Countries across the globe are paying a heavy price for Russia’s war in Ukraine. Deemed a humanitarian disaster, the war has led to the killing of thousands and forced millions to flee from their homes. The war has also triggered global economic unrest by onsetting the cost-of-living crisis.

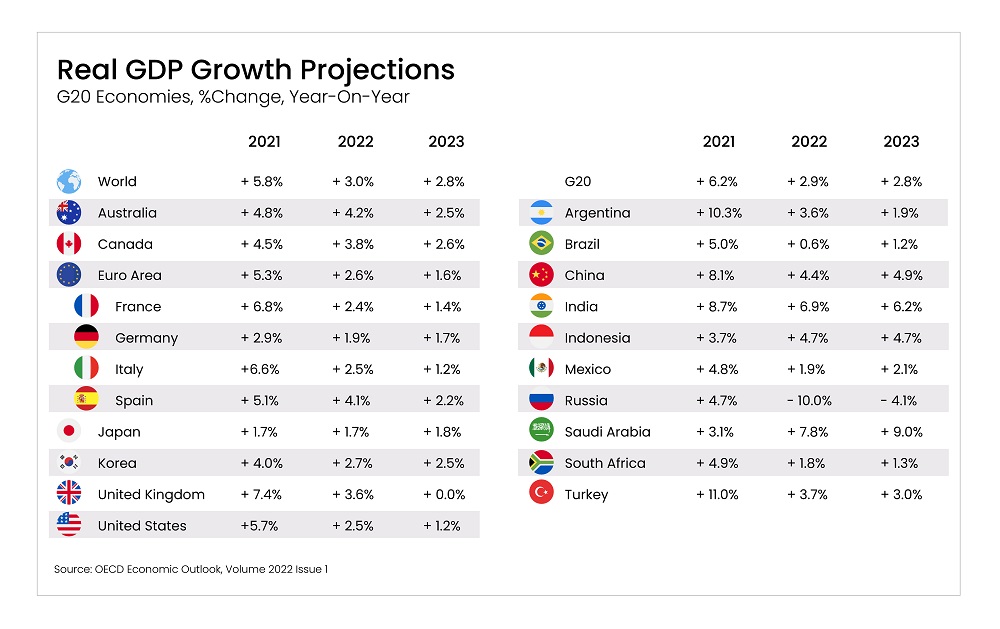

When coupled with China’s zero-COVID policy, the war has led the global economy on a path of slower growth and higher inflation. This is being largely driven by steep increases in the price of energy and food and is raising serious security risks for countries with poor economies.

