Many sectors have been riding the digitization wave and the automotive industry is no exception. The evolution of data analytics in the automotive industry, coupled with changing customer expectations, is triggering a zippy disruption.

The automotive sector has witnessed a sea change over the last decade, disrupting the conventional ecosystem of automotive players. Ever since Karl Benz invented the first car in 1886, the industry has been obsessed about the ‘car of imagination’. In fact, the ‘car of imagination’ is steadily taking shape, and is going to be smarter than any imagination. The future cars will be increasingly intelligent with prodigious connectivity. To put it differently, data analytics in the automotive industry will allow the cars to communicate, collaborate and navigate without human intervention, creating vast amounts of data. The cars will soon be producing up to 25GB of data every hour. This pool of data will ultimately power the disruptive technologies, creating multiple possibilities for the players across the value chain. Is the automotive industry ready to discover the possibilities hidden in data pools?

Data analytics in the automotive industry: Powering disruptive technologies

Advanced technology-equipped cars are likely to become the poster child of the technological revolution. The applications of these technologies are likely to reinvent existing prototypes, change the ecosystem, and revamp customer satisfaction. Along the transformation journey, the profit pools will shift, and the economic value will be forever altered.

While there is no scope for complacency, the automotive industry will witness disruption led by technological changes: mobility & connectivity and autonomous driving. We aim to make these disruptive trends more tangible by revealing how technological disruption is being powered by data analytics in the automotive industry. Those industry players who realize this and seek ways to tap into the potential of data analytics in the automotive industry will enjoy a competitive edge over their peers. Industry players who develop data analytics capabilities to improvise business models, materially enhance customer experience, and take decisions in the intelligence age, will define the future control points.

Mobility and connectivity

Connectivity, which was once considered to be science fiction, is now becoming the reality of the automotive industry. Cars are equipped with sensor systems that can monitor everything encompassing miles-driven, location, routes, brake wear and tire pressure. Connectivity and mobility are enabling new applications, which will transmit adequate data for the automotive industry to create unmatched value. Basically, traffic signals just turned green for connected cars.

Vehicles, under plush seats and high-performing engines, have become increasingly intelligent due to data analytics in the automotive industry. The onboard technology is transmitting information about vehicles and driver performance. For instance, manufacturers are leveraging artificial intelligence to identify vehicle performance data patterns. Such manufacturers are developing robust cognitive predictive maintenance capabilities to optimize their products and ensure customer safety.

Data analytics sparking connected cars

Connected cars are also providing localized information encompassing everything from gas stations to retail outlets. Eventually, automotive players are using localized data to produce customized offers based on customer preferences. Predictive and prescriptive analytics provide relevant data, which can be transformed into next-best action offers for personalized customer experience. Such an approach is helping the industry increase customer engagement and acceptance. Moreover, it is imperative for the automotive industry to ensure quality and reliability by prioritizing and promptly resolving auto issues. For instance, automakers are leveraging warranty analytics to identify emerging issues, thus reducing warranty costs and protecting brand equity.

Location-based data has started flowing in as a result of connectivity within vehicles. Automotive players are leveraging data to reveal correlations and causation. These players can use sophisticated mathematics and statistics to accurately predict the upcoming scenarios. Further, they could amalgamate domain expertise to assess the what-if scenarios. For instance, automotive players are extending customer experience beyond the vehicle by providing location-based offers. Automotive players could capitalize on vehicle data by recommending content through infotainment systems, dedicated payments, and intelligent messaging based on travel patterns. Automotive players will partner with insurance companies over the long-term to create risk profiles of customers. Those customer profiles would be based on traffic routes taken, miles-driven, speed vs. speed limit among other factors. This will enable insurers to drastically reduce costs and deliver improved services.

