Why investors pour money into Evergrande?

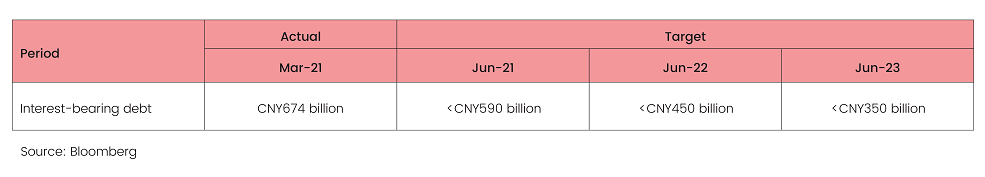

The introduction of the ‘three red lines’ rule in January 2021 by Chinese regulators set the stage for the deleveraging plan of the most indebted Chinese real estate player, Evergrande. Investors started monitoring closely the management’s efforts to deleverage the balance sheet. The group reported a drop in its net debt position in 2H20 and announced its plans to bring ratios in line with the regulatory requirement in the earnings call on March 31, 2021. The management aimed to meet the net gearing threshold by June 2021, cash to short-term debt ratio by year-end, and liabilities to assets ratio (excluding advance receipts) by 2022-end. Evergrande announced its target to reduce debt by CNY150 billion per year in 2021 and 2022.

Evergrande outlined three major actions to deleverage:

(1) Improve sales and collections

(2) Reduce land reserves and ramp up urban development projects, which would lower land acquisition costs

(3) List spin-offs including property management and electric vehicles.

Since the group has several levers to pull for addressing the debt pile, the investor sentiments turned positive. After all, it is considered an asset-rich group with a sizable land bank in tier-1 and tier-2 cities. Several of its subsidiaries are having reasonable valuation metrics and are waiting to get listed on the stock exchanges. Since January 2020, the group has been able to repay offshore debt without accessing capital markets.

Why did bond prices fall sharply?

The bonds traded well in April and May 2021. Evergrande has not defaulted interest payments. However, the news that Chinese regulators are examining transactions worth more than CNY100 billion between the developer and Shengjing Bank Co. triggered a sell-off. This was exacerbated by a slew of negative news and rumors that raised concerns about the financial health of the group. Evergrande was the subject of numerous headlines about delayed payments to its suppliers, legal disputes with its lenders leading to asset freezes, and sale suspensions.

The management acted to solve several of these issues as early as possible, however, it failed to boost investor sentiments. The stress started building in when the news came out that Evergrande is growing its reliance on financing through commercial bills (of around US$32 billion) as liquidity pressure mounted after banks and bond investors refrained from providing long-term funds. The tight liquidity situation led to rating downgrade by all three international rating agencies. While Evergrande was grappling with the debt problem, the macroeconomic risk heightened in China, leading to sell-off in assets across the board.

Chinese regulator’s ban on Didi Global, its largest ride-hailing company, for listing its app on mobile app store days after the company completed in NYSE IPO had a knock-on effect on the capital markets. Subsequently, concerns over Beijing’s widening crackdown on internet companies (education start-ups) and other industries sent the broader Chinese market into a tailspin. The broadly tracked iShares MSCI China ETF (MCHI) fell more than 12% in July. Short-sellers increasingly targeted Evergrande as they almost doubled their bets on the developer. According to Markit, the face value of Evergrande bonds lent out to other investors rose to near US$400 million, almost a 2x increase from the beginning of June.

What lies ahead?

Evergrande needs to deal with short-term debt, commercial bills, and bond maturities

