Private credit enters 2026 having moved beyond a phase dominated by defensive capital deployment. The year ahead will reward underwriting discipline, structural control, and platform scale as deal activity returns unevenly and performance dispersion widens.

From 2023 through 2025, private credit operated largely in a defensive mode, with elevated rates and stalled exits concentrating activity in refinancings, amend-and-extend transactions, and dividend recapitalizations. As 2026 approaches, deal activity is expected to re-engage selectively as refinancing pressure eases and exit visibility improves. The asset class enters this phase with ample capital but higher execution demands, where deal selection, structuring rigor, and portfolio oversight increasingly shape outcomes.

Read more: 2026 US VC Outlook: Early-Stage Strength and AI Momentum

Buyout Activity Will Re-Engage as Refinancing Pressure Fades

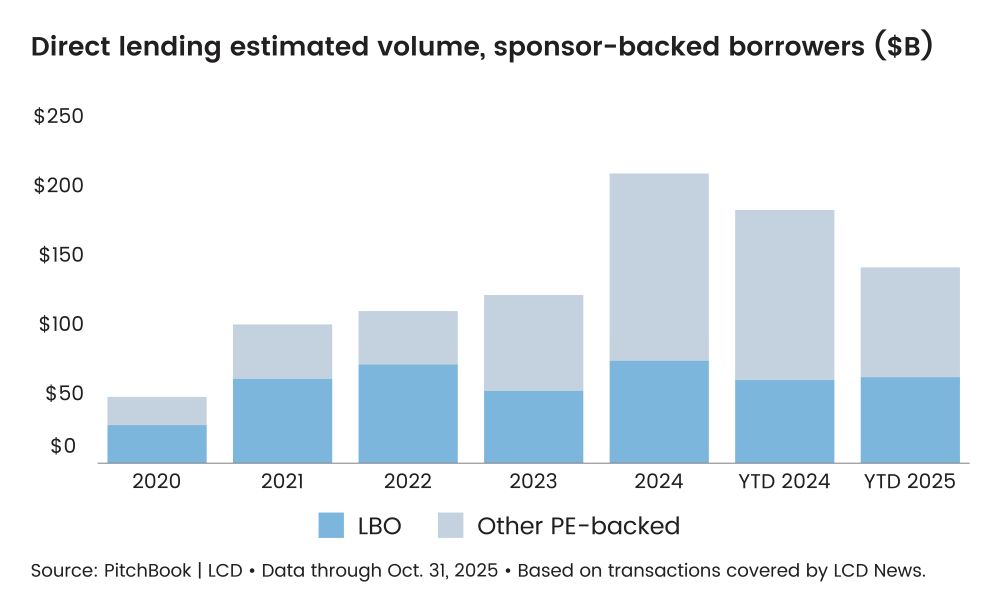

Buyout and M&A activity is expected to improve in 2026, though without a return to peak-cycle excess. Direct lending volume to sponsor-backed companies reached $141 billion by October 2025, exceeding full-year 2023 levels but remaining 23% below 2024, as per PitchBook. Buyout financing accounted for 44% of private credit volume in 2025, well below the 61% share recorded in 2021, highlighting that deal formation remains measured rather than expansionary.

Figure 1: Estimated Direct Lending Volume to Sponsor-Backed Borrowers (in $Billions)

Source: PitchBook, data as of October 31, 2025

This environment reshapes deployment priorities. Refinancing and repricing activity dominated volumes over the past two years, but incremental contribution from these transactions is diminishing. Only 15% of Business Development Companies (BDC) debt investments mature in 2026–27, representing $68.1 billion at cost. As this refinancing pipeline runs down, capital deployment will increasingly depend on the depth and durability of sponsor-led acquisition activity rather than balance-sheet repair.

Read more: Global M&A Regains Momentum in 3Q25 as Strategic Transactions Accelerate

Lender Pricing Power Will Improve as Issuance Normalizes

Spreads in private credit reached multiyear lows in 2025, driven by limited buyout activity and abundant dry powder. With fewer LBOs available, technical factors pushed pricing in favor of borrowers. As the deal supply is expected to improve in 2026, this dynamic will likely shift. Borrowers are unlikely to access terms as attractive as those available in 2025, particularly as competition for high-quality deals normalizes.

This shift does not signal a deterioration in return potential. Private credit issuance will likely decline by roughly 15% year over year to $120 billion in 2026, supporting a more balanced issuance environment, as per BofA Global Research. With origination pacing improving and capital less concentrated in defensive transactions, lenders are positioned to negotiate firmer economics, stronger documentation, and more consistent risk-adjusted returns.

Read more: Global IPO Market Reawakens as US Leads 3Q25 Revival

Scale and Structural Control Will Determine Returns

Private credit enters 2026 from a position of structural maturity rather than cyclical recovery. The US portfolio companies have continued to deliver double-digit annualized earnings growth despite sticky inflation and a softening labor market. Concerns that falling rates will materially undermine returns overlook the role of fees, call protection, and covenant structures in sustaining income.

Long-term performance reinforces this perspective. Across multiple rate cycles, private credit has delivered 200–400 basis points of excess return over liquid credit markets, reflecting compensation for illiquidity, structural protections, and active underwriting, as outlined by Ares. Conservative leverage, meaningful sponsor equity cushions, and tighter covenant frameworks help limit downside risk. Over long horizons, experienced direct lenders have reported minimal realized losses relative to public credit, underscoring how scale, discipline, and portfolio oversight influence outcomes.

Read more: Global Real Estate in 1H25: Stabilizing Market with Shifting Capital Priorities

Supply-Demand Dynamics Will Shift in Lenders’ Favor

Supply-demand dynamics are expected to tilt modestly toward lenders in 2026. New deal formation, combined with a remaining refinancing backlog, should absorb available capital and reduce competitive pressure on pricing. According to Morgan Stanley’s outlook, even in a shallow rate-cut environment, first-lien direct lending yields are expected to trough at 8%–8.5%, levels that remain attractive relative to long-term averages.

Demand-side composition continues to support stability. As per PitchBook, semi-liquid vehicles accounted for nearly one-third of the roughly $1 trillion US direct lending market as of September 30, 2025, while private credit CLOs represented about 20% of total CLO issuance as of November 30, 2025. At the same time, default and non-accrual rates have trended lower alongside modest improvements in EBITDA-to-interest coverage, suggesting lender leverage will likely improve without materially elevating credit risk.

Read more: US VC in 3Q25: Selective Optimism Amid AI-Fueled Growth

Rising Complexity will Elevate Underwriting Discipline

Growth in private credit is increasingly accompanied by greater structural and execution complexity. According to Fitch Ratings, managers continue to expand beyond core direct lending into asset-based finance, structured credit, and secondaries, broadening opportunity sets while raising analytical and monitoring demands. Credit fundamentals are expected to remain broadly stable rather than improving, limiting the margin for weaker credits.

Liquidity and transparency risks are also drawing increased attention. Fitch highlights liquidity transformation concerns in semi-liquid vehicles, where redemption features will likely be tested during periods of stress. Defaults are expected to remain contained but elevated relative to pre-2022 levels, while performance dispersion across managers and vintages is likely to widen. In this environment, structural discipline and portfolio construction will increasingly separate outcomes.

Conclusion

Private credit enters 2026 in a more selective and execution-driven phase rather than a renewed expansion. Deal activity is expected to recover unevenly, pricing discipline should strengthen, and lender leverage is likely to improve as deployment becomes more opportunity-led. For investors, outcomes will depend less on broad exposure and more on manager discipline, structuring capability, and risk control. Private credit in 2026 will be defined by the consistency and quality of underwriting decisions.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.