Data analytics in the automotive industry – Smartest Moves

General Motors has developed OnStar for a full-fledged connectivity mesh – a marvel of data analytics in the automotive industry. GM currently has more than 12 million connected vehicles on the road. The company is collecting data for improving its vehicle infrastructure. For instance, GM’s Verizon telematics has helped car owners track stolen vehicles and remotely unlock their cars using a smartphone. However, as per our observation, the company will be able to unlock innovative revenue streams by opening up its database for outside developers to trade the information. The company has signed with Apple and Google to bring their infotainment interfaces to its connected cars, and will soon explore its core data analytics capabilities through sensor-data management, predictions on context & business data, and scalable platform for data visualization.

Similarly, the Tesla team has succeeded in achieving seemingly difficult goals by establishing efficient data analytics in the automotive industry processes for solving complex problems. The company faced major challenges as many of its cars overheated in 2014. Tesla analyzed the performance data of around 30,000 cars and identified a solution – reduce power fluctuations. It might have adopted A/B multivariate testing methodologies for improving design efficiency. Tesla’s data-driven cars are emitting data from various sensors, thus making it more intelligent and agile than ever. For instance, Tesla’s cars have gathered data from more than 1.3 billion miles using its Autopilot software. This data is being used by the company to generate accurate roadmaps for driverless cars. With data that indicates where cars have slowed down or swerved around obstacles, Tesla’s self-driving cars might also be able to make intelligent decisions even in zero-visibility conditions.

Autonomous driving

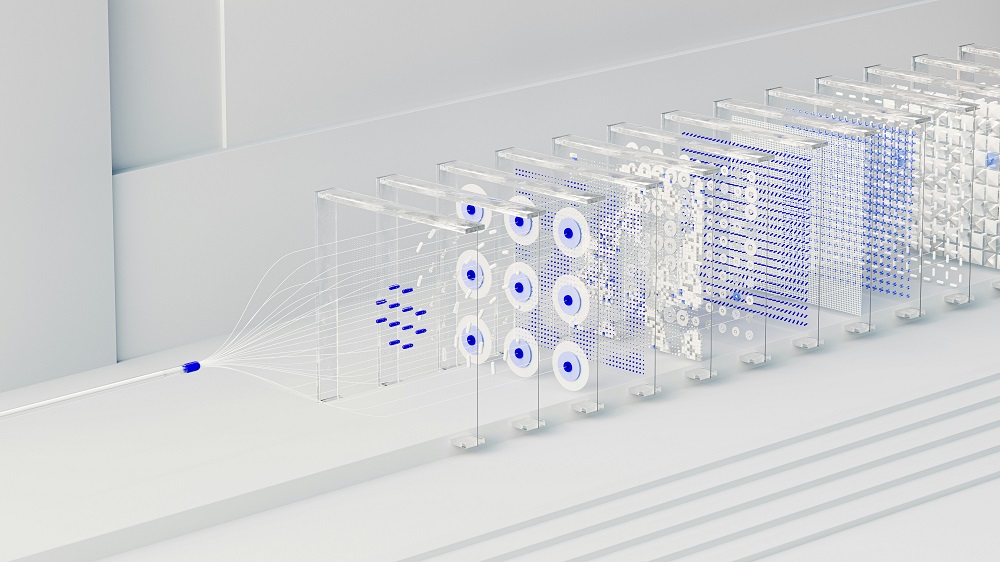

Autonomous vehicles, with their enormous potential, are grabbing the headlines in the automotive industry every day. The next generation self-driving cars promise to dramatically shift the industry’s dynamics. Consumers will no longer realize the importance of learning to drive. However, how is the industry planning to engage drivers and passengers when they sit idle in a driverless car? In fact, all stakeholders across the automotive value chain will be busy analyzing data, while consumers sit idly enjoying the possibilities uncovered by the assistive technologies. Meanwhile, the industry is exploring its data analytics techniques to deliver an intuitive, unforgettable experience to consumers.

The following are potential opportunities for the stakeholders along the autonomous driving value chain:

OEMs growing the core

In addition to selling infotainment and navigation services, OEMs can better understand customers by analyzing data. Resultantly, automotive OEMs will be able to predict and shape the maintenance choices of consumers, thus bridging the gap between service dealers and consumers. For instance, OEMs could power real-time remote booking of vehicle check-ups with advanced analytics. Nevertheless, automotive suppliers can also develop platforms to capture and analyze consumer data to effectively serve OEMs with product and service portfolio improvement recommendations.

