Private markets in 2025 demonstrate steady investor engagement, yet commitments are being allocated more carefully than in prior years. Investors are concentrating capital in managers with stronger track records and strategies that offer clearer stability, liquidity support, and predictable deployment.

In 3Q25, private markets are characterized by an environment where capital formation continues, but with more selective allocation criteria applied by investors. Fundraising cycles have lengthened, exit timelines remain uneven, and deployment pressure has increased as older vintages accumulate. These conditions have reinforced the advantages of larger, established managers while narrowing the opportunity set for emerging general partners (GPs). The year highlights not a decline in demand but a more defined allocation hierarchy across strategies.

Read more: 2026 US VC Outlook: Early-Stage Strength and AI Momentum

PE: Fundraising Concentrates Around Established Managers

Private equity (PE) fundraising reached $319.8 billion in 3Q across 411 funds, with weaker distributions limiting limited partner (LP) capacity to make new commitments, as per PitchBook. Experienced managers attracted 86.1% of capital in 3Q, reflecting consolidation among LP relationships and reliance on established performance records. Although exit activity shows incremental improvement, slower realizations continue to influence fundraising pacing. The environment favours managers with consistent execution and a clear operating approach.

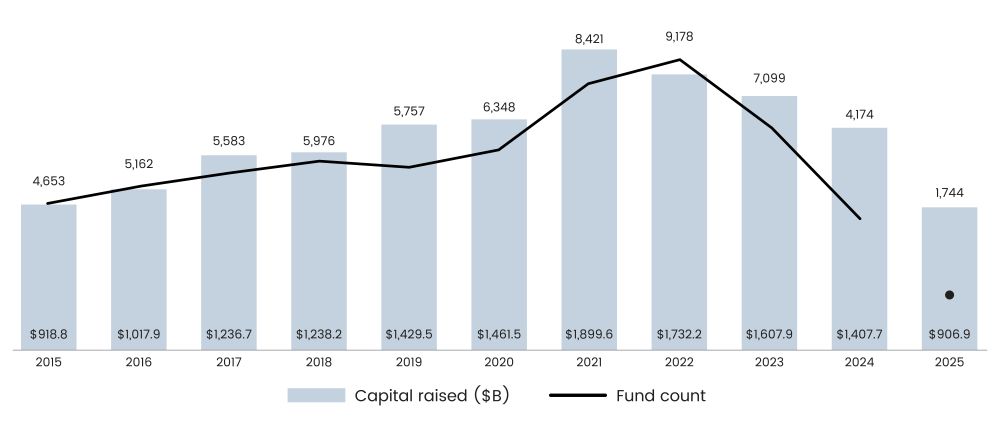

Figure 1: Global Private Capital Fundraising Activity

Source: PitchBook, data as of September 30, 2025

The largest PE funds captured 25% of total commitments, reinforcing the structural advantage of scale. Dry powder increased by $120.2 billion, intensifying the need to deploy capital raised during earlier cycles. This backdrop benefits firms with broader sourcing channels and measured pacing, while those managing older vintages face rising pressure to put capital to work within remaining investment periods. The coming year will test the balance between disciplined underwriting and timely deployment.

Read more: Global M&A Regains Momentum in 3Q25 as Strategic Transactions Accelerate

VC: Limited Liquidity Continues to Restrain Commitments

Venture capital (VC) recorded $82.6 billion across 849 funds in 3Q, marking one of its weakest fundraising periods in recent years, as per PitchBook. Limited exits continue to disrupt liquidity flows, which remain central to LPs making renewed commitments. Median close time extended to 17.4 months in 2025 YTD, highlighting the difficulty for GPs raising capital while managing slower deployment and shifting valuation expectations. These conditions have added operational strain to firms navigating a more selective environment.

North America accounted for 57.3% of global VC capital through 3Q, underscoring its dominant position as Asia’s contribution declines from earlier peaks. Moreover, experienced managers secured 63% of capital raised in 2025 YTD, reinforcing heightened investor scrutiny. Until exit conditions improve, LPs are likely to continue concentrating commitments in firms with stronger track records. These dynamics underline the importance of proven execution during periods of reduced liquidity.

Read more: Global Real Estate in 1H25: Stabilizing Market with Shifting Capital Priorities

Real Assets: Infrastructure Drives the Majority of Capital Formation

Real assets secured $123.9 billion in 3Q, exceeding recent years and drawing sustained interest in long-duration strategies, as per PitchBook. Experienced managers received around 91% of commitments, while funds larger than $1 billion captured around 88% of all capital raised. Investors sought clearer cash-flow visibility and diversified exposure across infrastructure, making real assets a stabilizing element within many portfolios.

Europe contributed $56.9 billion in 3Q, driven by infrastructure strategies that accounted for 91.7% of global real assets fundraising raised through 3Q25. Themes such as digital infrastructure, energy transition, and transport renewal shaped the largest fund closes in the period. Investors continue to rely on real assets for stability while other strategies navigate slower liquidity and deployment cycles. These developments reinforce the infrastructure’s role within long-term allocation plans.

Read more: US VC in 3Q25: Selective Optimism Amid AI-Fueled Growth

Private Debt: Consistent Fundraising Momentum Across Strategies

Private debt accumulated $154 billion across 125 funds in 3Q, sustaining its multi-year momentum and positioning the asset class to surpass $200 billion for a seventh straight year, as per PitchBook. Investors valued its yield profile, structural protections, and consistent risk-adjusted returns. Participation from private wealth channels also supported stable inflows across different market conditions. The result is a fundraising pattern that remains durable.

Specialized strategies expanded further, with asset-based finance achieving larger closes than earlier vintages and NAV financing gaining relevance as exits stayed slow. These developments broadened the private debt opportunity set and offered investors additional sources of income and diversification. They also show how the asset class adapts to shifting liquidity needs and evolving capital structures across private markets.

Read more: Global IPO Market Reawakens as US Leads 3Q25 Revival

Secondaries: Record Capital Formation Amid Rising Liquidity Needs

Secondaries raised $105 billion through 3Q, matching last year’s record and reinforcing their role in liquidity and portfolio-management solutions, as per PitchBook. The trailing total reached $122.6 billion, reflecting increased use of secondaries to manage pacing and reduce early-stage return drag. Investors are relying on the strategy to adjust exposures during longer holding periods and slower realizations. This has strengthened its position as a practical allocation tool.

Fundraising was concentrated, with the largest fund closing at $30 billion and the top five collecting 65% of all capital raised. Europe accounted for 74.1% of activity in 3Q, supported by established secondaries platforms. Investors see scope for continued expansion as the strategy becomes increasingly integrated into broader liquidity planning. These conditions provide a foundation for further growth as pacing and portfolio construction remain central considerations.

Conclusion

Private markets in 2025 remain well supplied with capital but increasingly selective. Larger and more established managers continue to attract commitments, while emerging GPs face extended timelines and narrower access. Strategies tied to steady income, essential infrastructure, or liquidity management show clearer fundraising momentum. As deployment pressure intensifies and distributions remain uneven, investors entering 2026 will benefit from closer scrutiny of pacing, discipline, and structural positioning across managers.

How SG Analytics Offers Insights into Global Private Markets

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.