Registered investment advisor (RIA) M&A activity is surging. It is set to record highs in 2025. Key drivers are falling rates, aging ownership, and abundant private equity (PE) capital fueling consolidation. This year marks a structural shift toward larger, institutionalized platforms. However, valuation discipline and integration challenges will likely test the sector’s staying power.

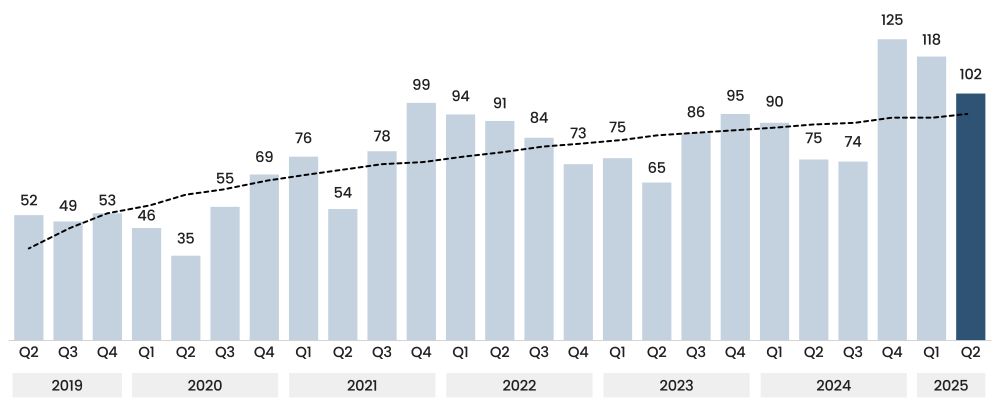

After a brief slowdown in 2023, the US RIA market has returned to robust dealmaking in 2025. According to ECHELON’s RIA M&A Deal Report, there were 102 transactions in 2Q25. Therefore, it was the third most active quarter on record, marking a 36% increase over 2Q24. The firm expects 380 deals by year-end, surpassing all previous records. In 2Q25, the total AUM transacted reached $828 billion, indicating a strong appetite for large, scalable firms. This renewed momentum is particularly notable given a backdrop of volatile markets and shifting interest rate expectations. These conditions would typically mitigate M&A sentiment.

Figure 1: US RIA M&A Deal Volume

Source: ECHELON Partners Analysis

Strategic Acquirers and PE Lead the Charge

Strategic buyers are driving this consolidation trend. ECHELON’s data show that 87.3% of 2Q25 transactions were executed by strategic acquirers. Moreover, 67.4% of those were backed by PE capital. These partnerships between capital providers and platform RIAs have redefined the market. They have been giving rise to larger, professionally managed firms. These firms often exhibit stronger operational capabilities and greater scale. As a result, these well-capitalized entities are setting the pace in today’s competitive acquisition landscape. They are essentially defining the market’s future direction.

PE remains the decisive force behind these deals. DeVoe notes that 79% of transactions in the RIA space are now directly or indirectly influenced by PE. The 2024 interest rate cuts reinvigorated activity. The result? Consolidators completed 79 transactions in the first half of 2025, a 41% increase over the prior year. These firms, often operating as roll-up platforms, have leveraged cheaper debt and larger balance sheets. That approach helps them expand into new geographies and client segments.

Read More: Role of Mergers and Acquisitions (M&A) Advisory Consulting Services

Succession and Scale Fuel the Supply Side

On the sell side, structural pressures are accelerating. A surge of aging founders, rising enterprise values, and limited internal succession options has pushed many mid-sized RIAs to seek external buyers. At the same time, about 38% of the financial advisors plan to retire within the next decade. They are representing 42% of total industry assets, as per McKinsey & Company. This looming demographic turnover underscores why succession-driven sales have become a key supply-side catalyst in RIA M&A.

DeVoe’s analysis shows that firms managing $501 million to $1 billion in AUM account for 26% of all deals, up sharply from 17% in 2024. These mid-market sellers give buyers entry into high-value secondary markets dominated by regional leaders. Larger RIAs, managing between $1 and $5 billion in AUM, have completed 42 transactions YTD. That is their most active pace since 2021. These sellers often cite professional management structures and client succession needs as reasons to merge into enterprise-scale wealth managers. Similarly, they expect to get sophisticated leadership and institutional funding.

Valuations Expected to Stay Firm as Competition Intensifies

While capital has surged into the sector, valuations have stayed surprisingly stable. According to DeVoe’s survey of major consolidators, 85% expect valuations to remain unchanged over the next six months. Despite lower borrowing costs, buyers are showing pricing restraint. This situation suggests a maturing market with a focus on integration quality. Therefore, sustainable economics rather than headline multiples are now central.

Moreover, competition for high-quality sellers is tightening. 77% of acquirers report larger deal pipelines than six months ago. Still, only 54% expect to close more transactions, reflecting a more selective approach. Firms are also expanding sourcing efforts to maintain volume, yet the yield per opportunity is falling. David Wahlen of Merit Financial Advisors notes that the priority has shifted to finding what truly adds value. Stakeholders examine how partnerships endure beyond the earn-out period. In other words, these trends signal a market moving toward strategic alignment rather than transactional opportunism.

Read more: Current Mergers and Acquisitions (M&A) Industry Trends – 2025

Bigger, Faster, and More Complex Deals

The profile of deals has also changed substantially. ECHELON reports that 40.9% of 2025 transactions involve $1 billion-plus firms. So, they are putting the year on pace for the highest volume of large-cap deals on record. Meanwhile, the average assets per deal have risen 10.5% compared with the 2020–2024 average. That underscores investor preference for platforms with scale, compliance infrastructure, and recurring fee models.

Headline transactions highlight this institutional tilt. Bain Capital’s $825 million investment for a 9.9% stake in Lincoln Financial and T. Rowe Price’s participation in a $1.6 billion funding round for Hub International reflect how PE and asset managers are deliberately targeting wealth platforms as strategic growth avenues. Beyond capital, these deals embed RIAs into global distribution networks. Consequently, they reshape the traditional boundaries between advisory firms, insurers, and asset managers.

Outlook: Sustained Momentum, Subtle Risks

2025 will close as the most active year in RIA M&A history. Yet record volume does not guarantee seamless outcomes. Integrating advisory teams, aligning client experience standards, and retaining key talent remain ongoing challenges. Moreover, the rapid rise of META-RIAs will likely heighten concentration risk if growth outpaces operational control.

However, the structural logic behind this consolidation is well-founded. Scale is increasingly associated with competitiveness, providing benefits in technology investment, compliance, and access to private markets.

As interest rates stabilize and new capital continues to flow into the sector, the RIA industry is expected to transition from a fragmented model toward greater institutional integration. For investors, the growth observed in 2025 suggests a shift toward the sector’s long-term direction: one characterized by professionalism, PE partnership, and a persistent emphasis on scale.

How SG Analytics Helps Navigate the M&A Space

SG Analytics (SGA) is a global leader in data-driven investment research and capital markets analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.