ESG-mandated sustainable investment assets are projected to make up half of all professionally managed assets globally by 2024. 1% of the world’s population owns 38% of total wealth. However, the world facing climate catastrophe comes as no surprise. Nearly 9 in 10 people globally are committed to building a more sustainable and equitable world. With building momentum, businesses are shifting towards redrawing the guiding principles of politics and economics.

The ESG funds sector has rapidly ballooned in size. Financial regulators have been slower to come up with ways to guard the sector. That has led to the creation of limbo for consumers as they are at risk of buying products that may be packaged as something they are not.

Sustainability is a complicated field that is advancing in real-time. However, it is difficult to stay on top of the verbiage and what these claims mean.

Economy rule-makers are pushing for better transparency from managers of money market funds. This is another ESG-related offering that is falling short on the standards front, with the struggle to keep and attract investors increasing rapidly. A sustainable framework to attract future investment, partners, and public support is emerging as a trend for all investors.

With a stern current pushing toward the agenda forward, companies cannot afford to ignore building sustainability considerations at the heart of operations. The integration of ESG or environmental, social, and governance factors into money funds has experienced a sudden surge in recent years. There are just $9 billion in US prime money funds with ESG names.

Read more: Green Finance: The Next Step to Align India's Climate Priorities

ESG: A Call to Action

2020 ushered in a heightened focus on ESG or environmental, social, and governance issues. The momentum had been slowly building to support corporate social responsibility, with businesses moving towards a major development. However, the pandemic and associated economic dislocation, along with the heightened social unrest, and climate change, have compelled organizations to plan for action on the environmental, social, and governance (ESG) agendas.

Financial firms are commencing to measure and disclose their efforts to support all stakeholders and provide a solid foundation to build a broader perspective. Organizations are now focused on resolving two questions:

What are the essential elements that are to be incorporated within the ESG framework?

What tools will assist the industries?

Global sustainable mutual fund assets have hit a record high, bolstered by new disclosure rules. However, the pace of net inflows slowed from the prior quarter, as per the data released by Morningstar. Funds focused on ESG, or environmental, social, and governance-related issues, witnessed their combined assets climb to $3.9 trillion at the end of September 2021. This often-overlooked part of the burgeoning ESG industry is likely to encounter greater scrutiny from regulators across the globe.

The loopholes would allow banks to continue to make new investments. But this scenario is poised to change due to the SEC’s recently proposed rules that require public organizations to track and disclose their emissions. This gap between the money funds’ claims and the reality of the investments has left investors and stockholders talking about the litigation on mis-selling in the US.

Understanding the Scenario

Money funds are among the least risky investments available as they hold the safest government and corporate-bond securities. Today the level of investment demand for ESG products exceeds the availability of bonds. As the yield climbs with central banks boosting interest rates around the world, the presumption is that more investors are likely to gravitate to money funds if stock markets continue to lose value.

While there are more and more ESG-related bonds and commercial paper programs, the supply is still too small to build a valid ESG-only portfolio. Like other facets of the ESG industry, money funds are more susceptible to greenwashing as more and more funds are proliferating in the market. Expanded ESG disclosures and third-party oversight to investigate funds in a standardized manner help reduce these risks.

Greenwashing usually occurs when organizations, people, or governments exaggerate or misrepresent their climate credentials. The term also includes issues when organizations overhype their ESG commitments in their sustainability framework.

The ESMA or European Securities and Market Authority is leading the way in cracking down on such mis-selling. In the recently published ESG supervisory briefing, ESMA has highlighted a framework to provide convergence across the EU in the supervision of investment funds with sustainability features.

ESG reporting disparities exist between different domains that lead to the creation of inconsistencies in reporting standards across the market. A more formulated prescriptive and standardized framework is vital to managing the disclosure regime.

Read more: New SEBI Guidelines to Tackle the ESG Ratings Conundrum in India – An Analysis

What does it mean to be a green organization?

A term widely used in label and market ESG funds; it carries a more legal weight than many firms have initially thought. At the COP26 climate summit in Glasgow, signatories committed to achieving the new greenhouse gas emissions targets by the end of the year. The legal standards were set to promote ESG funds reporting. The target is to restrict global warming to well below 2C and preferably to 1.5C, compared to the pre-industrial levels.

Launching ESG-themed products is gaining momentum as it is emerging as a much-needed area of growth. Branding funds as green enables businesses to tap into a huge wave of investors. Retail investors are focusing more on making a positive difference to the planet and targeting marketing investments that offer claims a fund’s documentation. For investors interested in capitalizing on the green transition, there are several options available for them.

ESG funds are popular, but the sector is rife with greenwashing. ESG investment prioritizes companies and bond issuers with high environmental, social, and governance standards. Investors globally are pouring investments into sustainable funds. Asset managers also continue to repurpose and rebrand conventional funds products and package them into sustainable offerings.

.jpg)

How can Organizations Stay Ahead of the Crisis?

