Healthcare capital flows in 1H25 reflect a shift from broad sector allocation to selective strategies centered on liquidity, scalability, and risk-adjusted returns. Investors are concentrating capital in healthcare private equity (PE) and healthtech, while life sciences venture funding faces structural recalibration.

1H25 Healthcare private markets moved in different directions. Healthcare PE continued attracting capital due to stable earnings and consistent deployment, while life sciences venture capital (VC) experienced its weakest fundraising in more than a decade amid limited exits and high capital requirements. At the same time, healthtech VC surpassed life sciences VC, signaling investor preference for scalable, capital-efficient healthcare models. Healthcare is no longer treated as one allocation but as distinct strategies with different risk, liquidity, and duration profiles.

Healthcare PE Shows Capital Resilience

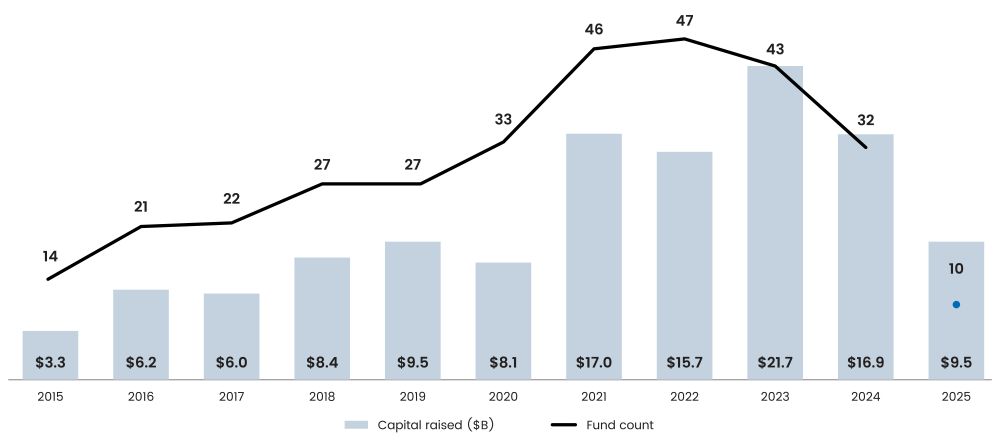

Healthcare PE funds secured $9.5 billion across ten funds in 1H25, underscoring sustained investor interest following record fundraising in 2023, as per PitchBook. Moreover, healthcare represented 4.5% of all PE capital raised, the largest share recorded to date. Investors are allocating to the sector due to recurring revenue, demographic-driven demand, and lower exposure to economic cycles. Even with slower exits, healthcare PE continues to demonstrate consistent deployment and stable performance, reinforcing its position as a dependable private market strategy.

Figure 1: Healthcare Specialist PE Fundraising Activity in North America and Europe

Source: PitchBook, data as of June 30, 2025

However, capital is concentrating among a narrower group of managers. Linden Capital Partners VI closed at $5.4 billion, accounting for more than half of healthcare PE capital raised in 1H25. Patient Square Capital is targeting $6 billion for its second fund, up from $3.9 billion in its debut. LPs are prioritizing managers with operational capabilities, scalability, and established healthcare expertise, rather than diversifying across smaller or emerging firms.

Investors Concentrate Capital in Larger Managers

Although fewer healthcare PE funds are closing, the segment’s share of overall PE fund count has risen to 3.8% through 1H25, as per PitchBook. LPs are narrowing GP relationships while increasing commitment sizes, favoring managers capable of executing platform strategies, acquisitions, and operational value creation. Moreover, nearly two-thirds of healthcare PE capital raised in 2024 went to funds above $1 billion, and this trend continued into 1H25.

Fundraising outcomes reinforce this shift. Since 2024, 82.6% of healthcare PE funds have met or exceeded their targets, compared with 73.4% of non-healthcare middle-market funds, as per PitchBook. Moreover, on a weighted average basis, healthcare funds closed at 103.5% of the target size. Healthcare PE has transitioned from a niche outperformer to a core allocation focused on capital preservation, earnings stability, and consistent distributions.

Life Sciences VC Undergoes Structural Retrenchment

Life sciences VC raised only $1 billion across nine funds in 1H25, well below the 10-year annual average of $14.6 billion, as per PitchBook. The strategy accounted for just 1.6% of the total VC fund count and 2% of the capital raised. 2Q25 also marked the first quarter since 2016 without a US biopharma IPO, limiting exit visibility and delaying capital returns to LPs.

This pullback is structural rather than cyclical. Biopharma investing involves long development timelines, regulatory uncertainty, and high capital intensity. With limited liquidity and extended return horizons, LPs are postponing commitments. While firms such as Blackstone Life Sciences and Andreessen Horowitz remain active, broader participation has contracted. Life sciences VC now appeals primarily to investors with patient capital and a higher tolerance for scientific and clinical risk.

Healthtech VC Gains Capital Preference

Healthtech VC raised $1.4 billion across 12 funds in 1H25, surpassing life sciences VC and accounting for 2.8% of total VC capital, as per PitchBook. Investors are backing AI-enabled clinical tools, digital health platforms, and workflow technologies that scale faster and require less capital than biopharma. IPOs from Hinge Health and Omada Health have reinforced investor sentiment around digital health exits. Since 2021, 63.5% of healthtech funds have been raised by emerging managers, and 34.2% of capital has gone to funds under $250 million, signaling a shift toward capital-efficient healthcare innovation.

Performance Highlights: Distinct Risk and Liquidity Profiles

Performance data reinforces the divergence across strategies. Healthcare PE has delivered strong historical results, with 29.9% pooled IRRs for 2012-2014 vintages, but more recent 2021-2022 vintages moderated to 9.5%, below the 12.3% return for all PE, as per PitchBook. In venture strategies, life sciences VC generated 9.1% IRRs for 2021-2022 vintages, outperforming healthtech VC at 2.3%, although most gains remain unrealized due to limited exits. This positions healthcare PE as the most stable and liquid strategy, life sciences VC as higher-risk but competitive on returns, and healthtech VC as earlier-stage with limited realized outcomes to date.

Conclusion

Healthcare investing in 1H25 is not a single allocation decision but a set of differentiated strategies. Healthcare PE remains the most stable and institutionally favored segment. Moreover, life sciences VC is undergoing a structural reset shaped by weak liquidity and longer development cycles. Healthtech VC has gained fundraising momentum as a lower capital segment, but remains early in its exit cycle with limited realized outcomes. For investors, the key decision is no longer whether to allocate to healthcare but how capital should be positioned within it to align with risk tolerance and return expectations.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision. Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.