Commercial Due Diligence Support Services

Market & Industry Analysis

We conduct comprehensive assessments of the end industry and region, including its size, growth trends, supply chain analysis, key drivers, and addressable markets (TAM, SAM, and SOM). Additionally, we conduct research on macroeconomic, geopolitical, and regulatory factors on the industry’s future to assess any top-down risks faced by a company or industry.

Competitive Benchmarking Services

We analyze the competitive scenario and the target company’s market position vis-à-vis comparable peers, including deep-dive company profiles, market share mapping, unique selling propositions (USPs), product benchmarking, and strengths, weaknesses, opportunities, and threats (SWOT) analysis along with specific sub-segment dynamics.

Customer Analytics Services

We conduct social media analytics, expert interviews, and client surveys with key customers to gather unfiltered, objective insights on customer experiences, loyalty, churn, and purchasing patterns.

Sales & Marketing Effectiveness

We provide in-depth analytics on sales team effectiveness, marketing spend effectiveness and provide gap analysis with recommendations to fill those gaps to ensure business impact.

Financial Due Diligence Support Services

Quality of Earnings (QoE) Analysis

We conduct granular analysis of multiple historical income statements to identify, highlight, and normalize one-off, non-recurring, and unusual items that mask the ‘true performance’ of a company. We understand the nuances of adjusting several items and arrive at a true, sustainable ‘run-rate’ earnings before interest, taxes, depreciation, and amortization (EBITDA) for the valuation exercise.

Balance Sheet Analysis

We put the balance sheets and notes to accounts under the magnifying glass and identify hidden items such as off-balance-sheet liabilities, unfunded pension obligations, contingent liabilities, litigation impacts, and tax liabilities. We reveal uncommon insights and strive to refine the metrics that get us as close to a realistic picture as possible.

Working Capital Analysis

While focusing on long-term sustainability, we also emphasize short-term operational liquidity. We track several metrics, such as an unrealistic or sudden rise in receivables or payables and sudden increases in deferred revenues or payments to associates, thereby avoiding post-closure surprises.

Cash Flow & Capital Expenditure (CapEx) Review

We analyze historical and projected CapEx in the context of the company’s cash flow generation ability to determine optimum capital spending to sustainably fund long-term business growth.

Business Plan & Projections Review

Leveraging our deep expertise of financial statements and sectoral knowledge, we increase the quality and reliability of management’s financial projections and business plans. We prepare customized scenario and sensitivity analyses to objectively assess business resilience across the economic cycles.

Benchmarking Analysis

We compare performances with listed peer companies to draw historical market performances across various market cycles and use it as a relative measure to assess how the target fares compared to bellwether companies following best practices.

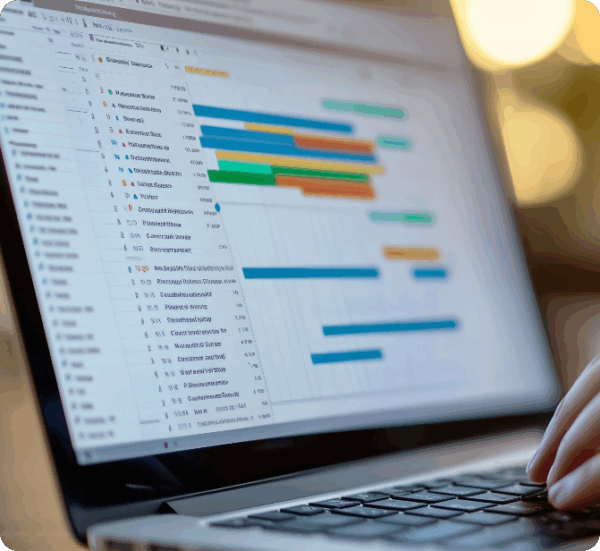

Our Research Ecosystem

We utilize our complete research ecosystem of operations to provide our clients with a one-stop-shop experience.

Our in-house design and language experts support investment banks to deliver high-quality, ready-to-use, impactful presentations and content.

Efficiency tool to streamline the preparation of financial models and presentations and workflow management tool for transparency and efficiency. The analyst has access to SEAS – SGA’s Data Extraction Automation Solution.

The BIS team with in-depth expertise in various databases to deliver high-quality research insights.

Supported by experts with significant experience in working with independent valuators, investment banks, and private equity firms across financial reporting, tax compliance, and transaction-related and litigation-related valuations.

Our in-house subject matter experts across various sectors and domains guide the team of analysts to provide domain understanding and create impactful outputs.

Our in-house design and language experts support investment banks to deliver high-quality, ready-to-use, impactful presentations and content.

Efficiency tool to streamline the preparation of financial models and presentations and workflow management tool for transparency and efficiency. The analyst has access to SEAS – SGA’s Data Extraction Automation Solution.

The BIS team with in-depth expertise in various databases to deliver high-quality research insights.

Supported by experts with significant experience in working with independent valuators, investment banks, and private equity firms across financial reporting, tax compliance, and transaction-related and litigation-related valuations.

Our in-house subject matter experts across various sectors and domains guide the team of analysts to provide domain understanding and create impactful outputs.

Our Automation-Powered Solutions

Workflow Management

- Automate and streamline request life cycle and evaluate capacity availability.

- Track the time spent on each request through a single dashboard view for managers.

- MIS reporting feature to track productivity.

Knowledge Management System

- Centralized knowledge repository leveraged by teams globally.

- User-friendly search through available content to reduce TAT and increase efficiency.

- Easy to implement, integrate, and customizable as per the client’s requirements.

Investment Banking Productivity Suite

- Package of slide layouts and infographics in client’s color scheme.

- Investment banking productivity suite.

- TOC creation with pre-ideas/guidelines.

- Build custom automated tombstone slides using past deal data.

- Manage and edit charts, tables, format, etc. with a single click.

Custom RPA Tools

- Automated data extraction from structured and unstructured sources.

- AI-/ML-driven NLP tools for processing qualitative information.

- Automated quality check and assurance tools.