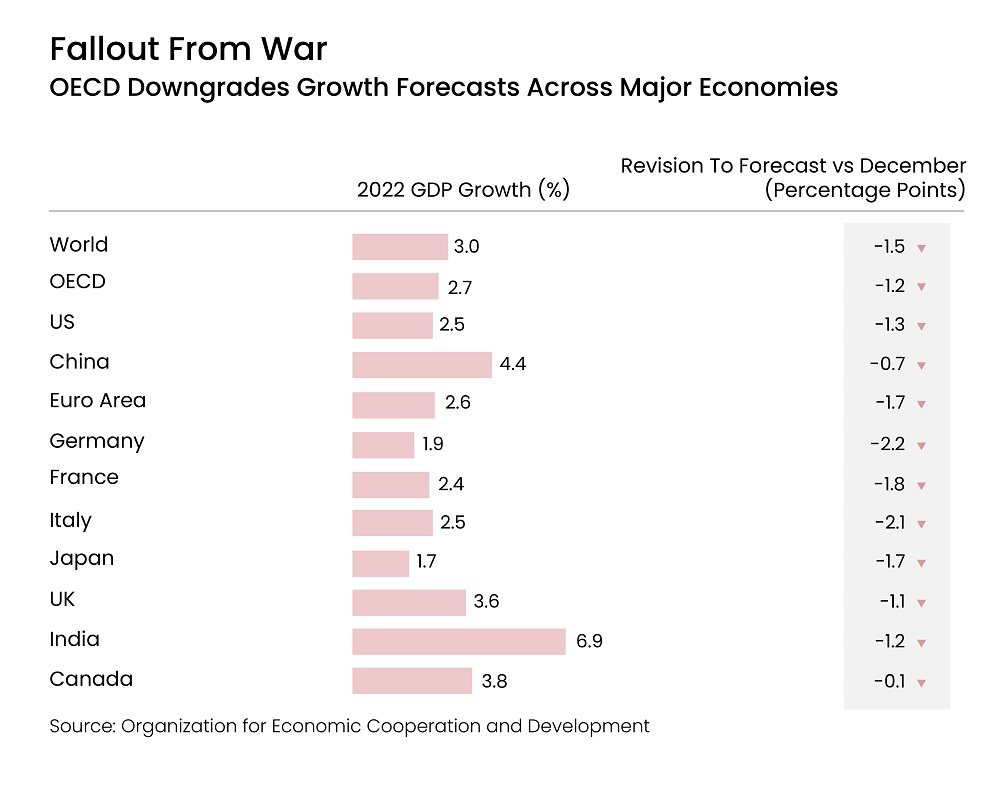

In OECD’s latest Economic Outlook, they warned that the world economy would have to pay a hefty price for Russia's invasion of Ukraine as it slashed its growth forecast in 2022 and is projecting higher inflation.

A Paris-based organization, OECD or Organization for Economic Co-operation and Development, represents 38 most developed countries. Their latest institution predicted lower GDP growth due to the conflict that has sent food and energy prices soaring. The gloomy assessment offers a deeper and broader insight into the economic fallout from Russia’s invasion. In the report, OECD offers a detailed view of the global fiscal and monetary policies.

The OECD doubled its forecast for inflation among its members, which include the United States, Australia, Japan, and Latin American and European nations. The world is expected to pay a huge price for Russia's war against Ukraine, with the humanitarian crisis unfolding before our eyes. The early effects of the war are being felt in the surging prices. The effects have forced central banks to tighten their monetary policy. Meanwhile, governments are reconsidering spending plans as they attempt to shelter households.

Read more: The War in Ukraine: Ripples Across the World

Key Highlights from the OECD report:

-

Europe is being perceived as one of the regions that are likely to be hit the hardest due to the war in Ukraine, as its economies are struggling to wean themselves due to Russian fuel sanctions

-

Low-income households are at higher risk due to surging prices of food and energy supply

-

Sharp increases in rates could slow down economic growth

-

China’s Covid Zero policy persists in weighing on the global economic outlook

The recommendations emphasized in the OECD report include:

-

Additional aid and global cooperation on logistics to avert the food supply crisis.

-

Targeted support from governments for households that are hit the hardest due to the rising cost of living

-

Signals from central banks that they will not allow inflation to spread.

-

US monetary policy is expected to tighten faster as prices are driven by over-buoyant demand.

-

More solidarity in Europe on energy spending

-

Trade to be kept open to ensure diverse value chains for the green transition.

The Impact on Global Action

The war in Ukraine has forced the global economy to encompass weaker growth, stronger inflation, and potentially long-lasting damage to the supply value chain. Rising inflation is also posing an additional challenge to this inclusive recovery. Inflation is disproportionally affecting low-income households that spend a large share of their income on food items.

The decline in real incomes is pronounced in developing countries, where poverty is more prevalent, and wage growth is constrained for vulnerable groups. Surging food inflation is worsening food insecurity as developing countries are struggling with economic shocks from the pandemic. Central banks globally are unleashing a greater amount of policy firepower as they are striving to combat unrelenting inflationary pressures.

The war in Ukraine is unfolding at a time when global CO2 emission is at an all-time high. This upward trend came in after a temporary drop in the first half of 2020 due to responses to the COVID-19 pandemic. Total greenhouse gas emissions in 2019 reached nearly 59 gigatonnes of carbon dioxide equivalent (GtCO2-eq) units. The remaining carbon budget, consistent with a 50 percent chance of limiting global warming to 1.50C, has been estimated at 500 GtCO2-eq units. This is being perceived as a short-term increase in emissions that is even more problematic. Greenhouse gas emissions are expected to increase if no replacement is found.

