1H25 reflects a market showing early stability at the surface while undergoing a deeper structural shift. Investors are adapting by moving away from income-led strategies and toward diversified, opportunistic, and non-US exposures as fundraising gradually rebuilds.

Global real estate entered 2025 with modest momentum but continued to exhibit uneven performance across regions and strategies. Fundraising reached $77.1 billion in 1H25, as per the Realfin Global Real Estate 1H25 Report. Long fundraising cycles, clear differentiation across strategies, and shifting regional flows remain defining characteristics of the market. While conditions are gradually improving, the current pattern of allocations signals a broader reset in how investors approach opportunities across global markets.

Read more: US VC in 3Q25: Selective Optimism Amid AI-Fueled Growth

Capital Concentration Shapes the 1H25 Fundraising Cycle

1H25 showed a continuation of the consolidation pattern visible over the past year. Only 226 funds closed compared with 428 in the 2H24, as per Realfin. Moreover, the top 10 funds captured $42.2 billion, which shows investors concentrating capital in managers with scale and strong execution capabilities. This shift reflects caution as elevated financing costs and uncertain exits continue to influence allocation decisions.

Diversified strategies gained significant weight over the period, with diversified funds attracting 80% of total capital raised, as per Realfin. In contrast, specialist strategies weakened sharply. Residential fundraising fell from $22.2 billion to $7 billion YoY, reflecting investor reluctance toward narrow exposures while pricing clarity remains limited across sectors. In this context, flexibility and cross-sector reach are clearly favoured as conditions normalise.

Read more: Global IPO Market Reawakens as US Leads 3Q25 Revival

Core Strategies Lose Ground as Investors Move Up the Risk Curve

Core strategies continued to weaken during 1H25 as investor appetite shifted toward higher-yielding approaches. Only $2.7 billion was raised for core funds, as per Realfin. Although 80 core funds closed, the average size was only $35 million, indicating low investor appetite for income-driven approaches in a high-rate environment. With borrowing costs elevated, core returns no longer compensate sufficiently for risk.

Core plus strategies showed slightly stronger traction but still reflected cautious sentiment. They raised $3 billion across six closings, as per Realfin. Most of these allocations flowed into North America. LPs continue to favour markets with liquidity depth, transparent underwriting, and more stable cash flow conditions. The broader trend is clear as investors are reducing allocations to lower risk vehicles and emphasizing strategies that will likely capture repricing and operational upside.

Read more: Global M&A Regains Momentum in 3Q25 as Strategic Transactions Accelerate

Fund Formation Weakens Signaling Cautious GP Behavior

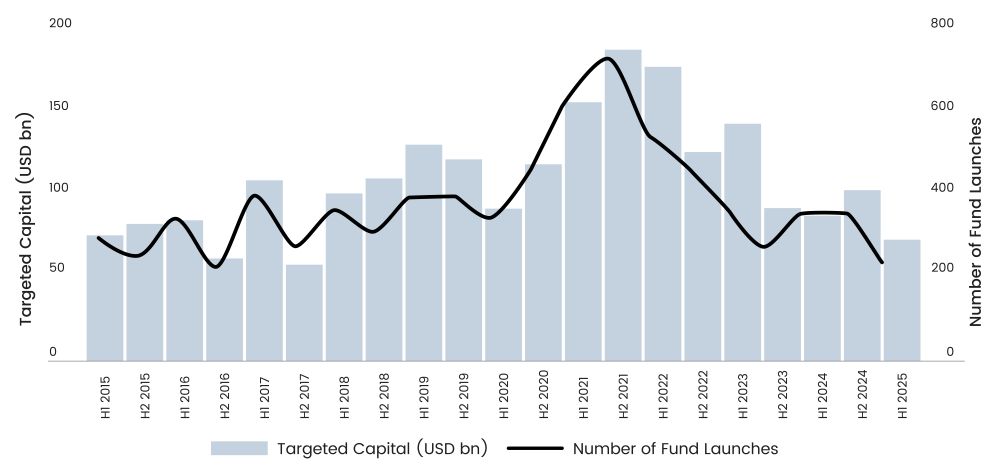

New launches fell to an eight-year low, with only 243 vehicles introduced, targeting $74 billion, as per Realfin. This is the smallest target pool since 2017. While a few major launches took place, including an $8 billion strategy by Related Digital and a $6.5 billion value-add vehicle by Blue Owl, the overall pipeline remained thin. Many managers appear to be delaying new products until valuations stabilize and liquidity improves.

Figure 1: Global Real Estate Fund Launches

Source: Realfin

Launch activity also shows the direction of future fundraising. Most new vehicles were value-added or opportunistic strategies. This reflects expectations that the next stage of the cycle will be driven by repricing rather than income-oriented or highly specialised approaches. Targeted capital for newly launched funds was highest in North America at $52.7 billion, reinforcing its role as a key global market. Still, the limited number of launches suggests fundraising will remain selective through the rest of 2025.

US Shares Decline as Europe Strengthens Its Position

Cross-border capital flows showed clear shifts in 1H25. North America captured 53% of global commitments, as per PitchBook. Europe reached 27.8% and Asia reached 18%, both surpassing their full-year 2024 totals within six months. Stronger price recovery in Europe and resilience in Asian markets during periods of higher rates have supported these reallocations.

The largest fund closings further highlight this trend. Five of the 10 biggest vehicles came from outside the US. Japan stood out with significant raises from BGO’s BentallGreenOak Asia IV, PAG’s Secured Capital Real Estate Partners VIII, and Ares Management’s Japan DC Partner I. These vehicles benefited from strong demand for data centers and logistics assets. The distribution of capital indicates a broader search for geographic diversification and markets with clearer valuation signals and structural growth drivers.

Read more: Reassessing the Role of Private Markets in Defined Contribution Investing

Opportunistic and Theme Driven Strategies Dominate Demand

Opportunistic and value-add strategies dominated 1H25, accounting for 77.9% of capital raised, as per PitchBook. Investors remain focused on repricing, distressed opportunities, and long-term thematic demand. Digital infrastructure continues to attract capital, supported by vehicles such as Principal Data Center Growth and Income Fund and PGIM Global Data Center Fund. These strategies benefit from sustained expansion in data processing and storage needs.

Real estate debt strategies also gained momentum with $12.9 billion raised by 2Q25. With banks applying strict lending conditions, private lenders have increased their footprint by providing faster execution and more flexible terms. The $8 billion Blackstone Real Estate Debt Strategies V illustrates the scale and relevance of credit-based real estate solutions in the current environment. Asset-level performance also showed signs of stabilisation, supported by six consecutive quarters of positive outcomes in the Green Street commercial property return index (CPRI) for North America.

Conclusion

1H25 shows a market regaining stability while undergoing a clear strategic transition. Real data reflect higher concentration among established managers, reduced interest in core strategies, and limited new product formation. Regional allocations shifted meaningfully, and demand strengthened for opportunistic, thematic, and debt-linked vehicles. Investors who position portfolios around structural trends, disciplined underwriting, and selective diversification appear best placed for the next stage of global real estate.

About SG Analytics: Uncovering Investment Insights

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.