In 2024, climate tech startups found themselves under pressure, grappling with shrinking capital flows and intensifying investor scrutiny. Amid macroeconomic headwinds, AI-driven capital redirection, and mounting policy uncertainty, venture investors have become far more selective, reshaping the sector’s funding landscape.

Shift Toward Late-Stage Deals Reflects Investor Caution and Capital Discipline

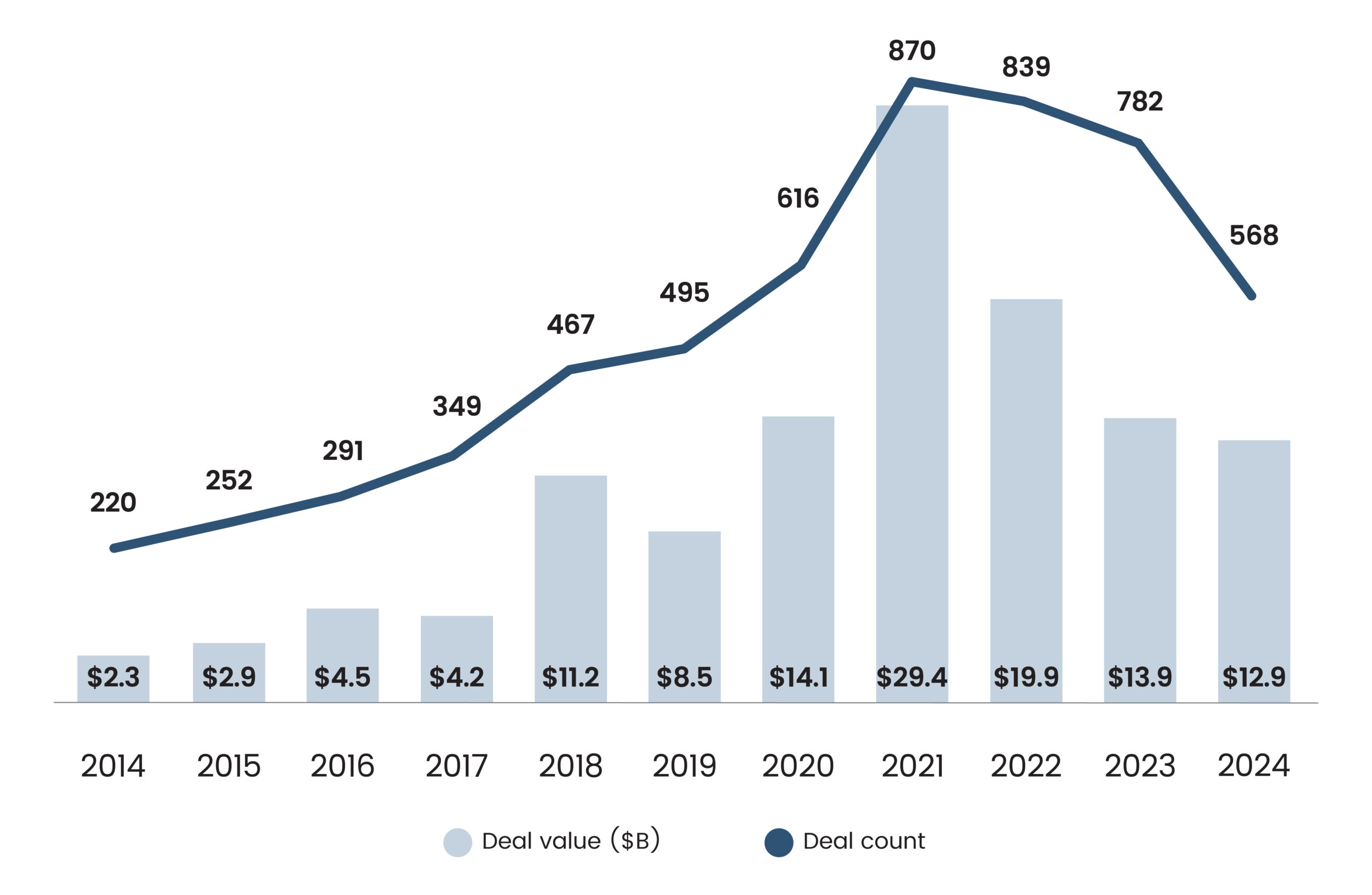

Climate tech startups, once a focal point for venture capital investment, faced a tough funding landscape in 2024. According to PitchBook, VC investment in climate tech fell 7.2% YoY to $12.9 billion. While this was an improvement from the 30% drop in 2023, it reflects sustained caution among investors. There was also a concentration of investment in more mature companies, with 40% of climate tech VC deal activity occurring at late-stage and venture growth stages. This signals a re-evaluation of risk appetite and capital allocation across the sector.