The worsening energy and food crises are dragging down global economic growth. Sustained price increases in global energy markets are accelerating the adoption of renewables and efficient alternatives. This has led to an increase in the cost of production of batteries. However, supply chain issues are expected to undermine demand for electric vehicles.

Read more: The U.S. & the UK Announce Ban on Russian Oil Imports; What is the Future of Global Energy Supply?

Russia's war is imposing a heavy price on the global economy. The crisis has rattled commodity markets, exacerbating supply-side shocks. In 2022, the growth in global trade is projected to slow down after a strong rebound in 2021. The conflict is disrupting exports of crude oil, natural gas, fertilizer, grains, and metals, driving energy, food, and commodity prices. The Russian Federation and Ukraine are key suppliers of agricultural goods. They account for 25 percent of global wheat exports, 16 percent of corn exports, and almost 56 percent of sunflower oil exports.

.jpg)

Reshaping the Global Landscape

The war in Ukraine and the economic sanctions imposed on the Russian Federation are fundamentally reshaping the global economic landscape. The conflict has roiled global markets and propelled investment as well as energy security concerns to the forefront. Governments around the world are employing measures to shield households and businesses from the effects. In addition to offering direct income support to low-income households, measures are being taken to cut value-added taxes on energy consumption and other cost subsidies.

The new OECD report indicates the large and global impact of war on inflation, which has already reached 40-year highs in countries including Germany, the United Kingdom, and the United States.

Due to the escalating prices, countries are now looking to expand their domestic energy supplies. However, these efforts are likely to result in increased fossil fuel production. Higher prices and growing energy security concerns have prompted the United States, the world’s largest producer of oil and natural gas, to increase its drilling activities. Meanwhile, the U.S. Government has also announced the release of 1 million barrels of crude oil every day for a duration of six months to bring energy prices down.

High food and energy prices, along with the continued worsening of supply-chain troubles, indicate that consumer price inflation will peak at higher levels than previously foreseen. The sharp rise in prices is undermining purchasing power, thereby forcing lower-income households globally to cut back on other expenses to afford basic energy and food needs.

The gradual reduction in supply chain and commodity price pressures, as well as the impact of rising interest rates, is predicted to be felt through 2023. The core inflation is projected to remain at or above central bank objectives in major economies.

Read more: Russia-Ukraine Crisis; Global Stocks Plunge; Inflation Risk Looms; What's Happening?

Key Takeaways

-

The Russia-Ukraine war is slowing the global economic recovery

-

Inflationary pressures have intensified, weakening growth prospects

-

The cost-of-living crisis is expected to cause hardship and risks of famine

-

The war in Ukraine will give rise to a stronger inflation

-

Central banks are facing a delicate balancing act

Final Thoughts

The war is hurting economic growth globally. The effects are being felt by Europe the most because it is more exposed to war through trade and energy links. The OECD cautioned that the economic turmoil is expected to hit the poor the hardest. The war is disrupting supplies of food like wheat and energy, for which Russia and Ukraine are major global suppliers.

The OECD also raised the warning about poor countries farther afield facing food shortages. The food situation in low-income countries is expected to be hit the most. It is fanning inflation for those with disposable income and living standards. The Russia-Ukraine war is sending shockwaves all the way to countries across the globe. The war is expected to even spark starvation, giving rise to political unrest and turmoil.

First, due to the pandemic and then the war, countries globally are facing the heat of economic unrest. The current situation highlights the clear risks of growth slowing down more sharply than expected and inflationary pressures intensifying further. The longer the unrest due to the war lasts, the longer the economy along with supply chains will be disrupted, and the less there would be an appetite for global investment.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in Market Research services, SG Analytics enables organizations to achieve actionable insights into products, technology, customers, competition, and the marketplace to make insight-driven decisions. Contact us today if you are an enterprise looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.