- Resources

- Blog

- The Stability Mandate: How Data-Backed Stablecoins Are De-Risking Crypto

The Stability Mandate: How Data-Backed Stablecoins Are De-Risking Crypto

Cryptocurrency

Contents

October, 2025

The promise of instant, borderless digital transactions, the very foundation of the blockchain economy, is constantly overshadowed by the crypto market’s significant volatility. As a result, senior financial leaders find it difficult to justify integrating an asset class that could see an approximate 60%-80% value erosion in a single quarter. This reluctance necessitates a strategic solution. CXOs and decision makers need a solution that captures blockchain’s efficiency without the risk. This guide explains how regulated, data-backed stablecoins make crypto safer for institutions. Ultimately, these instruments are now recognized as critical infrastructure, bridging volatile crypto markets with conventional financial trust.

Why Stablecoins are the Necessary Evolution of Digital Cash

Cryptocurrency began as an idea for secure, digital cash in the 1980s. The creation of Bitcoin in 2009 turned this idea into a global phenomenon. However, the market’s early years saw significant volatility. Asset values fluctuated rapidly due to market sentiment and technological advancements.

Therefore, this inherent price instability prevented crypto assets from functioning effectively as a reliable medium of exchange for payments or a predictable store of value. This systemic instability demanded an economic solution. Consequently, the market created the stablecoin, which emerged as a mechanism for stability.

The Stablecoin Value Proposition

A stablecoin is a type of cryptocurrency. Furthermore, it is designed to maintain a stable value by pegging its price to a real-world asset. This is most commonly a fiat currency like the US dollar or the Euro. This allows users to enjoy crypto’s speed and borderless reach while retaining the stability of traditional currency.

Crucially, organizations issue stablecoins; they are not mined like Bitcoin or Ethereum. These organizations hold reserves of the underlying asset. This reserve-backed approach ensures users can redeem every digital coin 1:1. This offers a high level of confidence essential for institutional use.

The Circulation Mechanism

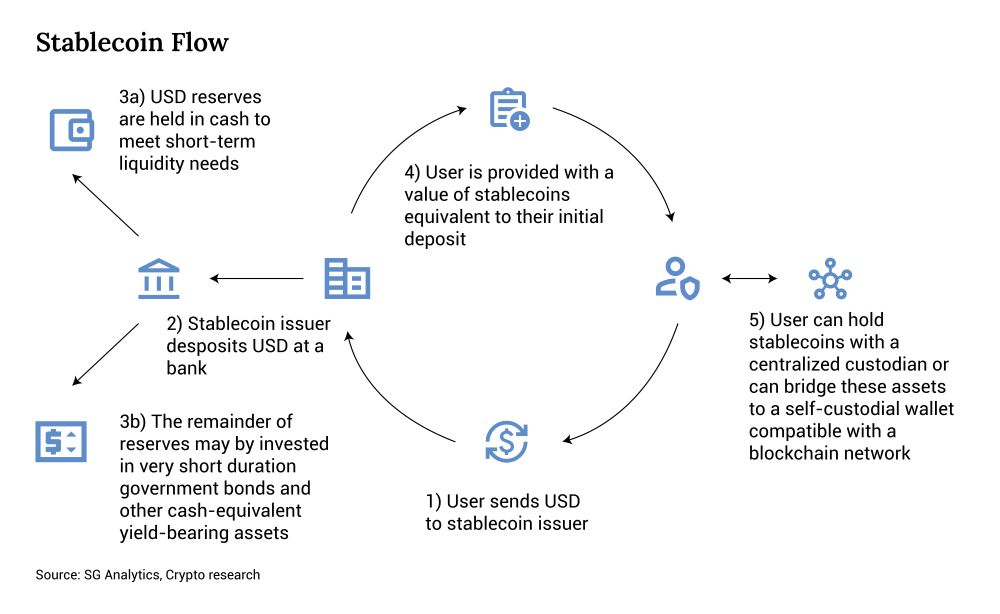

A five-step mechanism governs the circulation of a fiat-backed stablecoin. This process ensures the peg holds and manages liquidity.

