The global real estate fund market in 2024 was marked by cautious recalibration rather than a collapse. As allocators navigate macroeconomic headwinds and a tougher distribution environment, capital is consolidating around experienced managers and high-conviction strategies like opportunistic and debt.

Fundraising Struggles Continue, But the Landscape Is Not Uniform

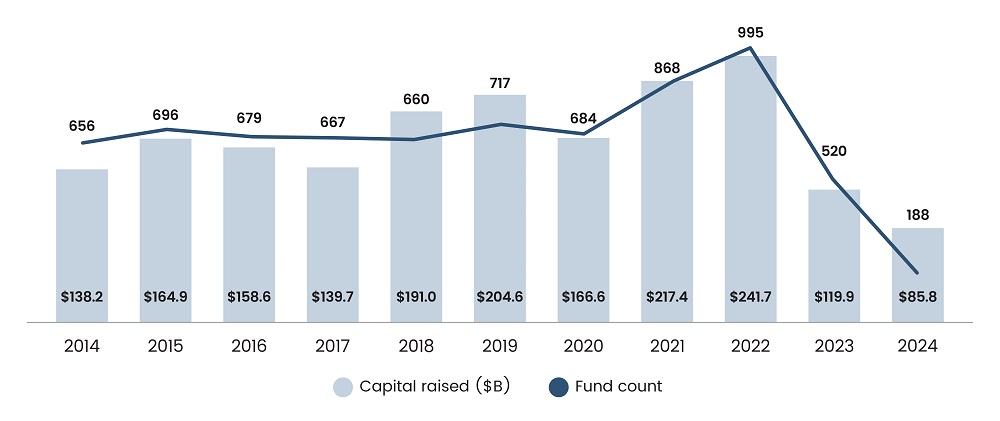

Global real estate fundraising plummeted to $85.8 billion in 2024, the lowest annual total in a decade, as per PitchBook. This contraction, driven by allocator liquidity constraints, soft performance, and rising macroeconomic uncertainty, forced many managers to extend fundraising cycles. The data further indicate that the median fund closure time rose to 21.4 months, up sharply from just 12.3 months in 2022. While overall sentiment remained cautious, the persistence of dry powder signals latent capital waiting for deployment as pricing stabilizes.

Figure 1: Real Estate Fundraising Activity

Source: PitchBook, data as of December 31, 2024

However, this decline was not evenly spread across geographies. North America showed relative resilience in comparison to the Asia and Europe markets, which saw larger declines. Investors favored familiarity during volatility, as 87.4% of all capital in 2024 went to managers with at least three prior funds. Emerging managers were sidelined, receiving just $10.8 billion, as per PitchBook. This reveals a growing bifurcation as allocators are consolidating exposure to trusted hands, especially amid geopolitical and rate-driven uncertainty.

Fund Strategy Rotation: From Core to Opportunistic and Debt

Core and core-plus strategies, once dominant, have seen waning enthusiasm. In 2024, value-add and opportunistic strategies accounted for over 60% of total capital raised, as per PitchBook. This trend is poised to continue as a majority of investors across all regions selected value-add as their preferred strategy in CBRE’s 2025 Global Investor Intentions Survey. This pivot is largely attributed to the dislocation in real estate valuations over the past year, coupled with tightening liquidity and a looming debt maturity wall.

Debt funds continued to surge in relevance in 2024, reflecting their emerging role as substitutes for risk-averse banks. In an environment where traditional financing remained scarce, and asset repricing was ongoing, these vehicles offered both yield and downside protection. Goldman Sachs’ $7 billion West Street Real Estate Credit Partners IV underscored this shift in 2024. Building on this trend, Blackstone announced in March 2025 the final close of its latest debt fund, BREDS V, with approximately $8 billion in total capital commitments. This momentum signals not just a tactical reallocation but a structural change in real estate capital formation.

Read more: Policy Jitters and AI Boom Reshape Climate Tech VC Landscape

Macro Headwinds Obscure Recovery Signs

According to Pitchbook, real estate returns were weak overall, with a negative 3.5% return for the 12 months ending Q2 2024. However, green shoots emerged late in the year, with Q3 2024 showing a rebound across value-added, debt, and opportunistic strategies. Public REIT indices also surged in Q3 on the back of Fed rate cuts before falling 8.2% in Q4 amid inflation concerns and Trump-era tariff threats. These fluctuations underscore the real estate sector’s sensitivity to macro signals.

Nonetheless, the volatility is masking longer-term positives. Lower CMBS delinquency rates in some sectors and improving vacancy dynamics suggest underlying strength. However, risks remain elevated, especially in the office and industrial segments. Moreover, political uncertainties in the US and uneven central bank policy responses globally complicate forecasting. The potential for reinflation is expected to delay further easing, which would dampen recovery prospects in the near term.

Niche Strategies and ESG Are Gaining Favor

Amid broad weakness, niche strategies gained traction. Investors are homing in on grocery-anchored retail, affordable housing in the US, and student housing in Europe, areas showing consistent demand and favorable policy tailwinds. Data centers also continued to attract interest fueled by the demand for AI infrastructure. This shift signals a broader evolution in real estate investing from scale-driven plays to precision-led strategies. Thus, allocators are prioritizing asset classes that offer visibility on cash flows and structural demand resilience.

Simultaneously, ESG integration is rising in importance. Climate transition and physical risk are being priced more explicitly, as evidenced by Goldman Sachs’ Article 8-compliant debt fund. Further, weather events and regulatory shifts are altering underwriting models and insurance costs. Real estate fund managers must now answer how they manage exposure to rising premiums, construction risk, and stranded asset risk. Therefore, ESG isn’t a marketing point anymore; it’s a capital access issue.

Read more: Secondaries Cement Their Place with $160 Billion Record

Experience, Not Innovation, Is Winning Allocator Trust

In real estate, managerial experience is emerging as the strongest predictor of capital inflows. Unlike other private market verticals, where emerging managers can succeed through disruption or niche focus, real estate’s reliance on local networks, operational partners, and complex asset management makes it hard for new entrants. Returns bear this out: funds led by experienced managers have consistently outperformed across all time horizons.

In conclusion, real estate fundraising in 2024 reflected a market in strategic transition defined by caution, consolidation, and a flight to quality. As capital grows more selective, success will hinge not on scale, but on expertise, adaptability, and alignment with long-term structural themes.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.