The FTX meltdown has been the latest in a series of failures to have hit the crypto world in 2022, precipitated in part by the indiscriminate fall in crypto prices. While on the face, the series of collapses seem to put the future of cryptos as an emerging asset class in grave doubt, a deeper analysis shows an urgent need for formulating regulatory guardrails and accounting rules and standards aimed at cryptocurrencies and companies. Furthermore, the unraveling of FTX is yet another reminder for private market investors to enforce adherence to more rigorous due diligence.

Figure 1: Series of Crypto Meltdowns in 2022

Source: SGA Research

Read more: Generative AI – The New Venture Capital (VC) Gold Rush

While the dust is yet to settle on the FTX saga, the preliminary analysis reveals (1) a glaring saga of lack of transparency, (2) concentration of power in the hands of a select few, (3) inappropriate rehypothecation of assets, (4) and above all a gross financial misconduct supported by an absence of even basic corporate governance – FTX reportedly didn't have an in-house accounting department. The collapse is being investigated by multiple regulatory bodies, including the SEC.

"Never in my career have I witnessed such a complete failure of corporate controls along with the absence of trustworthy financial information as occurred here," new FTX CEO John Ray III, overseeing company liquidation.

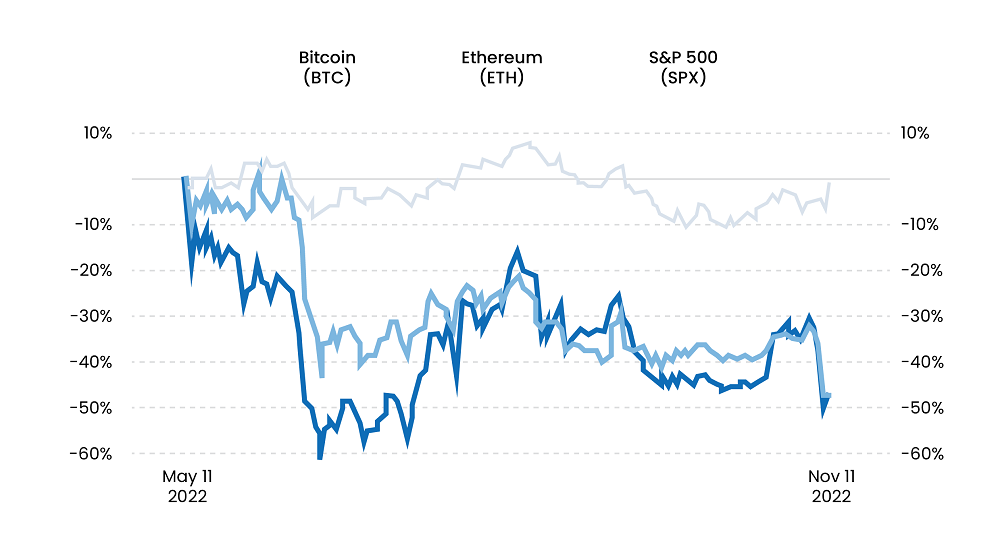

Figure 2: Crypto Industry Reels under the impact of FTX Implosion

Source: CNBC

Such was the state of play that Alameda Research, Sam Bankman-Fried (SBF) 's crypto hedge fund, loaned $1 billion to SBF before going bankrupt. Previously, FTX rescued BlockFi to seemingly gain control over customer funds and moved $10 billion to Alameda to cover its thin balance sheet.

The shady financials spooked Binance, which attempted to bail out FTX. Just over 24 hours after agreeing to buy its troubled rival FTX, crypto exchange Binance backed out. The fallout led to FTX, which was valued by private investors at $32 billion in January despite turbulent markets, filing for bankruptcy and its FTT token close to rock bottom.

Read more: Tech-Related Ethical Concerns Businesses Should Address in 2022

More Oversight Required to Re-establish Trust

Private market investors are increasingly favoring entry and exit timing or chance instead of proper audit/due diligence. For instance, while multiple investors lost billions in the Terra/luna collapse, some investors, including Pantera Capital, had spectacular returns earning nearly 100x on their $1.7 million investment.