- User Deposit: The process begins when a user sends USD to the stablecoin issuer.

- Reserve Holding: The stablecoin issuer then deposits the corresponding USD at a partner bank.

- Reserve Allocation: The issuer holds USD reserves in cash for short-term liquidity and may strategically invest the remainder in low-risk, short-duration government bonds and other cash-equivalent assets.

- Coin Issuance: Next, the issuer provides the user with a value of stablecoins equivalent to their initial deposit.

- Digital Use: Finally, the user can hold these stablecoins with a centralized custodian or bridge the assets to a self-custodial wallet.

When users redeem their stablecoins for fiat, the issuer destroys, or “burns,” the coins. This action maintains the precise peg and ensures transparency.

Market Impact and Growth

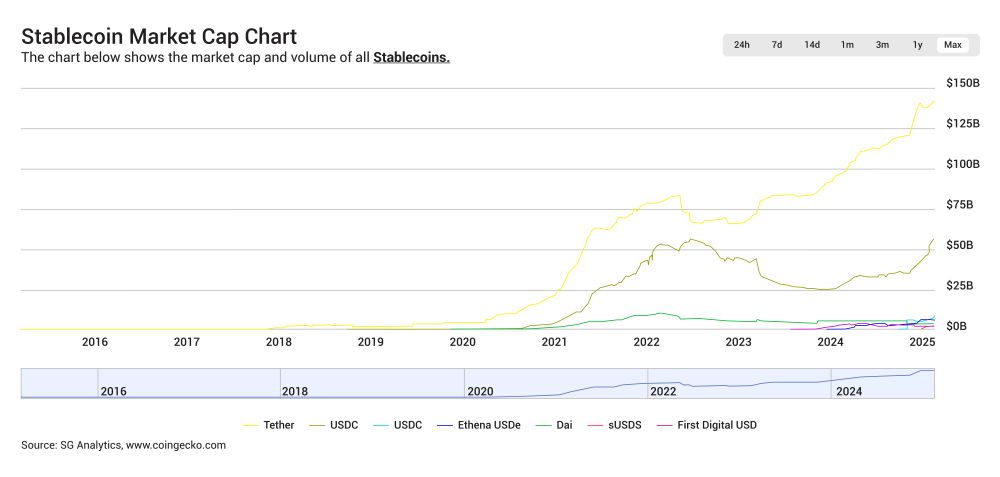

The market acceptance of this fully-backed model demonstrates its significance and growing utility. In fact, in January 2016, the market cap of stablecoins was around $1.5 million. This figure has since grown to over $295 billion, underscoring their growing significance in the digital economy.

This explosive growth is directly linked to the critical roles stablecoins fulfill. For example, they serve as an alternative medium of exchange. They provide a reliable substitute for fiat in regions facing monetary instability. Moreover, they offer a mechanism for low-cost, efficient cross-border payments. Furthermore, stablecoins power liquidity for lending, staking, and liquidity pools across the Decentralized Finance (DeFi) ecosystem. Stablecoins are the necessary digital layer that allows organizations to transact with confidence and manage liquidity within the crypto ecosystem.

Case Study in Credibility: Understanding Reserve Trust with USDC and EURC

The foundational mechanics of a stablecoin are clear. Nevertheless, the decisive factor for institutional trust remains the transparent management of the underlying reserves. The collapses witnessed during the Crypto Winter (2022) clearly demonstrated that a mere “claim” of backing is insufficient. Robust, auditable data is paramount. Therefore, the model pioneered by Circle, through its USD Coin (USDC) and Euro Coin (EURC), provides the definitive case study in how to build this necessary financial credibility.

The USDC Reserve Standard

The Centre Consortium, a joint venture between Circle and Coinbase, officially launched USD Coin in September 2018. They launched it with the express aim of creating a regulated and transparent stablecoin ecosystem.

