Venture and private equity (PE) activity in medtech is rebounding after a multi-year lull, led by platform-driven innovation and disciplined capital deployment. Yet regulatory ambiguity and muted exit markets demand strategic selectivity from investors.

Investor sentiment in the medtech sector is showing renewed vigor in 2025. Venture capital activity is rebounding, and PE has seen a modest revival, driven by renewed interest in diagnostic platforms, remote care technologies, and neuromodulation startups. Venture funding rose to a post-2022 high, led by large rounds in smart diagnostics and whole-body imaging. At the same time, spin-offs, valuation resets, and policy uncertainty are reshaping risk and return profiles. For investors, the landscape is shifting from post-pandemic contraction to a more fundamentals-driven recovery.

VC Recovery Amid Exit Challenges

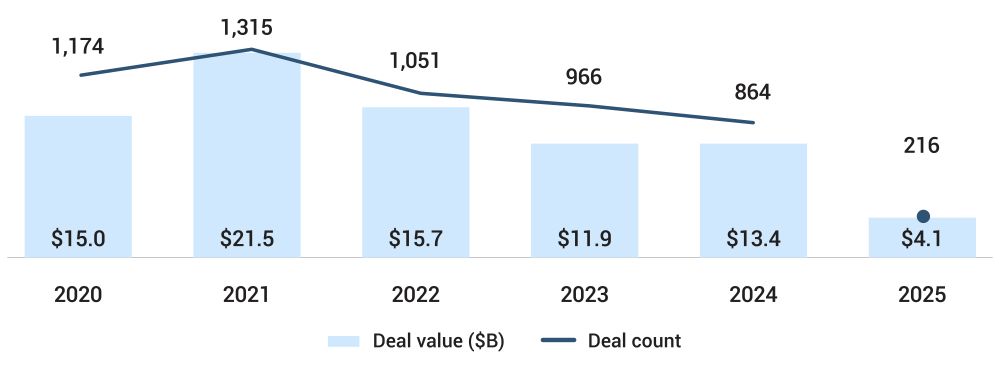

Venture funding reached $4.1 billion across 216 deals in 1Q25, as per PitchBook. This was the highest quarterly total in over two years. Eleven of these deals exceeded $100 million, including Sweden’s Neko Health at 260 million and EverBridge Medical at 138.9 million. Prenuvo, another player in the whole-body screening space, raised 120 million. Function Health’s acquisition of Ezra in May further highlighted strategic consolidation in diagnostics. This marks a reversal from 2023’s stagnation and reflects not just higher capital deployment but also larger average round sizes.

Figure 1: Global Medtech VC Deal Activity

Source: PitchBook, data as of March 31, 2025

However, the resurgence in funding is not matched by a rebound in exits. Only nine venture-backed exits occurred in 1Q, with total exit value at just $1.5 billion, as per PitchBook. This is far below recent annual highs. Public market appetite remains weak, and notable exits such as Beta Bionics, Gynesonics, and SoniVie, while positive, did not generate substantial returns relative to historical benchmarks. Until liquidity conditions improve, general partners (GPs) must focus on operational milestones and interim value creation to sustain investor confidence.

PE Deal Flow Recovers, Exit Gaps Remain

PE deal activity reached 44 transactions in 1Q25, as per PitchBook. This puts the sector on track to exceed 2024’s full-year total of 126 deals. Transactions like Saluda Medical’s $100 million raise, backed by TPG and Redmile Group, and OrganOx’s $142 million round underscore PE’s growing presence in neuromodulation and transplant technologies. While historically overlooked, these areas are now attracting diversified investor pools, signaling deeper conviction around technology-driven care delivery.

Yet the exit environment for PE remains a bottleneck. Despite momentum in pharma and healthcare services, medtech has not seen the same rebound in liquidity. Caris Life Sciences’ upcoming IPO, targeting a $5.3 billion valuation, will be closely watched. However, recent public listings such as Ceribell and Beta Bionics have underperformed post-debut. Until public markets recover or large acquirers return with greater consistency, PE firms must focus on value creation through tuck-in acquisitions and platform expansion.

Strategic Consolidation Shapes the Landscape

Strategic buyers are reshaping portfolios through targeted acquisitions and spin-offs. Becton, Dickinson and Company announced a spin-off of its diagnostics and biosciences units, while Medtronic disclosed plans to divest its diabetes business. These moves reflect a sharpening of focus among large medtech players, although they also raise questions about valuation and internal capital allocation. Boston Scientific’s acquisition of SoniVie highlights continued interest in renal denervation and other specialized technologies.

However, expectations that recent regulatory developments would spur M&A activity have yet to materialize. Market volatility and increased scrutiny are introducing delays and uncertainty into deal timelines. The ongoing review of the $627 million acquisition of Surmodics is one such example. Regulatory actions in this case have been supported by state-level authorities as well. As a result, investors should prepare for elongated diligence processes and potential interventions even in mid-market deals.

Regulatory Outlook Complicates Planning

The regulatory environment remains unsettled. The FDA’s decision not to challenge the court ruling on lab-developed tests maintains the current commercialization model but adds long-term ambiguity. While startups will likely move quickly to market, the lack of formal oversight is expected to reduce pricing power and make it harder to build durable competitive moats. In parallel, a BTIG survey of hospital procurement leaders revealed that two-thirds expect budget cuts if proposed Medicaid reductions proceed, potentially delaying adoption of high-cost technologies like imaging platforms and robotic systems.

Valuations Normalize in a Disciplined Market

Valuation discipline is returning to the medtech space. Median pre-money valuations for early-stage startups increased from $22.7 million to $48 million in 2025, while late-stage companies were valued at $49.5 million, as per PitchBook. These figures remain elevated relative to pre-pandemic norms but are notably below the highs seen in 2021. Median deal values have also stabilized across funding stages. These trends point to a more fundamentals-driven cycle, where companies must demonstrate product-market fit and commercial readiness to justify premium pricing.

This recalibration is broadly healthy for long-term capital formation. It enables newer investors to enter at sustainable levels and encourages efficient capital deployment among founders. GPs are concentrating capital into fewer high-quality assets, while limited partners are showing renewed confidence in vintage-year performance. In a more disciplined valuation environment, companies with strong clinical outcomes, regulatory clarity, and commercial momentum are positioned to command the highest investor interest.

Conclusion

Medtech investing in 2025 reflects a market in transition, where capital is flowing back with greater discipline, valuations are becoming more rational, and investor focus is shifting toward platforms with clear clinical and commercial advantages. While the exit environment and policy backdrop remain challenging, the sector offers compelling opportunities for investors who prioritize execution, scalability, and long-term resilience. As the ecosystem reorients around fundamentals, disciplined capital is well-positioned to lead the next phase of sustainable growth.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.