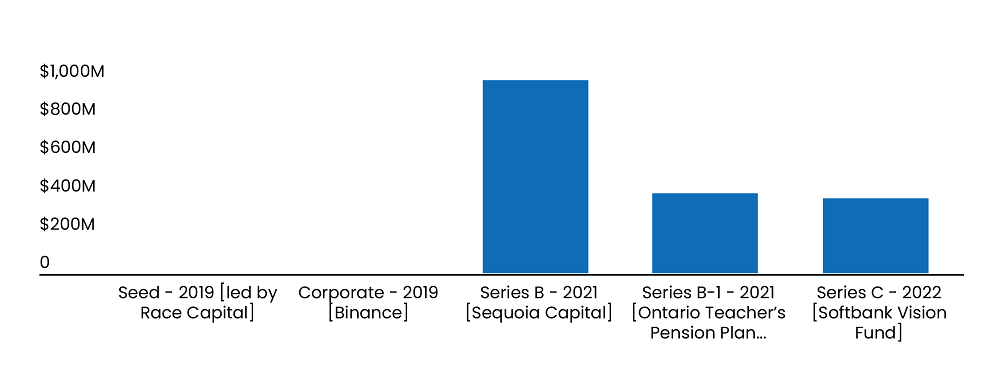

Sequoia, one of the leading venture capital firms with the tagline "We help the daring build legendary enterprises," is a major investor in the firm. The fallout has hurt both its reputation and financials. It had published a eulogical 14,000 words article on SBF, which has now been taken off the site. The VC firm has had to write off over $210 million in investment in FTX. Similarly, the Ontario Teachers' Pension Plan has written off a $95 million investment in FTX.

Read more: Stocks with Multibagger Potential: Top Metaverse and Crypto Mining Stocks to Invest in

Figure 3: FTX's Investors

Source: Crunchbase

While these may be minuscule amounts of the total AUM for these investors, the larger concern is the erosion of trust in crypto companies that the ensuing saga could trigger, particularly at a time when digital assets were progressively emerging as an alternative inflation-proof investment class with a potential for high returns and little correlation to other asset classes. Positive perception of cryptos had grown by six percentage points per a Fidelity Digital Assets survey of institutional investors.

Going ahead, in addition to regulations, the broadening cohort of private market investors will have to get back to basics in terms of due diligence. Growing competition for promising start-ups notwithstanding, private market investors just can't afford to have an outsourced due diligence process anymore when its LPs' and customers' trust is increasingly at stake. First-hand verification of operational and financial metrics should outweigh other factors, including getting influenced by the names of other investors on the cap table. Above all, private investors will have to shoulder the responsibility of bringing credibility to the start-up ecosystem by bringing tighter oversight and enforcing stricter corporate governance, especially in the wake of Theranos and FTX wreckage.

Read more: The Emerging Blockchain-Based Tokenization: What Investors Need to Know About it?

How it Will Impact the Crypto Industry

The fast-moving FTX-Binance saga has shaken market sentiment for retail investors and is a serious setback to crypto's journey toward becoming a legitimate asset class. That said, it is unlikely to impact venture investment in the crypto space in the long run as VCs' investment horizon is long enough to brush aside the impact of such fallouts. Regardless, the collapse, along with a slew of previous insolvency events such as that of Terraform Labs, Three Arrows Capital, and Celsius Network, will set off a series of changes in the crypto industry.

Multiple centralized and opaque crypto lending platforms will likely vanish away as consumer trust erodes. The event, which marks the stunning fall of SBF's vast crypto empire, is also likely to bring in more opportunities in decentralized finance and leaves an opportunity for companies working on sustainably building real value.

Investors are likely going to gravitate toward Defi, which appears to be the future with logic embedded in the code, as highlighted by John Wu of Ava Labs. In that sense, the debacle could ultimately prove to be a silver lining for the industry as it ushers in the maturation of the industry with frothy players succumbing to market realities. Additionally, the crisis could underline the importance of blockchain intelligence companies detecting crypto-related fraud and financial crime, with digital assets and the mainstream financial system becoming increasingly intertwined.

Most importantly, there is an urgent need for more regulation of centralized crypto platforms. Additionally, the onus also lies on surviving crypto firms such as Binance to proactively adopt tighter financial and regulatory controls to regain lost investor and customer trust.

Partner of choice for lower middle market-focused Investment Banks and Private Equity firms, SG Analytics provides offshore analysts to support across the deal life cycle. Our complimentary access to a full back-office research ecosystem (database access, graphics team, sector & domain experts, and technology-driven automation of tactical processes) positions our clients to win more deal mandates and execute these deals in the most efficient manner.