Business Strategy Consulting Services & Solutions

The global business strategy consulting services segment is worth US$ 48 billion and is stipulated to almost double, reaching US$ 80 billion in the next decade, from 2026 to 2036. As differentiation of market positioning and regional/local presence expansion becomes vital for most organizations worldwide, the adoption of business and technology strategy consulting is projected to gain momentum. Utilization of business, operational, and technology strategy consulting services is enabling leading and emerging businesses to not only obtain a magnified view of their market potential and competitive benchmarking but also diversify their product offerings to improve their competitive edge.

Leading Business Strategy Consulting Firm

As a leading business strategy consulting firm in the US, SG Analytics partners with clients across multiple sectors to collect, process, and analyze signals that power long-term business strategies. We provide business strategy consulting services to address challenges emerging from changes in the regulatory framework.

Business Strategy Services & Solutions Provider

As a business strategy consulting firm, we offer growth, market, technology, and industry-specific strategy consulting to client organizations across financial services, technology sectors concerning software and ICT services, the media & entertainment and telecommunications space, and healthcare markets.

SG Analytics’ 360-degree business strategy consulting ecosystem is well positioned for buyers, such as enterprises, and sellers, like technology vendors or ICT service providers, to help them meet their short-term, mid-term, and long-term value propositions. Our pre-configured in-house primary and secondary research capabilities, along with strong industry-specific expertise, provide stakeholders with cost-effective, scalable, and interactive insights to build a future blueprint with steady growth prospects without offsetting core KPIs like revenue and margins. Furthermore, nearshore delivery and center of excellence enable our clientele to determine sustainable local and regional expansion strategy objectives.

Business Strategy Consulting Services & Solutions

Competitive Market Intelligence Services

Our market intelligence helps organizations become customer-centric, understand market demands and consumer opinions, collect real-time relevant data, boost upselling opportunities, reduce risks, increase market share, and gain a competitive advantage.

Market Opportunity Assessment Services

Assessing market potential and opportunity for both the buy-side and the sell-side. Examples include total addressable market (TAM), serviceable addressable market (SAM), and serviceable obtainable market (SOM) for existing and newer products, services, and technology launches, along with identification of market opportunities for newer markets and segments for existing offerings.

Competitive Benchmarking Services

Our enterprise and technology clientele leverage our strong regional and local competitive assessment and comparative capabilities to understand the strategy and technology roadmaps of their direct and indirect peers on a regular and periodic basis.

Growth Strategy Services

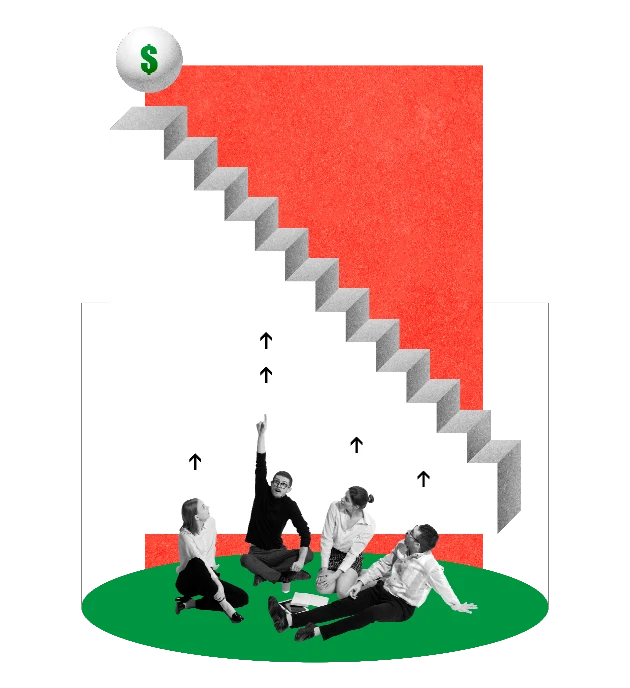

Acquisition of a new customer base is the leading priority for most enterprises in today’s connected economy. We assist these leading and emerging organizations in accelerating their growth strategies on a short-term and long-term basis.

Product & Services Strategy

A product and services strategy outlines how a business plans to develop, manage, and deliver its products or services to meet customer needs and achieve competitive advantage. It connects customer demand with the company’s capabilities and long-term business goals.

Go-to-Market Strategy Consulting Services

Real-time and continuous re-engineering of products and services catalog pivotal in carving niche market positioning is enabled via SG Analytics’ robust intelligence across multi-channel product and services strategies across local, regional, and global markets.

Pricing Benchmarking Services

Evaluating the optimal and best-case regional and local go-to-market strategy, involving direct vs. indirect vs. hybrid approach comparisons, is essential for long-term sustainable competitive advantage.

Technology Assessment, Including IT share of Wallet

Identifying tailored pricing models per buyer persona, location, and customer purchase lifecycle management is essential in today’s hybrid digital economy. SG Analytics leverages extensive pricing intelligence and executes tailored projects across multiple countries worldwide.

Sales & Marketing Enablement Services

SG Analytics is highly skilled at strategic technology assessment of key trends, challenges, and unique characteristics across multidimensional workflows within 5-6 segments globally. It has a proven track record of strategy consulting for BFSI, telecommunications, media and entertainment, healthcare and life sciences, and industrial automation enterprises.

Industry Coverage

BFSI & Fin-Tech

Healthcare

Manufacturing

Technology & IT

Media and Entertainment

Retail and E-Commerce

Automotive

Consumer Goods

Pharmaceuticals

Government

Why SGA for Business Strategy Consulting

Product Thinking

Unique perspective on working with tech companies and bringing product thinking.

Versatile

Rich exposure to a broad range of use cases across sectors globally.

Accuracy

Research findings augmented with analytical capabilities to generate sharper insights.

Deep Expertise

Experienced consultants with deep sector expertise and rich experience.

Who We Work With

Corporates

Insights that enhance understanding of current and target markets.

Boutique Research Firms

Sector experts across BFSI, healthcare, technology & media & entertainment.

Market Research Firms

Key insights that drive strategic inputs for end-clients.

Technology & Management Consultants

Opinion pieces and thought leadership collateral.