Alternative investments are forms of investment that are not classified into traditional asset classes like stocks, bonds, or cash. Private equity, venture capital, hedge funds, real estate, commodities, infrastructure, and other types of investments are examples of alternative ones. The possibility of higher returns and portfolio diversification has increased the popularity of alternative investments in India over the last few years.

Size of India’s Alternative Investment Market

Over the last few years, India’s alternative investment market has been gradually expanding.

The alternative investment assets under management (AUM) in India in 2022 were $72 billion, according to the Preqin Benchmark Report for India Alternative Investment Funds. This represents an increase of more than 100% from 2016 when the AUM was $36 billion. The main drivers of alternative investment market expansion are Investment in real estate and private equity.

As of 2023, the Indian alternative investment industry is estimated to be worth around $90 billion. This estimation includes all types of alternative investments, such as private equity, venture capital, hedge funds, and real estate funds, according to Outlook India.

Increasing wealth of Indian households: The middle class in India is expanding rapidly, leading to a rise in the proportion of households with investable assets.

- Rising interest rates: Increasing interest rates reduce the appeal of conventional assets like fixed deposits. This compels the investors to look for alternative investments with higher yields.

- Regulatory changes: In an attempt to make it simpler for investors to enter these markets, the Indian government has made a few modifications to the legal environment for alternative investments.

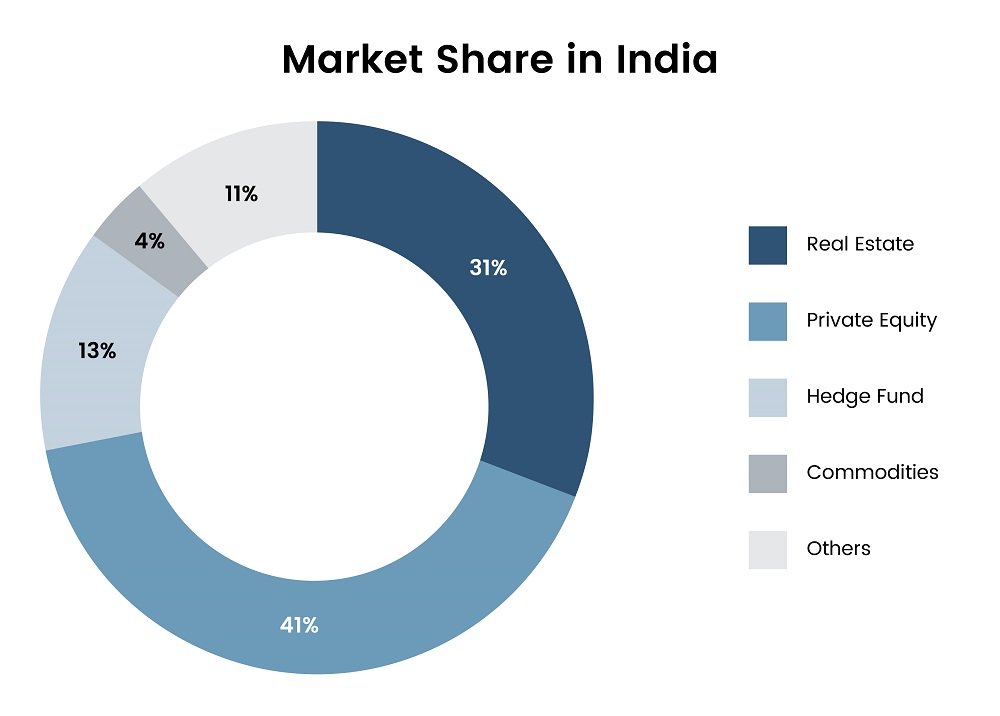

The key investment portfolio in the alternative investments market and their market shares-

Source – India Private Equity Report 2022 by Bain & Company

Risks connected to investing in alternative investments are illiquidity, volatility, lack of transparency, and fraud.

Despite the dangers, alternative investments can provide investors with excellent returns and diversity. Investors considering making an alternative investment should carefully assess the advantages and risks before choosing an option.

Conclusion

Adding alternative investments to your investing portfolio might be a great approach to potentially increase returns and reduce risk. By looking beyond stocks and bonds for additional asset classes, you can take advantage of prospective opportunities and alternative investment techniques. Before making alternative investments, do your homework, consult a professional if necessary, and carefully consider your financial objectives and risk tolerance.

SG Analytics, recognized by the Financial Times as one of APAC's fastest-growing firms, is a prominent data insights and analytics company specializing in data-centric research and contextual analytics. Operating globally across the US, UK, Poland, Switzerland, and India, we expertly guide data from inception to transform it into invaluable insights using our knowledge-driven ecosystem, results-focused solutions, and advanced technology platform. Our distinguished clientele, including Fortune 500 giants, attests to our mastery of harnessing data with purpose, merging content and context to overcome business challenges. With our Brand Promise of "Life's Possible," we consistently deliver enduring value, ensuring the utmost client delight.

A leading enterprise in Data Solutions, SG Analytics focuses on integrating a data-driven decision framework and offers in-depth domain knowledge of the underlying data with expertise in technology, data analytics, and automation. Contact us today to make critical data-driven decisions, prompting accelerated business expansion and breakthrough performance.

About SG Analytics

SG Analytics is an industry-leading global insights and analytics firm providing data-centric research and contextual analytics services to its clients, including Fortune 500 companies, across BFSI, Technology, Media & Entertainment, and Healthcare sectors. Established in 2007, SG Analytics is a Great Place to Work® (GPTW) certified company and has a team of over 1100 employees and has presence across the U.S.A, the U.K., Switzerland, Canada, and India.

Apart from being recognized by reputed firms such as Analytics India Magazine, Everest Group, and ISG, SG Analytics has been recently awarded as the top ESG consultancy of the year 2022 and Idea Awards 2023 by Entrepreneur India in the “Best Use of Data” category.