy and tackle the escalating security crisis and cartel violence prevalent under the current administration. While both candidates lean left, Gálvez's pragmatic approach adds a layer of competitiveness to the race, resulting in a tight competition for victory.

Bank of Mexico will reduce interest rates amid prevailing political and economic instability.

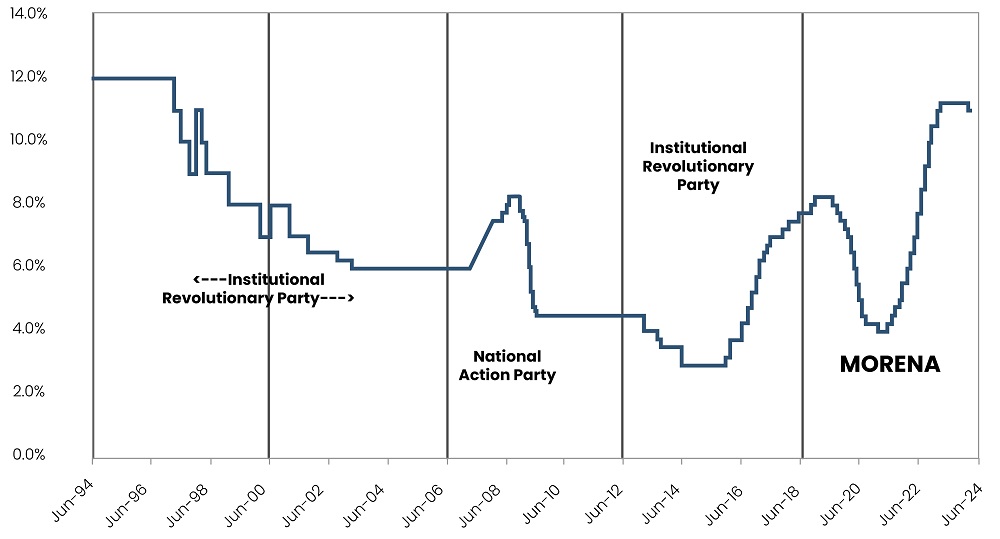

Mexican monetary policy has undergone a significant shift post-election, primarily driven by economic and inflationary considerations. There is no evidence to suggest that political influences have played a role in these policy changes.

On March 21, 2024, the Bank of Mexico made its first interest rate cut since the onset of the COVID-19 pandemic, aiming to address economic instability. Further rate reductions are anticipated in the next two quarters of 2024 as inflationary pressures begin to ease. Although interest rate fluctuations during previous election years have been minimal, the trajectory of the bank's rate cuts in 2024 presents an intriguing prospect, particularly against the backdrop of a challenging economic and political environment.

Figure 3: Bank of Mexico rates vs Mexico election dates

Source: Bank of Mexico, S.G. Analytics Research

U.K. election amid economic turmoil: Inflation eases, wage increases, mortgage pressures mount

The U.K. stands on the verge of electing a new Prime Minister in 2024 after navigating a turbulent path in recent times. The economy is experiencing a challenging phase, grappling with successive shocks. Although there are signs of easing inflationary pressures, there is hope for a rebound in real wages in 2024. However, the aftermath of monetary tightening looms large, particularly for the increasing number of borrowers who are facing the prospect of refinancing mortgages at significantly higher rates.

The U.K. economy took a downturn in the second half of 2023, plunging into recession and dealing a significant blow to the current Prime Minister Rishi Sunak's Conservative Party. In contrast, the opposition Labour Party's Green Prosperity Plan (GPP), aiming to allocate £28 billion annually toward low-carbon infrastructure, has stirred mixed reactions, positioning the party as a frontrunner in advocating for green investment.

To counteract the prevailing negativity, tax cuts have been announced in the latest budget. Nonetheless, it remains intriguing to observe how the alignment of both parties' policies will fuel public speculation, particularly regarding poverty, inequality, taxation, and state intervention in the economy, thereby influencing the election results.

