US capital markets in 2026 will be shaped by macro stability, earnings-led equity leadership, valuation dispersion, and a more selective primary market. Investors who prioritize profitability, execution quality, and valuation discipline will define return outcomes.

US capital markets enter 2026 with a stronger foundation than in recent years. Growth remains resilient, productivity is improving, inflation expectations are anchored, and monetary policy is gradually turning supportive. At the same time, valuation sensitivity and investor selectivity are reshaping how capital is allocated across public markets. For investors, this is not a return to excess, but a transition into a more disciplined and constructive phase of the cycle, where returns will increasingly depend on fundamentals rather than sentiment.

Read more: Global M&A Regains Momentum in 3Q25 as Strategic Transactions Accelerate

Macro Stability Reshapes the 2026 Risk Landscape

US real GDP is expected to grow 2.5% in 2026, supported by productivity gains and improving corporate efficiency, as per Franklin Templeton’s Global Investment Management Survey. AI adoption is translating into declining unit labor costs and stronger operating leverage across industries. This indicates that growth is being driven by structural efficiency rather than cyclical stimulus, improving the credibility and persistence of earnings expansion for long-term investors.

Monetary conditions further reinforce this macro strength. The Federal Reserve is expected to cut interest rates twice in 2026, while inflation expectations remain stable within a narrow range, as per Franklin Templeton. This policy backdrop allows growth to continue without destabilizing price pressures, creating a constructive environment for risk assets while preserving investor confidence in macro stability and long-term policy credibility.

Read more: 2026 US VC Outlook: Early-Stage Strength and AI Momentum

US Equities Remain the Core Return Driver

US equities remain supported by superior earnings visibility, strong corporate balance sheets, and embedded productivity gains from AI, as highlighted by Morgan Stanley. Unlike prior cycles driven primarily by multiple expansion, expected equity returns in 2026 are framed around operating performance and margin sustainability supported by business fundamentals.

US earnings growth is expected to outpace developed international markets, reflecting innovation leadership and capital market depth. Europe faces structural growth constraints, while China continues to struggle with reflation dynamics. In contrast, US equities combine policy support, institutional confidence, and financial resilience, supporting their position as the primary allocation within global investor portfolios over the medium term.

Read more: Private Credit in 2026: Underwriting Discipline Becomes the Differentiator

Valuation Dispersion Drives Return Differentiation

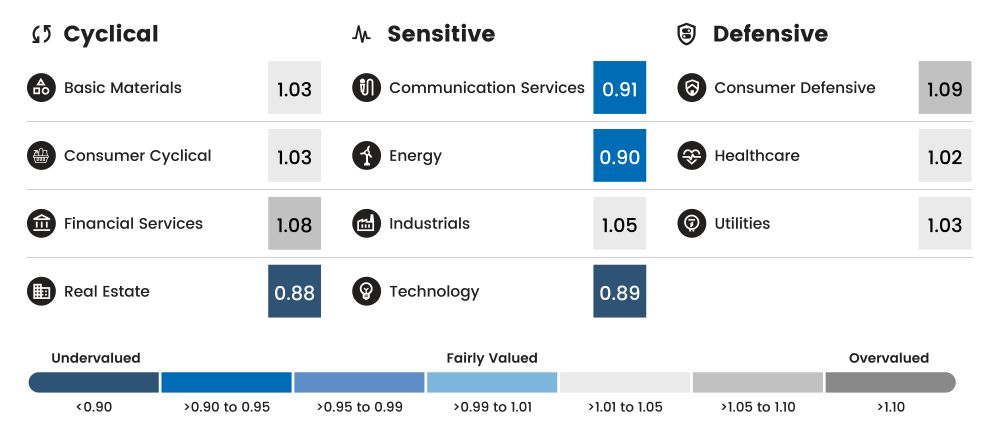

The US equity market was priced about 4% below Morningstar’s composite fair value estimate across more than 700 covered stocks as of the end of 2025. However, valuation dispersion across sectors and styles remains significant. Small-cap stocks trade at meaningful discounts, while growth stocks have regained valuation support following upward revisions in intrinsic value estimates over recent quarters.

Figure: Morningstar Price/Fair Value by Sector

Source: Morningstar, data as of December 31, 2025

At the sector level, real estate remains the most undervalued sector, while technology and communication services have moved into undervalued territory following fair-value upgrades. In contrast, consumer defensive stocks and parts of financials reflect stretched assumptions. This reinforces a critical investor reality: in 2026, valuation will not limit returns, but mispriced expectations will shape performance outcomes and portfolio risk.

IPO Windows will Favor Operationally Proven Issuers

The US IPO activity is expected to accelerate in 2026, supported by a large backlog of IPO-ready companies and improving market stability, as outlined by PwC. Moderating inflation and easing interest rates have reopened issuance windows, but access to public markets will increasingly depend on operational credibility rather than growth narratives. Investor scrutiny around business fundamentals and governance standards remains high across sectors.

Sector leadership in IPO pipelines is concentrated in AI infrastructure, industrial technology, insurance, and software. Investors are prioritizing profitability visibility, cash-flow generation, and governance readiness. As a result, IPO success in 2026 will depend more on enterprise execution strength than market timing, improving long-term market credibility and investor confidence in new listings.

Read more: US VC in 3Q25: Selective Optimism Amid AI-Fueled Growth

Profitability Becomes the Primary Valuation Anchor

Public investors are increasingly prioritizing profitability and free cash flow over pure growth, fundamentally reshaping valuation frameworks, as observed by PwC. Business models without earnings visibility face persistent valuation pressure, while companies with operational maturity and balance-sheet discipline command stronger investor confidence in public markets.

Valuation dispersion is widening across public markets, reflecting stronger differentiation between high-quality and speculative models. This repricing discipline strengthens market credibility and improves investor confidence in new issuances, increasing the probability that returns will be driven by business execution rather than sentiment over time and across economic conditions.

Conclusion

US capital markets in 2026 will reward investors who move beyond broad exposure and toward precision in allocation. Earnings visibility, balance-sheet discipline, and valuation selectivity will matter more than market momentum. In this environment, portfolio outcomes will increasingly be determined by positioning rather than participation. Investors who adapt to this shift will not only protect downside risk but also improve the quality and consistency of long-term returns.

How SG Analytics Delivers Insights into US Capital Markets

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.