The Inflation Reduction Act (IRA) is an unprecedented boost to the renewable and cleantech sectors and an ambitious “make in America” project. At its core, the act seeks to spur innovation and improve industrial productivity. It will allocate nearly $370 billion toward energy security and the renewable sector over the next decade. In addition to helping accelerate the transition to clean energy and move toward carbon neutrality, the bill will be a big shot in the arm of the startups and broader VC ecosystem in the clean tech space.

Furthermore, with the IRA, the US aims to re-shore as well as strengthen local supply chains across technologies such as solar, wind, carbon capture, clean hydrogen, and energy storage. Among clean tech, (1) storage devices, (2) clean electricity, (3) and carbon capture garner the highest funding and will play a pivotal role in the transition to clean energy.

Read more: How are Impact Investors Tackling the New Opportunities in Climate Investment?

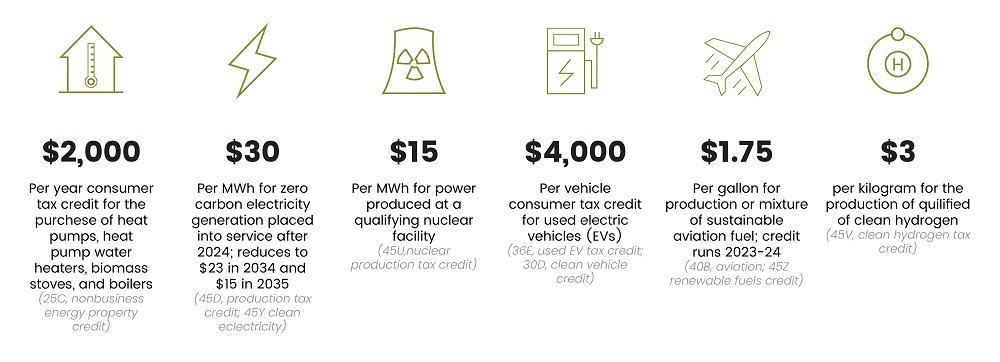

Figure 1: Key Tax Credit Modifications

Source: McKinsey

“We have to outcompete China and in the world, and make these technologies here in the United States—not have to import them.” Joe Biden, US President.

Energy Storage

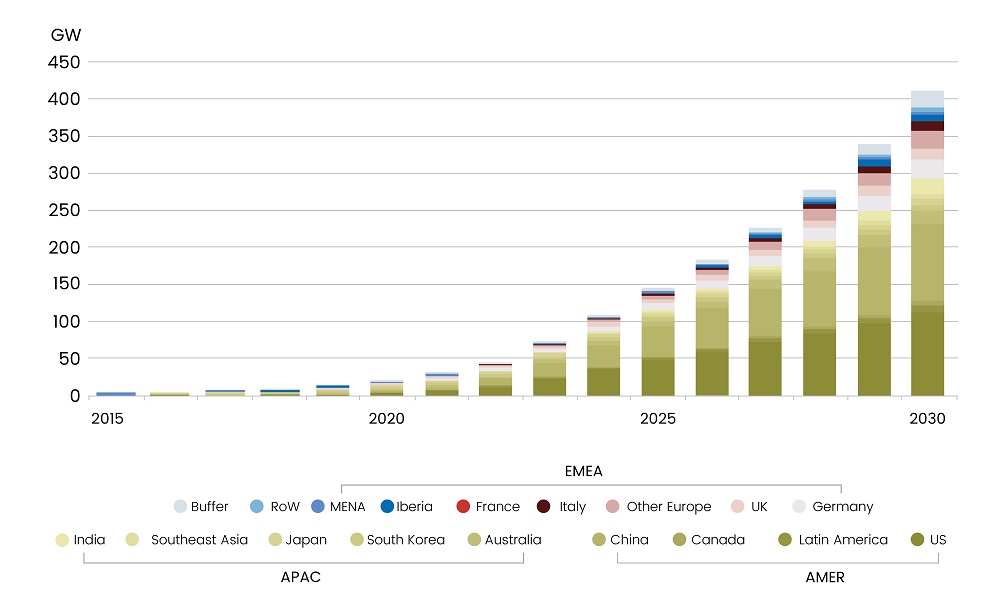

Energy storage is critical to transitioning from fossil fuel-based energy to renewable energy and underpins a range of industries, including mobility. As such, the market is expected to rise fifteenfold by 2030, per BNEF projections.

Read more: Private Equity Investment: 2022 Trends in Review

While China accounts for just 13% of raw lithium, it dominates lithium processing for the battery-grade chemicals market with a 60% share, per Benchmark Mineral Intelligence. The IRA will help new indigenous startups bring in much-needed innovation in the industry to reduce America’s dependence on Chinese and other Asian producers. The US, with investments and incentives, aims to raise mining production from roughly 1% to over 10% in the next six years.

Figure 2: Aggregate Energy Storage Installations

Source: BNEF

EnergyX, NEI Corp, and Sitration Inc are some of the startups coming up with breakthrough technologies in this space. Additionally, other startups such as Cadenza Innovation, EnPower, Prietto, and Lionano are pioneering disruptive technologies to produce better and more efficient Li-ion batteries.