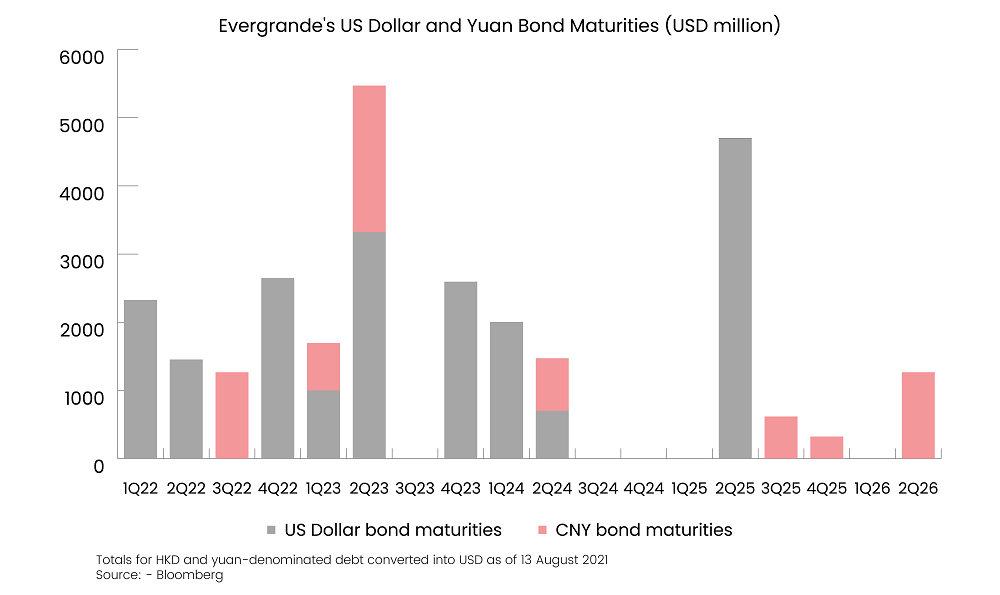

The group has repaid most of the debt to date and has not defaulted. It has no major bond due until US$2 billion offshore becomes due in March 2022, followed by US$1.45 billion the following month. This will give Evergrande around eight months to raise funds to repay these bonds.

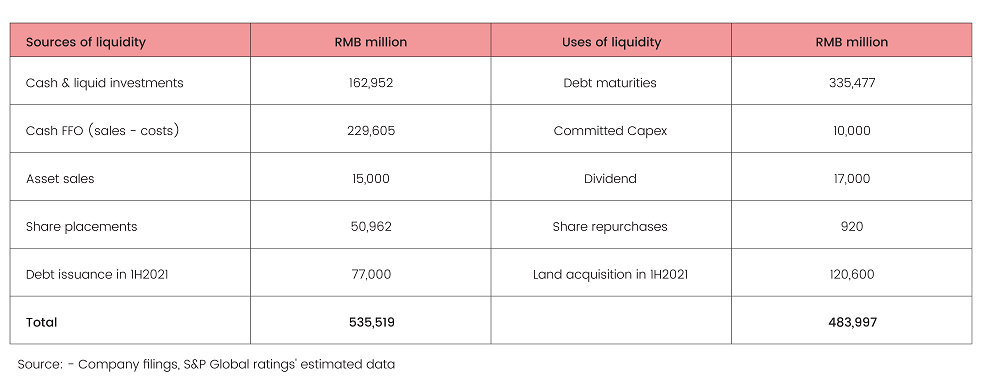

The group has recently decided not to pay a special dividend, which should ease some liquidity pressure. Furthermore, FFO through property sales and cash balance are seen as sufficient to pay the short-term debt. As of December 2020, the short-term interest-bearing debt stood at CNY335 billion, of which bank borrowings were around CNY273 billion. So far, Evergrande seems to have serviced all its debt. Most banks, if not all, are likely to refinance/rollover debt partly or fully through increasing either collateral or funding cost or both as the group would need some time for asset sale. The recent announcement by at least three Chinese banks to give the group more time to repay debt is seen as support flowing in for the troubled developer. However, commercial bills worth US$32 billion, short-term in nature, could be a cause of concern for investors as the rollover of the entire portion could be challenging. Only funds raised from asset disposal, subsidiary listing, or contracted sales could help solve the issue.

