The union budget before any general election term is a much anticipated one, where everyone awaits big, bold moves. But many budgets often fall short on the surprise factor. However, the 2023 budget was no exception, as it mostly repackaged some of the old schemes with an additional allocation of funds. But the budget took salaried taxpayers by surprise, as it offered them the much-needed tax break. Many other tax relief measures were also introduced in this new tax regime. It looks like the government wanted the taxpayers to adapt to this new tax regime and phase out the old one.

Union Finance Minister of India Nirmala Sitharaman presented the 2023 Union Budget, the fifth budget of Modi 2.0. In the last full-fledged budget presented before next year's general elections, Nirmala Sitharaman stated that the economy is on the right track and is heading toward a bright future. In a big boost for taxpayers and the economy, she announced major shifts in tax slabs under the newly issued tax regime as well as big hikes in allocation for railways and capital expenditure.

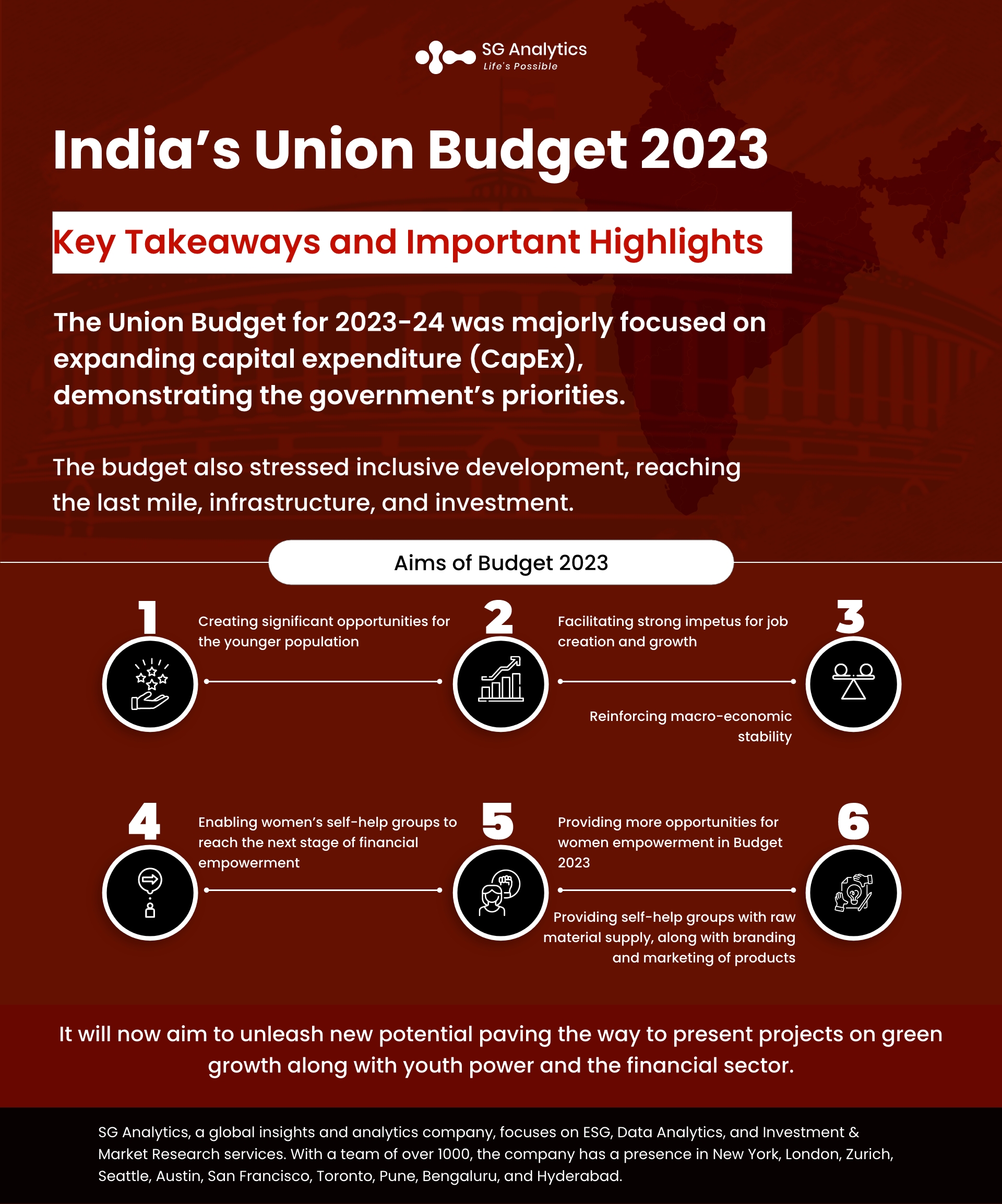

India's growth for the current year is estimated at 7%, the highest among all major economies, despite the massive global slowdown caused by the pandemic and the war. The budget also stressed inclusive development, reaching the last mile, infrastructure, and investment. This is now aiming to unleash new potential, paving the way to present projects on green growth along with youth power and the financial sector.

Read more: Global Business Trends Outlook 2023

Aims of Budget 2023

-

Creating significant opportunities for the younger population

-

Facilitating strong impetus for job creation and growth

-

Reinforcing macro-economic stability

-

Providing more opportunities for women empowerment in Budget 2023

-

Enabling women's self-help groups to reach the next stage of financial empowerment

-

Providing self-help groups with raw material supply, along with branding and marketing of products

Let us gain a sector-wise detailed reading of the measures announced in the 2023 Budget.

Budget 2023 Highlights: Direct Tax

-

Residents but not ordinarily residents will have to pay taxes on money received from Residents if the amount is more than ₹50,000.

