The blockchain technology that underpins digital assets is predicted to withstand the fall in values. The ongoing collapses in the cryptocurrency market have managed to wipe almost 80 percent off the value of the tokens that underpin Cosmos, cutting $10bn from their total worth. The price collapse in the tokens is being perceived by some as an opportunity to double down on what they believe in.

The total valuation of cryptocurrencies peaked in November 2021 before dropping around 70 percent, cutting $2tn from the value. However, bitcoin is likely to dominate the headlines. Today bitcoin accounts for 42 percent of the $900bn that remains in the crypto world.

The falling crypto prices do not indicate that all the projects involved are doomed. However, the crypto revolution reaching its peak stopping block is still in question. The market collapse has put more emphasis on a broader retreat from risky financial investments in the face of rising interest rates. This holds the potential to weaken the incentives that have made crypto one of the hottest junctions of the tech world today.

But the market collapse has put to light the claims that it will not derail the crypto revolution. This revolutionary technology could weaken control over the online activity of the political and business establishment, ushering in the decentralized online world where power would flow to the people.

The vision of digital money around bitcoin has broadened today into a movement being referred to as Web3. It has the same underlying blockchain technology framework that has the potential to record and track crypto assets as well as support user-controlled online services.

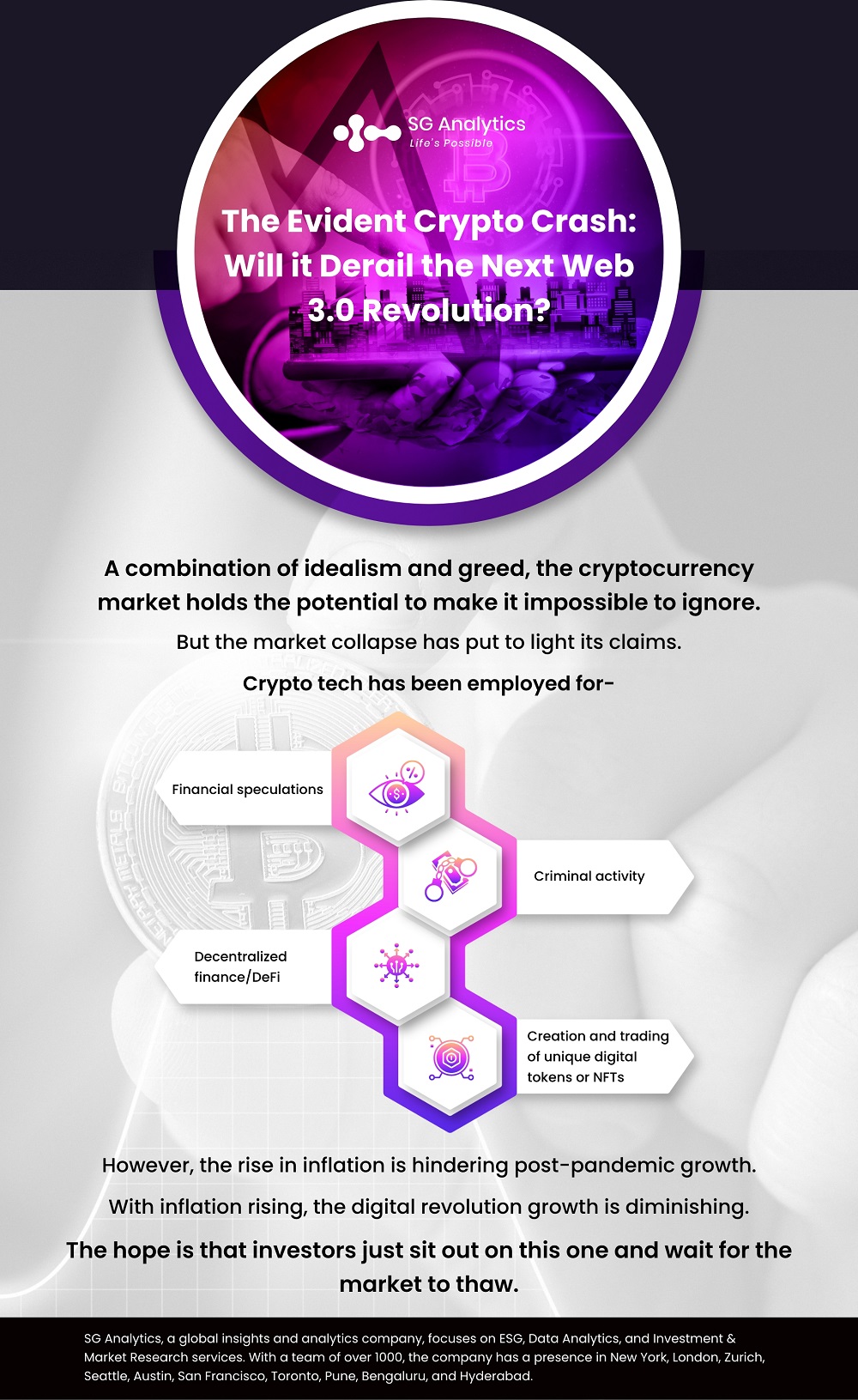

While it is impossible to ignore the total carnage of the crypto market- from crashing prices of Bitcoin, Ethereum, and other coins to the shutdowns of exchanges due to volatility to soothe the panic, the crypto market is in mayhem. A combination of idealism and greed, cryptocurrency in every form has the potential to make the sector impossible to ignore.