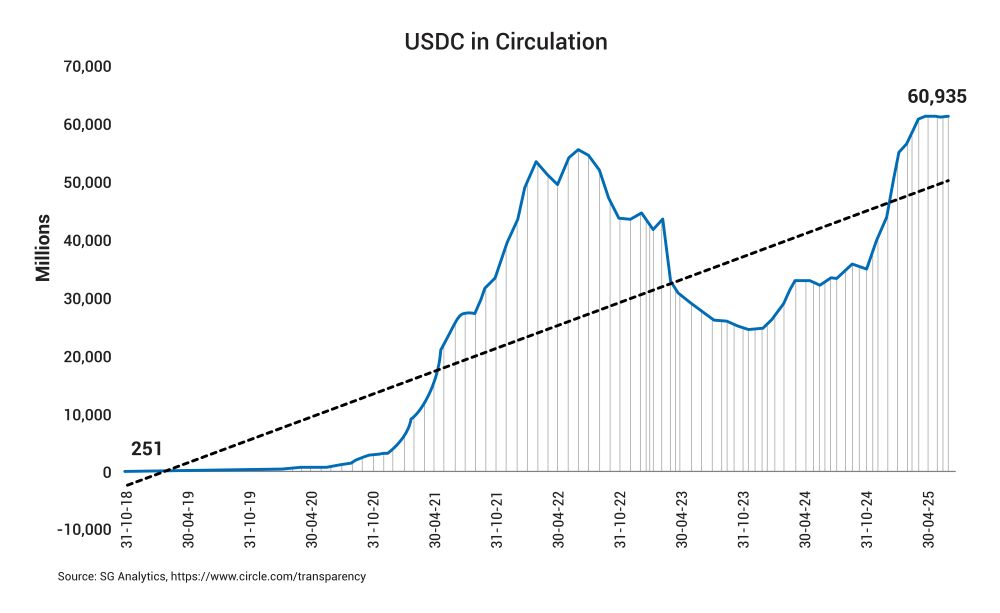

The historical data for USDC confirms a consistent commitment to coverage. Across every period from October 2018 through June 2025, the fair value of assets held in USDC reserves matched or exceeded the number of coins in circulation. This confirms Circle’s claim that equivalent reserves fully back each USDC token. Also, a slight surplus often exists to ensure stability and solvency.

The sheer scale of this growth underscores the market’s acceptance of this reserve standard. In fact, the amount of USDC in circulation has expanded substantially. It grew from about 127 million in October 2018 to over 61 billion by June 2025. This trajectory reflects increased adoption and the deepening trust placed in USDC over time.

Moreover, Circle has been strategic about its reserve composition. Since mid-2021, the focus has been on backing USDC almost exclusively with low-risk assets. These are primarily short-term US Treasuries and cash held at major banks. This strategic move ensures the reserve remains highly liquid and resilient, a critical feature for global financial instruments. Finally, Circle discloses reserve assets and supplies weekly, supported by monthly third-party attestations from leading accounting firms.

Expanding the Bridge with EURC

Building on the success of USDC, Circle introduced the Euro Coin (EURC) in June 2022. They launched EURC as a fully reserved, euro-backed stablecoin. Each token is backed 100% by euro-denominated reserves held in regulated European financial institutions.

The data on EURC demonstrates the rapid demand for a transparent digital Euro. The EURC in circulation has increased steadily from a launch base of just 2,186 tokens in June 2022 to over 1.7 billion tokens by June 2025. Throughout this explosive growth, the reserve assets held in Euros closely track or slightly exceed the circulating supply. This confirms that euro-denominated reserves fully back every EURC token.

Furthermore, EURC adheres to strict Markets in Crypto-Assets (MiCA) regulations. Monthly independent audits ensure both transparency and regulatory compliance. EURC also operates on multiple blockchains, including Ethereum, Avalanche, Solana, Stellar, and Base. This enables broad interoperability for cross-border payments.