The retreat from early-stage startups suggests that investors are seeking clearer paths to profitability and commercialization before committing capital. The sector’s capital-intensive nature has posed a considerable challenge, particularly for hardware-focused companies that require significant upfront investment. As a result, investors prioritized later-stage bets with proven traction, product-market fit, or government-backed demand signals, further widening the funding gap between emerging technologies and established players.

Figure 1: Climate Tech VC Deal Activity

Source: Pitchbook, data as of December 31, 2024

Read more: The AI Boom is Breathing New Life into Robotics Startups

Policy Setbacks and AI Hype Undermine Investor Confidence in Climate Tech

The primary factor weighing on the sector was policy uncertainty. While the Inflation Reduction Act (IRA) of 2022 had spurred optimism, delays in disbursing funds and fears of policy reversal, especially in an election year, created unpredictability. It has been reported in early April 2025 that several US clean energy projects, including battery and carbon capture initiatives, will be removed from the Department of Energy funding lists. Such developments will make it harder for investors to rely on policy tailwinds when assessing the viability of these businesses.

Competition from other sectors, especially artificial intelligence (AI), further diverted investor attention. According to PitchBook, AI startups in the US accounted for 46.4% of total VC deal value and 28.9% of deal count. Further, as of April 2025, Andreessen Horowitz is reportedly seeking to raise a $20 billion fund focused largely on AI, underscoring the redirection of capital. Meanwhile, OpenAI closed a $40 billion funding round in late March, dominating VC headlines. With AI promising quicker returns, many investors sidelined climate tech, especially when valuations and paths to liquidity in climate tech remained uncertain.

This diversion of capital has created a challenging fundraising environment for clean energy startups, particularly those in hardware-intensive segments like grid storage, hydrogen, and advanced materials. Unlike AI, which often scales with high software margins and comparatively lower upfront costs, climate tech typically requires significant capital outlays and longer development cycles. Consequently, investors seeking quicker exits or lower burn rates have increasingly shifted focus. These dynamic risks are slowing innovation in the sector despite the long-term necessity and global policy support for decarbonization technologies.

Macroeconomic Pressures Force Founders to Adapt Funding Strategies

The macroeconomic backdrop further compounded the challenges. Rising inflation, interest rate volatility, and a subdued public market weighed on limited partners’ confidence. According to Venture Capital Journal, VC funds found it harder to raise new capital, with early-stage VC fundraising in the US dropping to its lowest level in six years by the end of 2024. Many fund managers chose to preserve dry powder for follow-on rounds rather than take fresh bets on unproven startups in challenging sectors. In response, founders are recalibrating their strategies.

Read more: Biopharma Modalities VC Trends: Selective Bets as Investors Seek De-risked Opportunities

Many are actively pursuing non-dilutive financing, like government grants or forging strategic partnerships with legacy energy firms. Some are also reframing their narratives. A growing number of cleantech founders now emphasize national security, energy independence, or cost competitiveness, rather than only climate impact. Moreover, climate startups are increasingly shifting messaging to appeal to defense and industrial backers as policy and funding become more complex.

Final Thoughts

There is a silver lining to this reset: the capital discipline of 2024 should lead to a healthier innovation pipeline. The excesses of 2021–2022 inflated valuations and misallocated capital, but the current correction is pushing startups to prove traction earlier and focus on scalable solutions. While challenging in the short term, this is expected to strengthen sector fundamentals. Between macro headwinds, AI boom, and policy uncertainty, climate tech’s value proposition needed refining. But the long-term drivers, such as climate mandates, energy security, and industrial renewal, remain intact. Those who adapt quickly will likely emerge stronger when the next wave of green tech investment begins.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.