- Resources

- Blog

- Healthcare PE in 1Q25: Defensive Postures, Selective Plays

Healthcare PE in 1Q25: Defensive Postures, Selective Plays

Capital Markets

Contents

May, 2025

Private equity (PE) activity in healthcare services hit a new low in 1Q25 as macroeconomic volatility and policy shocks disrupted deal flow. Yet amid the turbulence, investors are pivoting to targeted, resilient plays, marking a strategic shift from growth at all costs to value and defensibility.

A Challenging Start to 2025: Volatility Overcomes Optimism

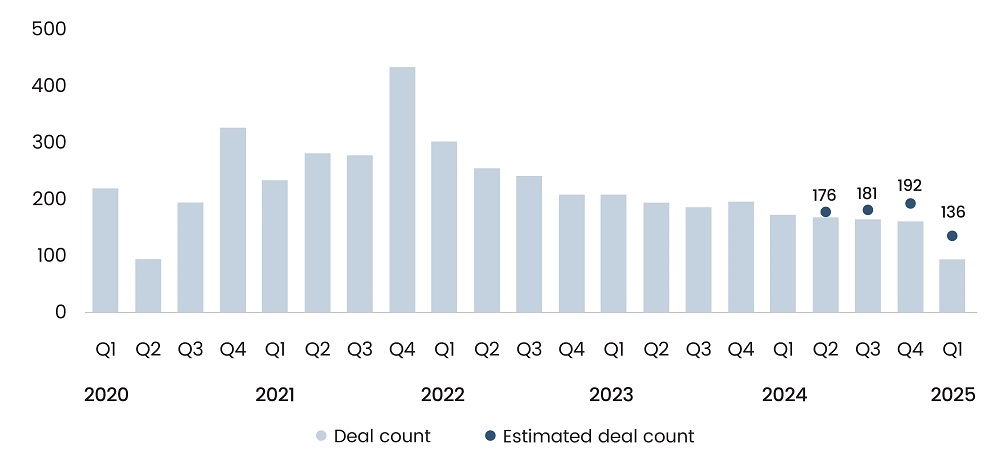

The healthcare services PE market entered 2025 facing macroeconomic and policy headwinds that quickly dampened early optimism. According to PitchBook, 1Q deal volume fell to its lowest level since the 2020 pandemic crash, reflecting investor hesitation amidst rate uncertainty, inflation concerns, and market-disrupting tariffs. Notably, the cautious optimism seen at the J.P. Morgan Healthcare Conference eroded quickly as volatility rose.

Figure 1: US and Canada Healthcare Services PE Deal Count

Source: PitchBook, data as of March 31, 2025

These conditions suggest 2025 will likely trail even the muted activity levels of 2024 unless there’s a significant turnaround. The healthcare PE is shifting from broad-based enthusiasm to a selective, defensive posture focused on recession-resilient niches and structured exits. While deal activity slowed, the sector’s relative insulation from tariff risks compared to manufacturing or tech kept the sector from experiencing a full-scale collapse, reinforcing its position as a defensive asset class rather than a high-growth vehicle amid market turbulence.

Read More: Secondaries Cement Their Place with $160 Billion Record

Walgreens Take-Private: Scale Doesn’t Mask Strategic Weakness

Sycamore Partners’ $10 billion take-private acquisition of Walgreens Boots Alliance in 2025 was the most significant healthcare buyout in recent years, but it revealed as much about strategic concerns as market opportunity. The deal is expected to prompt cost-cutting through store closures. Walgreens’ retreat from primary care initiatives signals long-term trouble in the retail pharmacy model and will likely create room for competitors like Amazon and Walmart to gain a share.

This transaction underscores a broader theme in 1Q, which is that PE is no longer chasing growth at any cost but is instead repositioning troubled giants. Sycamore’s history with Staples suggests a likely pursuit of asset carve-outs, signaling opportunism over innovation. In a market seeking resilient returns, large-scale deals are expected to become rarer unless they come with restructuring potential or distressed pricing.

Exit Activity Shows Life but Under Pressure

Despite slow deal flow, exits picked up meaningfully. According to PitchBook, the last three quarters have seen the highest stretch of PE exits since 2022. Much of this momentum stems from extended hold periods that have left firms with few options but to sell. Encouragingly, examples like Waystar’s IPO and R1 RCM’s acquisition in late 2024 will likely be nudging others to market.

Still, the IPO market remains largely frozen, and there has been no major listing in 2025 so far. The bright spot lies in secondary buyouts and strategic sales, which remain viable pathways. As volatility curbs aggressive buyout strategies, the focus is shifting to value realization and portfolio clean-up. PE firms are not retreating from healthcare, but they are pivoting toward exits and defensible plays over speculative bets.

Home-Based, Dental, and MSK Care Attract Focused Interest

Selective enthusiasm remained for specific verticals. PitchBook data shows that home-based care led 1Q deal volume with 18 transactions, followed by 12 deals in dental and 9 deals in musculoskeletal (MSK) care. The MSK segment’s emergence is particularly notable. Historically underappreciated, it’s gaining traction due to its link to overall care costs. The anticipated IPO of Hinge Health, a digital MSK platform, will likely serve as a catalyst for further investment.

While value-based care and behavioral health were previously high-valuation favorites, they now trade closer to broader averages, improving investor entry points. This normalization supports the thesis that healthcare PE is shifting to a valuation-sensitive and outcome-focused model. In today’s climate, sectors with strong payer alignment, digitization potential, and cost-containment impact will be prioritized over less scalable care models.

Read more: Policy Jitters and AI Boom Reshape Climate Tech VC Landscape

Strategic Carve-Outs and Real Asset Plays Are on the Rise

1Q also saw a rise in PE interest in carve-outs and real estate-backed plays. For example, Bain Capital’s $3.2 billion unsolicited bid for Surgery Partners highlights the growing interest in ambulatory surgical centers (ASCs). Meanwhile, Welltower’s $3.2 billion acquisition of Amica Senior Lifestyles underscores pension fund appetite for stabilized, income-generating healthcare assets. Such deals reflect a tactical move toward lower-risk, asset-backed investments.

Additionally, the $1.1 billion LBO of Soleo Health and BrightSpring’s $835 million divestiture shows a growing appetite for targeted transactions with clear value arcs. These transactions reinforce the view that PE firms are not retreating wholesale; they’re recalibrating around defensible strategies. With valuations now more rational and tariff exposure limited, healthcare services remain a viable lane for savvy investors.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.

Related Tags

Capital Markets Investment Banking Private Equity Private Equity ServicesAuthor

Contents