Valuations are resetting across US venture markets as down rounds normalize, exits remain constrained, and capital concentrates in a few dominant sectors. For investors, this is both a moment of recalibration and a test of discipline, with AI standing out as the primary driver of growth and volatility.

The 2Q25 confirmed what many venture capital (VC) investors have anticipated. A valuation correction is underway, reshaping pricing, deal flow, and exit dynamics. After years of constrained exits and inflated private market prices, founders and investors are adjusting expectations to better reflect public market realities. While this shift has brought more down rounds and uneven returns, it also lays the groundwork for a healthier and more investable cycle. For investors, the new environment offers opportunities to re-engage at disciplined entry points, particularly in sectors that continue to attract investment capital.

Valuations Recalibrate, Down Rounds Normalize

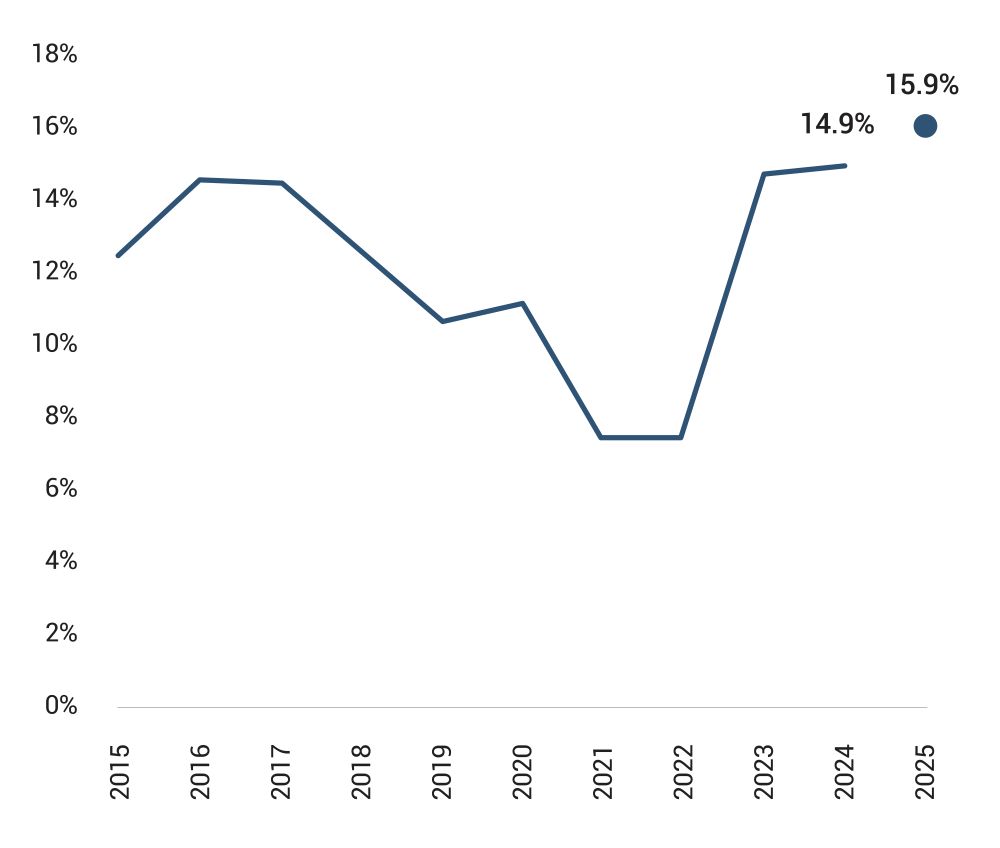

Valuation discipline has returned, with 15.9% of YTD deals in 2025 being down rounds, the highest share in a decade, as per PitchBook. While only 2% of these involved unicorns, nearly half of the unicorn population has not raised since at least 2022, showing reluctance to accept markdowns. Smaller, later-stage companies in IT and healthcare have been most affected, while a handful of elite startups continue to raise capital with ease. For investors, this reset represents a healthier market correction that brings pricing closer to fundamentals and creates attractive entry points, but only when paired with credible growth trajectories and strong capital discipline.