The USDC and EURC experience proves that stablecoins can be a reliable financial instrument. Strong regulatory and financial frameworks support this reliability. The consistent reserve coverage and commitment to low-risk asset backing set the non-negotiable standard for any stablecoin platform seeking institutional confidence. Therefore, choosing a stablecoin involves selecting a transparency and risk management model.

The Unavoidable Risks and the Governance Mandate

Stablecoins have proven their ability to preserve value, but unchecked optimism can breed complacency. The following table outlines the key risks that financial leaders must manage to ensure governance, resilience, and regulatory compliance.

| Risk Type | Description | Example / Implication |

| Counterparty Risk | Arises from reliance on centralized issuers and their banking partners. Failures or disruptions can expose users to operational or financial crises. | Example: The temporary USDC de-pegging during the 2023 SVB collapse highlighted vulnerabilities tied to third-party banking infrastructure. The stability of the asset ultimately depends on the issuer’s financial resilience. |

| Regulatory and Legal Risk | Evolving and fragmented global regulations create uncertainty in how stablecoins operate and manage reserves. | Example: The EU’s MiCA framework introduced tighter regulatory oversight, requiring issuers to stay compliant with shifting international standards. |

| Systemic and Collateral Risk | Growing links with DeFi protocols increase contagion risk, while crypto-backed stablecoins remain exposed to asset volatility that demands disciplined liquidation controls. | Implication: Greater complexity in maintaining stability and managing user exposure during market stress. |

Managing these risks is not a compliance formality but a strategic imperative. Strong oversight, transparent audits, and disciplined governance define the institutions that will lead in the next phase of digital finance.

The Path Forward: Strategic Integration for CXOs

The data confirms that asset coverage is both achievable and critical for user confidence. Stablecoins enhance liquidity and drive ecosystem growth. Therefore, the strategic mandate for leaders shifts from debating if they should engage with stablecoins to determining how they should integrate them responsibly. The future of global digital commerce depends on the model championed by regulated, fully-backed stablecoins.

We define the practical actions leaders must take to successfully leverage this stability:

Action 1: Prioritize Conservative Reserve Management

CXOs must view the stablecoin issuer’s reserve policy as a non-negotiable criterion for partnership. Demand full transparency. Crucially, ensure that your chosen partner backs their stablecoins with the most conservative, highly liquid assets, such as cash and short-term sovereign debt. Actively avoid complex or illiquid yield-bearing instruments. This conservative approach provides the necessary liquidity and resilience to withstand sudden market shocks.

Action 2: Establish Dynamic Compliance Frameworks

The regulatory environment remains in constant flux. Leaders must build internal due diligence and compliance mechanisms that track the evolving global landscape. Implement a policy framework that quickly adapts to new requirements, particularly those stemming from frameworks like MiCA. This proactive posture ensures that stablecoin use remains legally sound and strategically viable across all markets.

Action 3: Conduct Rigorous Counterparty Risk Monitoring

Centralized issuers introduce unavoidable counterparty risk. Consequently, you must conduct rigorous, ongoing due diligence on the issuing entity and its banking partners. Deeply understand their financial health and risk management protocols. This vigilance mitigates exposure to potential operational failures or liquidity crises, reinforcing the overall security of your digital asset holdings.

Conclusion

The age of stable, digitized currency has arrived. Stablecoins now bridge traditional finance and blockchain technology, providing reliable digital liquidity backed by transparent governance and resilient financial frameworks. The sustained stability of assets such as USDC and EURC shows that the digital economy can function with the certainty institutions demand.

Leaders need to act on this shift now. The real risk lies not in volatility but in hesitation. Institutions that embed governance and due diligence into their stablecoin strategy will define the next phase of financial innovation. The foundation of digital trust begins with disciplined oversight. Start evaluating your stablecoin partnerships today.

Related Tags

CryptocurrencyAuthor

SGA Knowledge Team

Contents