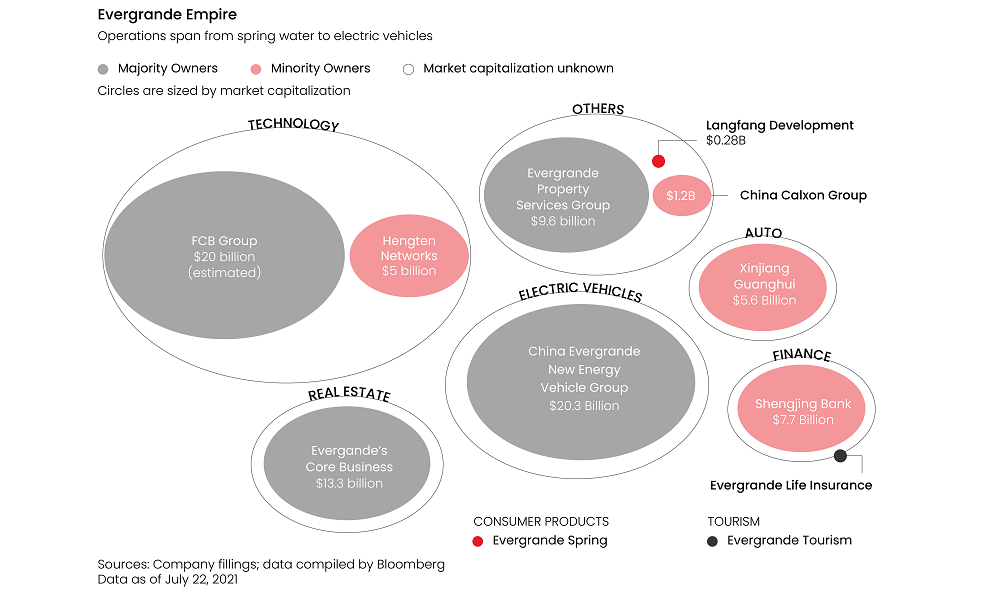

Evergrande embarks on asset disposal to raise funds

Evergrande has already raised nearly US$8 billion this year by selling stakes in its new electric vehicle (NEV) unit, its internet operation, an Hangzhou property firm, and FCB Group. Asset monetization helped to bring debt down by 21% to CNY570 billion (US$88 billion) at the end of June 2021. That said, the group appears to have finally launched its self-bailout asset-disposal program. The focus is turning to the assets, it has acquired outside of the real estate, which was worth US$82 billion as of June 2021 (refer to figure 2), almost equivalent to its current debt pile-up. The management is seen stepping up efforts to monetize assets. According to media news, the group is in talks to sell stakes in property management and electric car businesses.

Evergrande announced selling a 7% share of HengTen (a streaming platform) to Tencent for HK$2.06 billion and a 4% share to an unnamed buyer for HK$1.18 billion, resulting in a total sale of HK$3.24 billion or US$420 million. Furthermore, the group shed stakes worth nearly US$400 million in smaller developer Calxon in June. The group also repaid a US$1.47 billion offshore bond a week ahead of its due date as a sign of commitment to taming its balance sheet. To resolve its stress situation, Evergrande also embarked on plans to sell around CNY120 billion (US$18.6 billion) in assets and initiated talks with potential buyers such as China Jinmao Holdings Group in early June. The management also initiated a discussion to sell a small stake in Evergrande to Sinochem Holdings, Jinmao’s parent and a central state-owned enterprise (SOE). The group has more fundraising tools available. According to Bloomberg, its online home and car sales platform, FCB Group is valued at US$20 billion. Listing and share sales of subsidiaries raised CNY50 billion in 1H21, demonstrating its fundraising ability. Evergrande could look to raise money by listing its water business (Evergrande Spring), tourism business including a theme park, and healthcare business. The group is in talks with competitors to sell real estate projects nationwide. Overall, the group’s progress on this ground should help ease liquidity pressure. However, the stress in overall China’s real estate sector and weak sentiments toward the Chinese equity market amid regulatory crackdown could delay the selling of assets in the near term.

Is Evergrande seen as ‘too big to fail’?

Investors are worried about the size of Evergrande and its implication on broader financial markets if it fails. However, it seems the tag of “too big to fail” has been gradually coming down for the group. Following are a few facts:

(1) Evergrande’s market share in the top five provincial regions where it reported contracted sales in 2020 has remained below 4%.

(2) Reported land acquisition of CNY137 billion (US$21 billion) comprised a mere 1.6% of China’s total land sales revenue in 2020.

(3) Bank loans represented 70.7% of the total debt, in line with Chinese property developers’ 61.4% in 2020.

Although Evergrande’s liabilities involve more than 128 banks and over 121 non-banking institutions, the impact on the financial system may not be severe enough to call for a government rescue. However, the impact would be visible for homebuyers waiting for the completion of the projects. Also, the fallout impact on local government’s fiscal revenue is anticipated to vary as it contributed as low as 1.1% for Beijing to as high as 9.6% for Guiyang.

Will the government bailout Evergrande?

