Insurance Data Analytics Solutions & Services

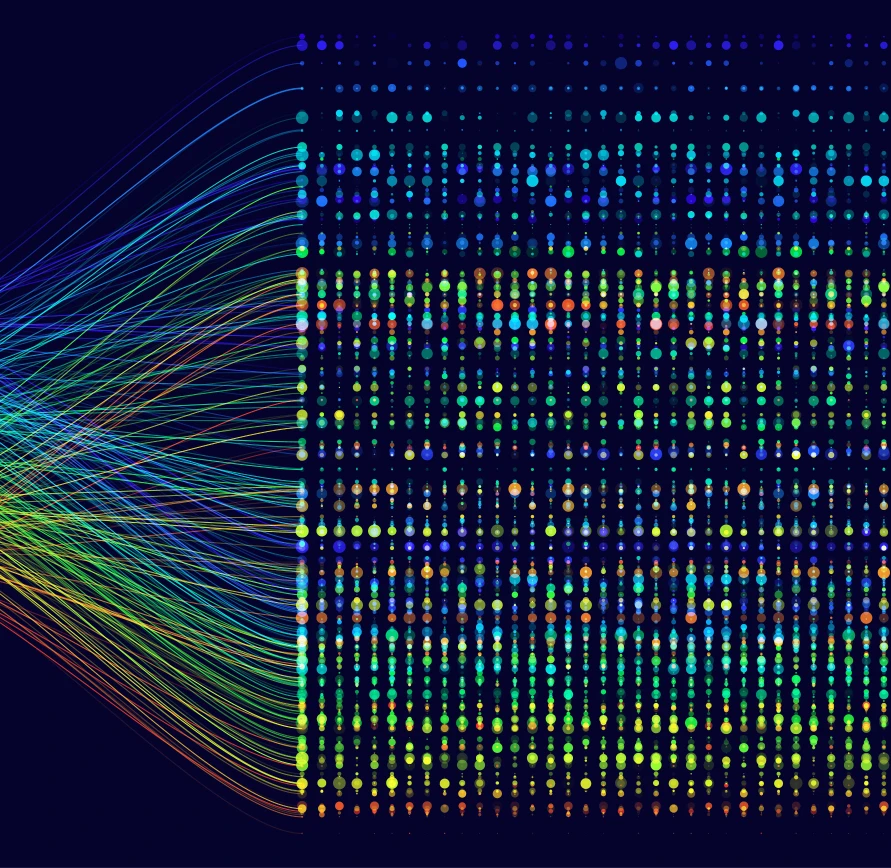

Stay ahead in the evolving insurance landscape with SG Analytics (SGA)’s comprehensive insurance analytics services. As a leading insurance analytics solutions company, we help organizations harness data-driven strategies, optimize risk assessment, and enhance decision-making with real-time, cross-channel analytics.

Transform Your Operations with

SGA’s Insurance Data Analytics Solutions

As a leading insurance data analytics services company, SGA delivers end-to-end, data-driven solutions that empower insurers to optimize risk assessment, maximize operational efficiency, and enhance customer experiences. Our integrated analytics services provide actionable insights into all insurance operations, enabling smarter decision-making and measurable business impact for clients operating in the rapidly evolving digital insurance landscape.

Insurance Analytics Solutions

Risk Assessment & Underwriting Analytics

Enhance accuracy in risk evaluation and policy pricing through advanced predictive models and comprehensive data analysis.

Fraud Detection & Prevention Analytics

Identify suspicious patterns and prevent fraudulent claims using Machine Learning (ML) algorithms and real-time monitoring.

Claims Processing Analytics

Streamline claims workflows, reduce processing times, and improve settlement accuracy through automated analytics.

Customer Analytics & Segmentation

Gain deep insights into customer behavior, preferences, and lifetime value for personalized product development.

Actuarial Analytics

Support pricing strategies, reserve calculations, and regulatory compliance with sophisticated mathematical modeling.

Regulatory Compliance Analytics

Ensure adherence to industry regulations and reporting requirements through automated monitoring and reporting.

Performance & Profitability Analytics

Optimize product portfolios, measure business performance, and identify revenue optimization opportunities.