Figure 3: Key Startups in the Lithium Extraction and Battery Technology Space

.jpg)

Source: CB Insights, StartUs Insights, SGA

Read more: Spotlight on EV Battery Technology as the US looks to Challenge China’s Dominance

Clean Electricity

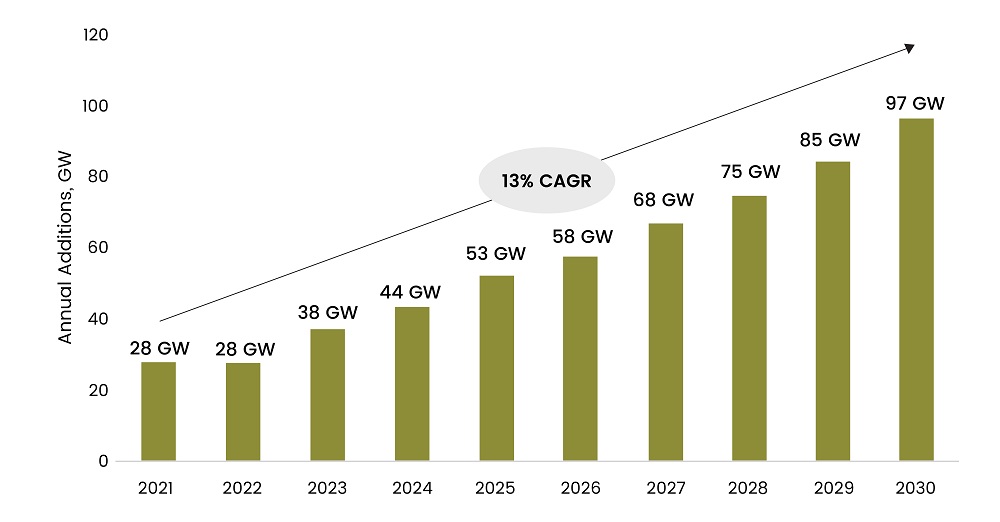

The Russia-Ukraine conflict and the ensuing energy crises have irreversibly moved the needle towards a globally shared belief to accelerate the transition to clean energy. The US, with its $70 billion allotment to the clean electricity space, is doubling down on reaching the 2050 carbon neutrality goals. The allocation to clean electricity can potentially catalyze the energy sector delivering up to 550 GW of additional clean power from 2022 to 2030, per estimates from ACP. This, combined with the existing 211 GW of clean power, could lead to nearly 40% of the total supply coming from renewable and energy storage systems by 2030.

Figure 4: Clean Power Capacity Installations – Annual

Source: American Clean Power

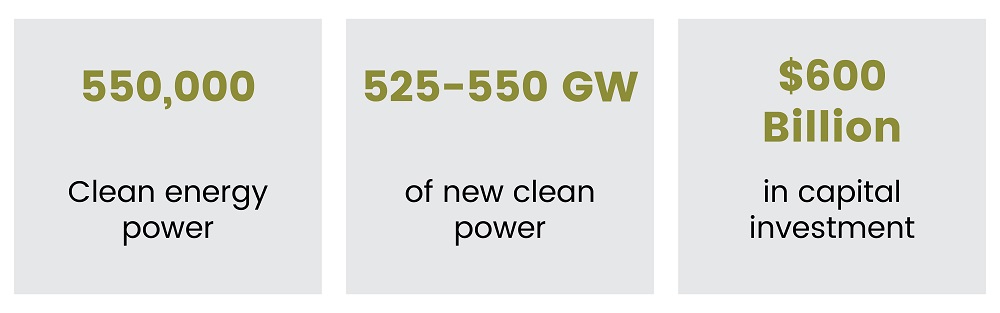

The surge in clean power will have a cascading effect on the broader economy as well, creating 550K in clean energy jobs and adding up to $500 billion to the U.S. GDP by 2030. Additionally, the 40% transition to clean electricity by 2030 will likely contribute to reducing carbon emission levels to roughly 33% of the 2005 electric-sector emissions levels.

Figure 5: IRA’s impact on Clean Energy Sector

Note: Capital investment from the private sector

Source: American Clean Power

Read more: The Rise of Sustainable Finance: 2022 Impact Investment Trends

Carbon Sequestration

The IRA provisions regarding controlling carbon emissions will turbocharge the sector. The slew of measures, including higher subsidy rates per metric ton, streamlined process to receive credits, and expanding the scope to allow smaller projects to qualify for carbon capture credits, will be a game changer for the sector. For instance, the increase in subsidy to $85 per metric ton for capturing CO2 from polluting sources will make carbon capture projects financially feasible even for industries with lower CO2 concentrations, such as cement plants. Additionally, IRA has also lowered the minimum capture requirement to 1,000 tons, which has companies such as Frontier Carbon Solutions and Switzerland-based Climeworks excited.

According to the Carbon Capture Coalition, the IRA and the Bipartisan Infrastructure Law will very likely transform the carbon capture industry thrusting it into the mainstream. The act will also boost emerging startups and help them raise more investments that are developing breakthrough technologies for capturing CO2 from the air. Heirloom, a carbon capture company, which recently signed an agreement with Microsoft to sell carbon removal credits, has witnessed increased demand.

Through IRA, the Biden administration aims to incentivize private sector investors to increase investments in the often-capital-intensive cleantech sector. With IRA’s 10-year timeline, the government is incentivizing investors to support venture startups that take an average of 7-10 years to reach scale. According to the head of investment at Bill Gates’ climate fund, the act could lead to the creation of nearly 1,000 new startups in the cleantech space.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.