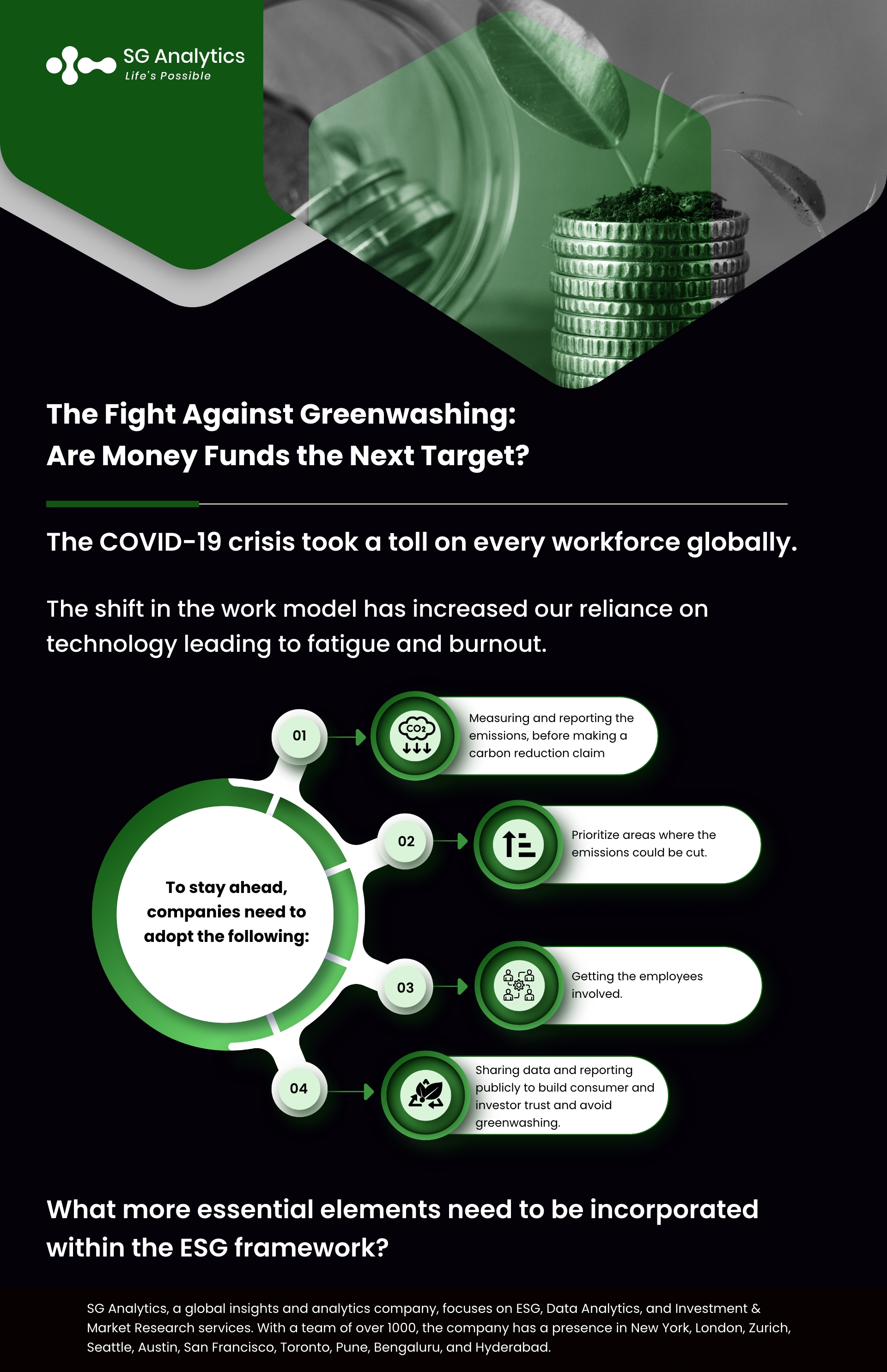

To stay ahead of regulations, companies need to adopt the following measures:

-

Before making a carbon reduction claim, start measuring and reporting the emissions.

-

After integrating an emissions benchmark, prioritize areas where the emissions could be cut to employ a realistic reduction strategy.

-

Getting the employees involved. This presents an excellent opportunity to empower motivated employees to work towards tackling the issues.

-

Sharing data and reporting publicly. This helps build consumer and investor trust and highlights the significant steps that are being taken to avoid greenwashing.

Organizations globally are planning to achieve net-zero by 2030. While these changes take effect, it will still be up to companies to voluntarily share their sustainability efforts. The public still must realize whether companies have an ESG strategy in place and which organizations are paying to keep up with their competitors.

Read more: ESG Market in Canada Faces Greenwashing Risks Due to Poor Data

Navigating Potential Shocks

The road ahead for organizations will not be a smooth one, as they need to prepare for inevitable shocks that are likely to arise in years to come. Some of the most impactful challenges will include climate adaptation, manufacturing, the changing role of the workforce, and reducing inequality. Many organizations are exploring possibilities of the materialization of elements that can spur the development of others. This has made it more vital for industry leaders to prepare for all of them.

These opportunities present a daunting list. From an ESG perspective, none of the aspects should be considered in isolation from one another. Instead of managing ESG in vertical silos, organizational leaders should shift their perspective to a multidimensional view and examine the risks present in all three areas.

In this world of greenwashing, responsible consumers and companies are feeling the need to up their environmental literacy. While some deliberately blur the truth, others struggle to understand ways to deliver on their promise of cutting down on emissions. By employing provision, organizations can make provisions to combat greenwashing in money market funds, along with the entire range of stock, bond, and other funds.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in ESG Consulting services, SG Analytics offers bespoke sustainability consulting services and research support for informed decision-making. Contact us today if you are in search of an efficient ESG integration and management solution provider to boost your sustainable performance.