Figure 1: Down Round Count as a Share of Total VC Deal Count in the US

Source: PitchBook, data as of June 30, 2025

AI Dominance Continues to Shape the Market

AI accounts for 65% of capital deployed in 2025 but just 35% of deal count, reflecting a tilt toward large deal sizes, as per PitchBook. Median valuations for AI startups are 56% higher at Series C and 230% higher at Series D+ compared with non-AI peers, reflecting both capital intensity and investor conviction. Series B step-ups of 2.1x for AI companies, versus 1.4x for non-AI, illustrate the premium placed on this sector’s perceived upside.

Yet, investor enthusiasm comes with caveats. According to PitchBook, while foundational AI developers continue to command high valuations, 29.3% of down rounds this year have occurred in AI and machine learning, mostly among firms applying AI to niche workflow problems rather than driving core innovation. This split reinforces the need for rigorous due diligence and a focus on defensible technology. The AI narrative remains influential, but valuations must be supported by sustainable competitive advantages rather than speculative momentum.

Rising Concentration in VC

The top-heavy nature of the venture market reached new extremes in 2Q, with the top five deals accounting for 36.7% of all funding, more than double 2024’s share, as per PitchBook. Mega-deals like Scale AI’s pseudo-acquisition by Meta and Thinking Machines Lab’s $3 billion seed round highlight how capital is clustering in a handful of companies. This underscores how a small number of investments are driving the bulk of performance.

For investors, this concentration means that missing out on elite deals will likely significantly impair outcomes. Those without access to these top-tier rounds will need to pivot toward differentiated strategies in overlooked market segments. While AI’s capital cycle continues to accelerate, smaller-scale companies with more measured valuations will likely provide stronger risk-adjusted outcomes for managers with disciplined sourcing capabilities.

Exit Activity Remains Limited

Exit value rose to $67 billion in 2Q, the highest since 4Q21, but IPO volume remains on pace for the lowest annual total in a decade, as per PitchBook. Most 2Q IPOs were down rounds relative to peak valuations, with Chime’s $9.1 billion listing far below its $25 billion high. While public listing medians are historically high, post-IPO performance has been mixed, with four of six unicorn IPOs trading below their first-day close.

M&A activity remains subdued, with median acquisition step-ups at just 1.2x, well below pre-2022 norms, as per PitchBook. Billion-dollar transactions like OpenAI’s $6.5 billion acquisition of io are exceptions rather than indicators of a broader recovery. Moreover, the secondary market has provided limited relief, with direct secondary volume estimated at $60 billion and median premiums rising to 12.9% in 2Q. However, this activity is concentrated among 20 to 50 in-demand startups, leaving most portfolio companies without access to meaningful liquidity.

Returns Recover but Remain Uneven

Venture market IRRs have moved back into positive territory over the past two quarters, and distribution yield rose to 10.9% in 2Q from 10.6% in 1Q, as per PitchBook. Even so, performance remains below the decade average of 19.6% and heavily relies on a small set of winners. The struggles of the 2019 vintage underscore the risks of illiquidity, with funds missing earlier exit windows and now holding weaker RVPI multiples. For investors, this underscores that without reliable liquidity through M&A or secondaries, headline valuations alone are not enough to deliver realized returns.

Conclusion

The 2Q25 US VC landscape reflects a market in transition. Valuations are moving closer to fundamentals, capital is clustering at the top, and liquidity remains elusive for many. AI continues to drive both opportunity and volatility, while returns have turned positive but remain uneven across vintages. For investors, navigating this environment requires a dual focus on securing access to elite opportunities and identifying overlooked assets priced with discipline. As conditions stabilize, those who maintain consistency in entry pricing and selectively deploy capital will be best positioned for the next phase of growth.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.