Fund Data Management Services for Asset Managers

Our fund data services focus on collecting, managing, analyzing, and factsheets production, newsletters, and other performance-related documents. These services are critical for informed decision-making by investors, fund managers, and other stakeholders.

Technology-Enabled

Fund Data Management Support & Services

We offer a comprehensive suite of fund data services for asset managers, including data gathering and the consumption of reports such as factsheets, newsletters, and performance presentations. The service covers review of existing processes to streamline the process flow and draw efficiencies through automation.

Key Activities in

Fund Data Services Include

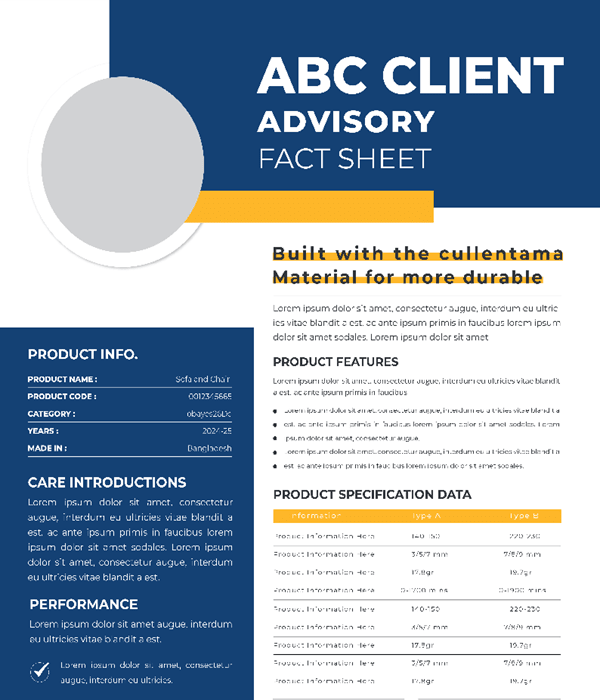

- Fund Factsheets: Comprehensive report covering fund’s performance metric, characteristic details, rating with visual representations.

- Newsletters: Detailed report covering fund manager’s commentary, performance metric, risk profile and rating.

- Fund Manager Profiles: Covers fund manager’s past track record in terms of value delivered, previous associations, qualifications.

- Investor Presentations: Presentation covering fund’s start date, objective, performance details, attribution analysis, holding details, and more.

Fund Data Services

We offer periodic factsheet creation services for variety of clients globally, providing them with customized factsheet templates and periodic updates of these factsheets. The typical update entails process raw data to derive performance metrics, benchmarks, and other relevant information including characteristic data. We also perform the process mapping to streamline dataflow and apply automation to make periodic factsheet creation process efficient and error-free.

We offer service for periodic update of investor newsletters covering fund manager commentary, market outlook and performance summary of the fund. We leverage our strong pedigree of investment research to provide qualitative research support for generating market outlook.

We also provide service for creating manager profiles for fund managers covering their track record of funds managed and delivered returns. This document provides comprehensive view on manager’s ability to deliver as per investor’s expectations.

We craft impactful investor presentations that align with your fund’s vision, performance, and strategy. Our data-driven storytelling and visual design help engage stakeholders, highlight key differentiators, and support capital-raising efforts with clarity and credibility.

We offer periodic factsheet creation services for variety of clients globally, providing them with customized factsheet templates and periodic updates of these factsheets. The typical update entails process raw data to derive performance metrics, benchmarks, and other relevant information including characteristic data. We also perform the process mapping to streamline dataflow and apply automation to make periodic factsheet creation process efficient and error-free.

We offer service for periodic update of investor newsletters covering fund manager commentary, market outlook and performance summary of the fund. We leverage our strong pedigree of investment research to provide qualitative research support for generating market outlook.

We also provide service for creating manager profiles for fund managers covering their track record of funds managed and delivered returns. This document provides comprehensive view on manager’s ability to deliver as per investor’s expectations.

We craft impactful investor presentations that align with your fund’s vision, performance, and strategy. Our data-driven storytelling and visual design help engage stakeholders, highlight key differentiators, and support capital-raising efforts with clarity and credibility.

Why SGA

Deep Domain Expertise

Our decade long expertise and team of SMEs ensure smooth process transition, setup, and ongoing operations.

Automation Capabilities

We offer full-service suite for process standardization, automation, and enhancement to draw efficiencies and scale up the volume.

Exceptional Design Support

Through our dedicated design team, we deliver impactful marketing materials.