Bank of England to slash interest rates in 2H24

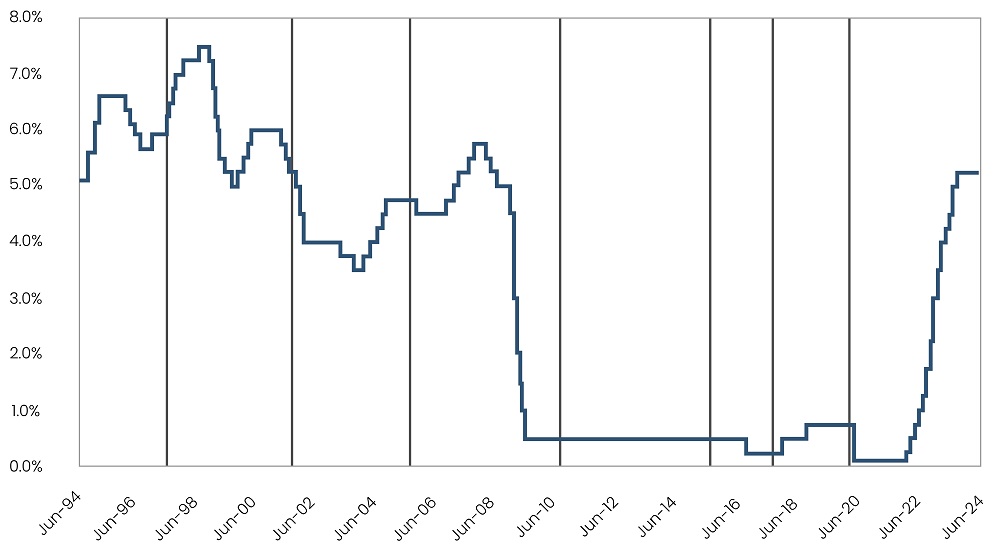

The figure below (Figure 4) reveals that past instances indicate that elections have no influence on the Bank of England's (BOE) interest rates. The bolstered economic sentiments have instilled confidence in policymakers, with the interest rate anticipated to remain unchanged until 2H24. Notably, for the first time in this cycle, no members advocated for further rate hikes, following two members favoring a quarter-point increase at the previous meeting. In its latest monetary policy decision, the Monetary Policy Committee votes 8-1 to maintain rates at their current levels, with one member proposing a 25-bps reduction to 5%.

Figure 4: Bank of England rates vs U.K. election dates

Source: Bank of England, SG Analytics Research

India's election stability: BJP's path to growth and stability

In India, the election outcomes are comparatively more predictable than in the above-mentioned countries. The Bharatiya Janata Party (BJP), currently in power under the leadership of Prime Minister Narendra Modi, has garnered popularity owing to its nationalist policies, initiatives for economic growth, and strides in improving foreign relations. According to a recent report by Goldman Sachs Research, the 2024 India election is expected to stimulate consumption growth through subsidies. Following the election, there is an anticipation of a rise in private investment owing to well-capitalized banks and robust manufacturing balance sheets. Overall, the political landscape in India appears to be more stable, with minimal possibility of disruption.

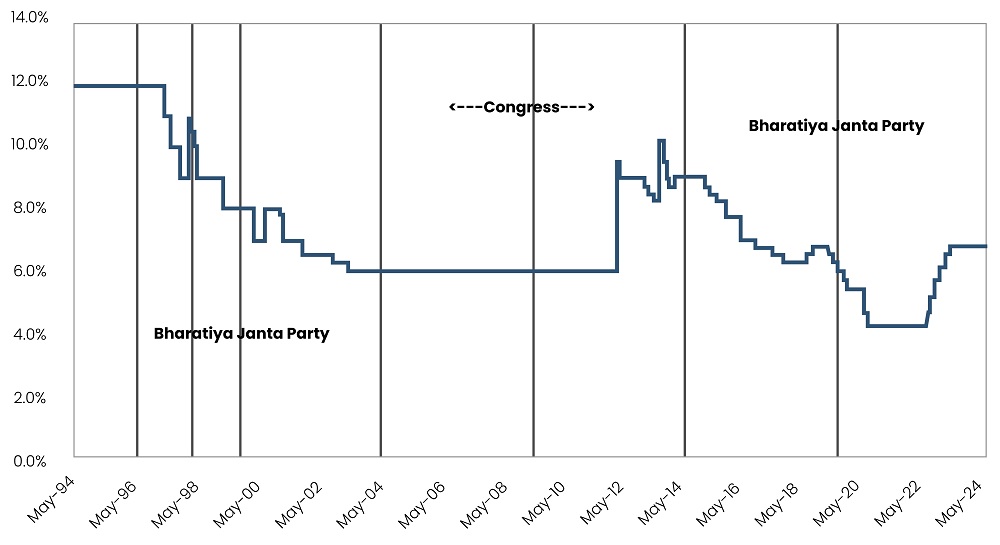

RBI to remain cautious in rate cut as inflation may spoil the recovery

In the past, there have been conflicts between the government and the Reserve Bank of India. However, the monetary policy has steadfastly remained impervious to political pressure. Furthermore, historical evidence indicates that while elections have historically sparked market volatility, interest rates have remained stable in the short term, primarily influenced by economic conditions. Presently, due to elevated food inflation, the RBI exercises caution regarding interest rate cuts, anticipating a shallow easing cycle.

Figure 5: RBI rates vs India election dates

Source: Reserve Bank of India, SG Analytics Research

In conclusion, as we navigate through 2024, the intricate dance between elections and monetary policy decisions promises to leave an indelible mark on the global economic stage. While historical data suggests that monetary policy remains insulated from direct political influence, the fiscal policies adopted by elected parties wield considerable power to sway economic trajectories. The aftermath of elections reverberates throughout economies, reshaping the terrain upon which monetary policies must tread. Therefore, the interplay between fiscal and monetary strategies is pivotal in determining the course of economic fortunes in the coming years.

A leader in Market research, S.G. Analytics enables organizations to achieve actionable insights into products, technology, customers, competition, and the marketplace to make insight-driven decisions. Contact us today if you are an enterprise looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.

About S.G. Analytics

SG Analytics (SGA) is an industry-leading global data solutions firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company with a team of over 1200 employees and a presence across the U.S.A., the UK, Switzerland, Poland, and India.

Apart from being recognized by reputed firms such as Gartner, Everest Group, and ISG, SGA has been featured in the elite Deloitte Technology Fast 50 India 2023 and APAC 2024 High Growth Companies by the Financial Times & Statista.