US venture capital (VC) in 3Q25 showed a measured recovery, with early-stage rounds proving resilient and late-stage funding more selective. Artificial Intelligence (AI) remained central to deal activity, but valuations grew faster than liquidity, keeping investor focus on fundamentals and discipline.

US VC in 3Q25 continued its gradual stabilization after a prolonged correction. Early-stage activity remained strong with investor competition sustaining valuations, while later rounds faced greater scrutiny on scalability and profitability. AI shaped both private market funding and exits. Yet liquidity improvements lagged, leaving returns muted. The quarter reflected a market balancing optimism with financial caution, where investors favored efficient operations and durable growth over rapid expansion.

Read more: Global IPO Market Reawakens as US Leads 3Q25 Revival

Early-Stage Gains Contrast with Series C Slowdown

Series A and B rounds recorded robust performance, with capital raised and valuations increasing between 1.6% and 29%, as per the JP Morgan Venture Beacon 3Q25 report. This strength reflected continued investor conviction in early innovation and manageable risk profiles. Median valuations and participation levels stayed stable, showing alignment between company progress and investor expectations. Series D+ rounds, meanwhile, saw smaller lead check sizes despite higher valuations, suggesting broader co-investment and cautious optimism.

Series C was the market’s inflection point. Financings declined across all metrics, including a 34% drop in capital raised and a 40% fall in valuations. Investors increasingly demanded tangible commercial traction before committing fresh capital. While fundraising timelines shortened to 21 months, the Seed-to-Series A graduation rate slipped to 18%, highlighting greater selectivity. The stage gap underscored a market prioritizing performance proof over potential.

Read more: Reassessing the Role of Private Markets in Defined Contribution Investing

Down Rounds Surge at Late Stage as Selectivity Deepens

Late-stage valuations faced pressure as Series C+ down rounds climbed from 16% in early 2025 to over 28%, as per Venture Beacon. This reflected investor caution toward companies unable to sustain efficient growth or justify earlier pricing. Early-stage down rounds, however, fell to 13.4%, suggesting healthier access for adaptable, cost-conscious startups. Investors linked valuation premiums to proven revenue visibility and operational discipline.

This divergence marked a recalibration rather than a retreat. VC remained active but more focused on execution and capital efficiency. Momentum investing gave way to fundamentals, with investors favoring startups that combined lean operations and consistent performance data. Firms lacking clarity or scalability faced longer funding cycles and flatter valuations, signaling a more rational pricing environment across the ecosystem.

Read more: Healthcare Fundraising in 1H25: A Realignment of Capital Across Private Markets

AI Drives US Deal Value and Signals IPO Recovery

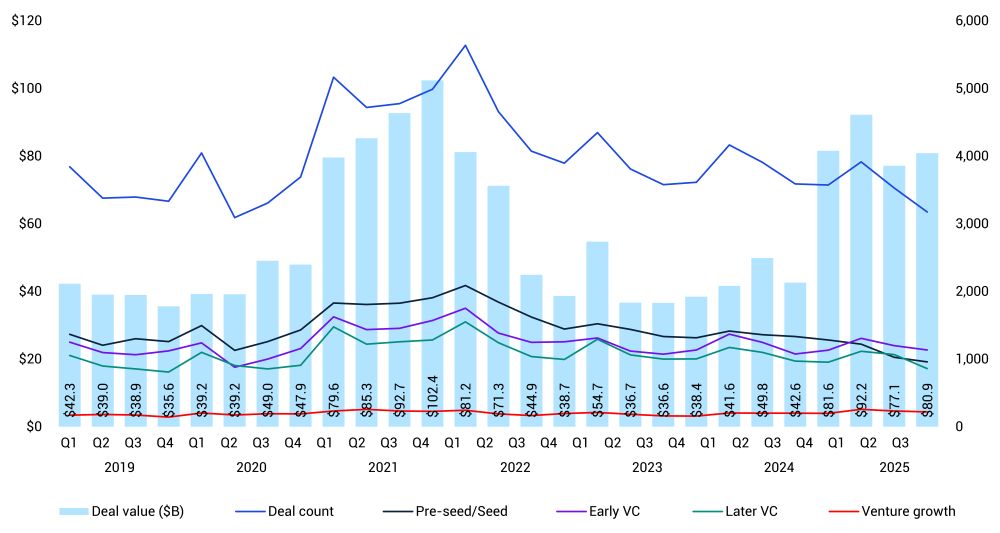

The US led global venture investment in 3Q25, raising $80.9 billion across 3,175 deals, as per the KPMG Venture Pulse 3Q25 report. AI-dominated dealmaking, highlighted by major rounds including Anthropic at $13 billion, xAI at $10 billion, Reflection AI at $1 billion, and additional significant raises for Databricks, Groq, Perplexity AI, Ramp, and Cognition AI. These investments spanned model development, infrastructure optimization, and applied AI product layers, which showed that capital deployment is deepening across the full AI value chain rather than concentrating only in foundation model developers.

Figure 1: US VC Financing Activity

Source: KPMG Venture Pulse 3Q25, data as of September 30, 2025

The IPO window reopened with encouraging signals. Figma’s $1.2 billion listing anchored the activity, followed by Bullish’s $1.1 billion debut and Klarna’s $1.3 billion US offering. These transactions restored valuation benchmarks and revived liquidity after two years of limited public listing. For investors, the return of IPOs confirmed that scalable technology firms will likely again access public markets. However, sustaining this recovery will depend on earnings performance and investor appetite through 2026.

Global Flows Reinforce US Leadership in AI Capital

Global venture funding totaled $120.7 billion across 7,579 deals, with the Americas capturing the majority through large US-based AI rounds, as per KPMG. Europe saw moderate progress led by Mistral AI in France and Nscale in the UK, while Asia remained subdued. The US accounted for eight of the ten largest global financings, underscoring its scale advantage in AI innovation and infrastructure.

This pattern reflects the US’s ability to combine venture funding with corporate partnerships to accelerate compute build-outs and model development. Investments now span the full AI stack from semiconductors and data centers to software and enterprise platforms. However, this leadership also increases concentration risk as capital clusters among a few dominant firms. For investors, diversified exposure and disciplined entry valuations remain critical to balance opportunity and risk.

Read more: From ICU to IPO: How Private Equity is Reshaping Global Healthcare

Valuations Rise but Returns Lag Without Liquidity

Valuations strengthened across funding stages in 3Q25, reflecting improved pricing confidence and a gradual normalization of investor sentiment, yet liquidity remained constrained. Step-ups continued for a fifth consecutive quarter as greater selectivity and disciplined deployment supported more consistent revaluations, as per PitchBook. However, realized returns did not keep pace with the valuation rebound. The one-year IRR held at 3.1%, and post-2019 fund vintages continued to underperform public benchmarks such as the S&P 500.

The gap between valuations and distributions stemmed from high entry prices and slow exit conversion. Limited IPO and M&A throughput left most paper gains unrealized. Even with improving rates and tentative liquidity recovery, managers face pressure to convert mark-ups into cash outcomes. Investors are expected to favor funds with proven distribution records and pricing discipline. Sustained exit activity remains essential to turning valuation recovery into durable performance.

Conclusion

3Q25 reflected a venture market regaining stability while staying cautious. Early-stage activity remained strong, late-stage funding tightened, and AI continued to drive valuations and exits. The IPO window showed early signs of revival, though liquidity remained partial. For investors, success will rely on patience, selectivity, and adherence to fundamentals. As capital continues flowing into AI and technology-led growth, consistent returns will depend on disciplined deployment, pricing prudence, and steady exit realization.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.