-

The new tax regime is set to be the default tax regime. The government took new measures to make the new tax regime attractive to citizens. Taxpayers will also have the option to choose the old tax regime.

-

A tax rebate was introduced on the income of up to ₹7 lakhs under the new tax regime, implying that taxpayers with an income of up to ₹7 lakhs will not be required to pay any tax at all.

-

The surcharge has been reduced to 25% under the new tax regime, which was previously 37%. This transition will help bring down the tax rate to 39%.

Read more: How are Impact Investors Tackling the New Opportunities in Climate Investment?

Income Taxpayers

-

Zero changes to the old tax regime

-

The newly presented tax regime is set to become the default tax regime while offering citizens the flexibility to opt for the old tax regime as well.

-

No tax will be levied on the income of up to Rs 7.5 lakh a year in the new tax regime.

-

The government also proposed to reduce the highest surcharge rate, which was initially 37% to 25% in the new regime.

-

Individuals with an income of Rs 9 lakh annually will have to pay only Rs 45,000 in taxes.

-

A standard deduction of Rs 50,000 to taxpayers has also been introduced under this new regime.

-

Tax exemption has been removed in insurance policies with premiums over Rs 5 lakh.

-

For online games, the government has proposed to levy TDS (Tax Deduction at Source) and taxability on net winnings at the time of withdrawal or the end of the fiscal.

-

Tax exemption on leave encashment for retired non-government salaried employees has been hiked to Rs 3 lakh, which was previously Rs 25 lakh.

-

For TDS on cash withdrawal, a higher limit of Rs 3 crore will be offered to cooperative societies.

MSMEs (Ministry of Micro, Small & Medium Enterprises)

-

Revamped credit guarantee for MSMEs will be put in effect from Apr 1, 2023, with an infusion of approximately Rs 9,000 crore in the corpus.

-

The scheme is aimed at offering additional collateral-free guaranteed credit of Rs 2 lakh crore, along with reducing the cost of the credit by about 1%.

Clean Energy

-

Capital with Rs 35,000 crores was prioritized for the energy transition.

-

The green credit program is to be notified under the Environment Protection Act.

-

Battery storage to gain more viability gap funding.

-

The government will offer its support by setting up battery energy storage of 4,000 MwH.

-

With an outlay of Rs 19,700 crore, the National Green Hydrogen mission will facilitate an easy transition to low carbon intensity, thereby reducing dependence on fossil fuel imports and assuming the role of technology and market leadership.

Read more: 2023 Conversations: Predicting the Big Trends in the Business Landscape

Budget Highlights: Other Direct Tax Updates

-

Leave Encashment: The exemption threshold for leave encashment in the new budget has been raised to ₹25 lakhs, which was previously ₹3 lakhs for non-government employees. At the time of retirement, leave encashment of up to ₹25 lakhs can be done. A maximum period of 10 months is tax-free under Section 10(10AA).

-

TDS on EPF Withdrawal: TDS rate has lowered to 20% from 30% on taxable withdrawal of EPF.

-

Payment-Based Deduction: Payments to MSMEs will now be made within the time frame agreed upon in writing. The maximum limit is 45 days. In case of no written agreement, the time frame will be set to 15 days (about 2 weeks). Any payment made outside the time frame can be deducted in the year it is paid.

-

Zero Penalty: Where an individual's loan is accepted, or they repay the loan by a primary agricultural credit society or through a primary cooperative agricultural or rural development bank, no penalty would surface under Section 269SS or 269ST.

-

Exemption limit for Capital Gains: The tax exemption for capital gains under Sections 54 to 54F has been restricted to Rs. 10 crores in the new budget. Previously there was no threshold.

-

Online Gaming: Net price winnings from online gaming will be taxed at 30%. From July 2023 onwards, TDS will be withheld on net winnings as well.

-

Section 80G donations: Donations can be made to the following funds but will not be eligible for 80G deductions. The funds are as follows:

-

Jawaharlal Nehru Memorial Fund

-

Indira Gandhi Memorial Trust and

-

Rajiv Gandhi Foundation

Key Highlights: India Union Budget 2023

-

Budget 2023 promised to foster smart classrooms, transport systems, and 100 Labs with 5G service and civil service.

-

Pan card to be made the main base to start a new business.

-

Three new centers of acceleration are to be created for artificial intelligence.

-

India Union Budget will also be considered a proof of address for Digi Locker under 2023 highlights.

-

Plans to encourage one million farmers to take up natural farming.

-

The government will spend 75,000 crores on transport infrastructure.

Read more: 7 Trends That BFSI Industry Cannot Ignore Anymore- Get Ready for 2023

In Conclusion

India's growth rate estimates for the fiscal year 2022-2023 was reduced by many institutions. However, RBI has reduced the growth rate for the current fiscal year to 6.8 percent. Under Budget 2023, a lot of focus has been on the measures to strengthen the economy so that inflation and employment generation can remain favorable in the budget for the next budget year.

The Union Budget for 2023-24 was majorly focused on expanding capital expenditure (CapEx), demonstrating that the government's priorities include building roads, highways, and railway lines. The middle-class populations also witnessed some relief in terms of shifts in the new income tax regime, which precisely points out that the government is now transitioning into the new regime from the older one. The issued budget is positive, considering the bloated deficit that has caused worries in the previous year.

With a presence in New York, San Francisco, Austin, Seattle, Toronto, London, Zurich, Pune, Bengaluru, and Hyderabad, SG Analytics, a pioneer in Research and Analytics, offers tailor-made services to enterprises worldwide.

A leader in Market Research services, SG Analytics enables organizations to achieve actionable insights into products, technology, customers, competition, and the marketplace to make insight-driven decisions. Contact us today if you are an enterprise looking to make critical data-driven decisions to prompt accelerated growth and breakthrough performance.