Infrastructure operators seizing opportunities

Roadside assistance providers can better gauge autonomous driving data and process distress calls to proactively dispatch rescue resources. Moreover, these roadside assistants can analyze auto breakdown data for providing valuable information to OEMs. Similarly, infrastructure operators such as toll operators, battery recharging dealers, and refueling operators can analyze autonomous driving data to strategize geographic deployment of services and monitor consumer preferences to devise variable-pricing structures. In effect, insurers will also collaborate with roadside assistance to capitalize on data with usage-based insurance contracts and occasion-related policies.

Expanding value chain creating a new ecosystem

Deep tech giants and OTT players are also perfectly positioned to collaborate with OEMs and advertisers to power fundamental autonomous driving data with meaningful content. Tech giants could develop in-car platforms and operating systems to boost the data generation process. For instance, OEMs and suppliers could motivate customers to share larger chunks of data by integrating voice-activated virtual assistants in their infotainment systems. Moreover, VR and AR innovators could also engineer applications to integrate gesture-activated controls, thus offering innovative monetization schemes. Similarly, retailers could analyze consumer data to optimize their sales network. Assuming retailers obtain detailed data frameworks, they could deliver products to the precise location of self-driving cars using drones. OTT applications could push highly tailored marketing to drivers’ handheld devices and infotainment systems based on consumer preferences.

With driverless, connected cars, the notion of rush hour will vanish into history. However, the industry must explore such possibilities and lay the groundwork to develop and monetize these consumer experiences. Advanced marketing analytics will hugely help manufacturers and suppliers explore innovative ways of collaboration and partnerships.

Data analytics in the automotive industry

For instance, Daimler, the maker of Mercedes-Benz autos has partnered with Uber to supply self-driving cars for ride-hailing services. General Motors is also developing self-driving cars by multiplying in-house automotive manufacturing expertise. The company leverages Cruise Automation’s expertise in robotics and artificial intelligence to design and manufacture cars that can make logical decisions. “Today, new technologies and changing customer needs are helping us transform personal mobility and deliver new transportation solutions that are safer, more sustainable and better than ever,” said GM Chairman and CEO Mary Barra. Speaking at the Orion Assembly factory event, she added: “We believe one of the best ways to deliver these solutions is through greater access to self-driving electric vehicles deployed in sharing networks.” The company also plans to introduce the autonomous technology to customers in ridesharing fleets across the US.

Path for the digital automotive industry

As we have extensively discussed, data is an enabler of a multitude of features that will generate noteworthy revenue streams for the automotive industry. However, it will require automotive players to establish an infrastructure for effectively capturing data from multiple sources and mapping those data sets to business contexts. As such, data is an asset as it provides a quantitative and structured way to prioritize investments and develop products based on consumer preferences. However, the automotive industry will only be as successful as their strategic partnerships across the value chain allow.

Automotive players seeking their niche in the ‘cars of imagination’ value chain must successfully communicate the importance of car data to customers and create value. It is definitely a positive message that OEMs are leveraging the expertise of technological innovators and digital consumer product industries. Automotive players, which embark on this interesting journey of analytics and intelligence, will be in the front seat to steer the wheels of revolution across the digitization street.

Will we be living in a utopian generation of cars that will silently whizz as per the passengers’ preferences? Here’s a case:

Light traffic – almost all cars around are autonomously driven. You are going to a business meeting on a sunny morning. The windshield’s smart tint has turned bluish to shelter the car from the sun’s glare – optimized automatically – letting you scroll the news stream with an adequate light on the dashboard. The phone rings and the music pauses. It’s your dear wife’s cheery face on the HUD, wishing you a happy anniversary!

What’s the next big thing in your car? Just after the call ends, your car’s voice assistant speaks to you, “we are 4 kilometers away from the ‘Pink Olive gift shop’. They have 20% discount on select anniversary gifts. We are already on the fastest route despite the usual traffic. Would you like to check it?”

Vroom…