There are slim chances of explicit support coming from the government amid the administration’s recent stance on leveraged firms. Even in the case of the state-owned firm Huarong, the government hesitated to come forward for providing timely support to the company. However, Chinese Vice Premier Liu’s mention of the current situation of Evergrande as a ‘liquidity stress and not insolvency’ makes a lot of sense. Beijing would be more vigilant as the implications of the group’s failure are broader. Several individual homebuyers, retail investors, employees, suppliers, and financial institutions are going to face the brunt of it. The group has 200,000 staff and hires 3.8 million people every year for project developments. This is probably why Liu had a special mention about Evergrande, an action that used to be reserved for firms such as the HNA group of state-owned Tsinghua Unigroup. The comment indicates the government is seeking time for orderly unwinding rather than rescue. Hence, there are still reasons to think why the government or other state entities or provinces won’t allow Evergrande to fail ultimately.

Recently, the vice mayor of a city in northern China urged state enterprises to boost their stakes in Shengjing Bank, in which Evergrande holds a 36% stake. China’s central government has ordered the Guangdong government to support Evergrande by coordinating with creditors and strategic investors. The Guangdong provincial government has already invited several companies to discuss the co-development of Evergrande’s projects. According to the latest report, Evergrande had 231 million square meters of land reserves with an original purchase value of CNY490 billion (US$75.5 billion). Although the cooperation is unlikely to resolve the liquidity squeeze significantly for the group, it is expected to stabilize Evergrande’s 798 projects in 234 cities for the benefit of homebuyers. Despite the government’s intervention, the process may not be concluded soon as Evergrande would not be ready to off-load stakes easily at discounted prices while buyers would see the sale as distressed deals. This is evident because, after several months of negotiations, the talks failed between Evergrande and China Vanke. Despite China Vanke’s expression of a strong interest in the asset, it temporarily withdrew plans to acquire Evergrande’s 59.04% stake (US$6.6 billion) in Hong Kong-listed Evergrande Property Services Group due to high prices and other issues.

Will history repeat itself?

The Chinese government’s intention seems clear that it is less interested in Evergrande’s debt problem and more interested in the delivery of the projects to avoid any social stability concern among homebuyers. Last year, the government would have allowed the listing of ‘A’ share of Hengda Real Estate that would have bailed out the developer without any cost to the state. However, it did not happen and Evergrande reached a stage of default.

If the government’s intention is just damage control, HNA Group’s restructuring could provide a guide. Although HNA Group had lesser offshore bondholders than Evergrande, the size of the claim was CNY1.2 trillion (US$185 billion). HNA’s financial condition deteriorated in 2017 and when it asked for a bailout in 2018, the government directed the Hainan government to take care of it. Similarly, Guangdong has been asked to manage the Evergrande mess. The government ordered HNA to off-load assets to trim down debt but did not provide any buyer. Several peers conducted due diligence but talks failed due to management’s high asset price tag. Similarly, Evergrande is also in discussions with several developers, but nothing has materialized yet. The high price tag keeps buyers away despite the strong interest shown by peers.

That said, lessons learned in HNA restructuring seem applied in Evergrande’s case by the government. China’s Supreme People’s court sent a notice directing all Evergrande’s ongoing lawsuits to Guangdong Intermediate People’s Court. This worked as a de facto stay for non-state lenders while state firms would have been already instructed to hold on. Furthermore, general investors have been barred from trading Evergrande’s local bonds, a move that happened very late in the HNA’s case. However, it would be important to see whether Evergrande’s current chairman Hui Ka Yan would be replaced as HNA’s chairman was replaced in February 2020.

Another classical case of Dalian Wanda could be seen as a path for Evergrande to come out of a similar situation. Although the size of assets shrunk for Dalian Wanda group’s billionaire owner, he managed to sail through and protect his wealth. Hui Ka Yan has embarked on a similar path of asset disposal, which is expected to trim down the size of his assets while surviving the storm. Notably, the difference between these two cases would be that Dalian Wanda had time and the process of asset disposal was completed in 18 months, while Evergrande has little time to clear the mess.

What lies ahead for offshore stakeholders?

Taking cues from the HNA case, the new management at HNA took four months to pay employee salaries and map out the corporate structure to identify the size of the assets and debt. Then, the restructuring discussion started. In the case of Evergrande, the government’s priority is homebuyers; hence, offshore bondholders and equity holders would be their last concern. Also, while supporting HNA back in 2018, China believed that it is necessary to protect the reputation of Chinese firms in international markets and keep financial regulators away. However, a recent shift in policy at the central level with plans to decouple from the west could mean a lot for offshore stakeholders. The recent crackdown on companies in the name of social security means Beijing would do its best to contain domestic risks and ensure social stability but do little for offshore investors.