Read more: How Will the Global Crypto and Stock Markets Recover from the Inevitable Doom Loop?

The Proof of Work for Web 3.0 Revolution

The ideation of decentralization imagined by crypto enthusiasts is now being diluted to the point where there is nothing to differentiate it from technology.

The creeping centralization of Web 3.0 across distributed computing platforms is echoing the trajectory of the web that preceded it. These open communication protocols are likely to prevent any government or organization from exerting control. However, the system has left plenty of opportunities for private companies to build empires on top of technological foundations. Web3 gaming is focused on creating sustainable economies concerning currency, digital items, or virtual real estate that would be a value-added proposition to the concepts of games. But the recent plunge has a different story to tell.

The current situation is highlighting that even the most established forms of cryptocurrencies like Bitcoin and Ethereum and the exchanges are still the wild west and have the potential to fluctuate wildly, if not collapse. With shared virtual spaces making headlines about selling millions in virtual metaverse real estate, the world is embracing itself for the havoc that is likely to follow. While the relative stability of Bitcoin cannot be judged based on the massive crashes, the same applies to the new Web 3.0 revolution in the metaverse.

Web 3.0 advocates are admitting that the existing blockchain framework is inadequate when it comes to supporting mass online services. The Ethereum network, which is at the core of the Web3 activity, can handle a maximum of 30 transactions every second. While the technology is difficult to use for non-experts, it is also troubled by unresolved privacy, security, and legal queries. This is being considered a result of technological immaturity rather than a fundamental flaw.

The new tech infrastructure is being built on top of blockchains to make it easier to use and to handle more transactions. But it is also threatening to weaken their decentralized nature. This could likely give rise to a new set of dominant companies that may gain controlling access to the technology in the same manner that the Big Tech companies are ruling today’s online world.

Due to the shortcomings of the technology, investors are predicting that this promise of a decentralized online world will likely turn out to be largely illusory.

Read more: NFTs: The Future of Payment and Loyalty Programs

Risky and Flawed

Blockchain technology is a combination of things that are centralized as well as decentralized. With serious doubts still in the picture regarding the long-term usefulness of the technology behind Web3, there is uncertainty about the resilience the crypto boom has already unleashed.

However, this is not a globally held belief. Crypto tech has mainly been used for financial speculations, criminal activity, and decentralized finance/ DeFi, along with the creation and trading of unique digital tokens or NFTs. To solve the cryptographic puzzles, one must verify new entries on the blockchain and consume vast amounts of systems that control how the network is governed.

The enthusiasm for digital assets in the tech world rests on blockchains and their distributed databases that offer a foundation for online activity. The specially designed consensus mechanisms of blockchains and cryptocurrencies are used to validate these updates.

While it is probably still early to judge the whereabouts of any lasting or underlying situation, the growing chorus of critics in the tech world is hinting toward a redeeming future.

The crypto boom is drawing its power from new tech, and powerful financial incentives, when combined, will usher in an era of loose money to produce an explosive mix. However, experts are of the belief that this era is apparently over, and now the crypto industry is entering a challenging new phase.

Read more: Thinking of Crypto Investments? Watch out for the Ten Common Mistakes

How will the Crypto Market Unravel from these Crises?

The cryptocurrency market is on a downward spiral. The original cryptocurrency, bitcoin, which is responsible for about a third of the value of the sector, has been dropping slowly since the end of March. Investment in bitcoin is now being perceived as a bet on the possibility of further technological upheaval, just like the investment in a tech stock.

Even tech stocks have been crushed in recent months due to the rising inflation, new interest rates imposed by the Fed as well as the war in Ukraine; all are contributing to the undercutting. High-growth, low-profit investments have also been hit by a series of revelations from the largest companies. This is giving rise to fundamental questions regarding the limits to their potential expansion.

The rise in inflation is hindering post-pandemic growth, coupled with a sense that irrational exuberance is leading to an overvaluing of tech stocks, with the value of the whole sector dropping. The crypto economy is driving retail investors due to the conventional day-trading. With the rising costs bite, investors are being compelled to liquidate their holdings, thereby drifting the sector even further. With inflation rising and bitcoin tumbling, the digital currency growth is diminishing, and so is the digital revolution.

Read more: NFT Digital Art: The Technology that is Transforming Creativity

In Conclusion

Cryptocurrencies and digital tokens, or NFTs, are embedded in the blockchain networks. The willingness of people to ascribe a monetary value to bitcoin and other coins is becoming central to decentralized digital economies, thus propelling a boom in the cryptocurrency market.

These new financial incentives hold the potential to solve the perennial problem faced by online consumers as well as organizations. Now the focus should be on attracting adequate people to get a new service off the ground, thereby triggering network effects that could make online services more valuable.

The soaring value of these cryptocurrencies and digital assets offers a way to finance blockchain projects as well as attract new tech talent to the industry. It has been drawing internet users to the online gaming services that are being built on blockchains and metaverse. Games like "play to earn” are gaining popularity as it offers the participants a chance to earn tokens that they can later sell.

While the sector has survived catastrophic crashes before, the element that is sparking the latest conversation is the plunging market value. Now the hope is that investors will just sit out on this one and wait for the market to thaw.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in the Technology domain, SG Analytics partners with global technology enterprises across market research and scalable analytics. Contact us today if you are in search of combining market research, analytics, and technology capabilities to design compelling business outcomes driven by technology.