Global M&A surged in 3Q25 as megadeals reignited market confidence and restored deal momentum to levels last seen in 2021. The quarter marked a decisive shift from caution to conviction, with corporates and sponsors accelerating strategic transactions amid stabilizing rates and improving financing conditions.

Global M&A regained momentum in 3Q25, supported by clearer rate expectations, easing financing conditions, and renewed appetite for strategic repositioning. After several periods of muted activity, both corporate and private capital moved from defensive balance sheet management to targeted expansion. The return of large-cap transactions signaled stronger boardroom conviction and steadier valuation visibility. The rise in deal value reflects a shift toward scale-oriented and strategically targeted transactions, with buyers prioritizing earning resilience and long-term positioning.

Read more: RIA Consolidation Accelerates in 2025 amid Rate Cuts and Succession Pressures

Megadeals Drive the Rebound

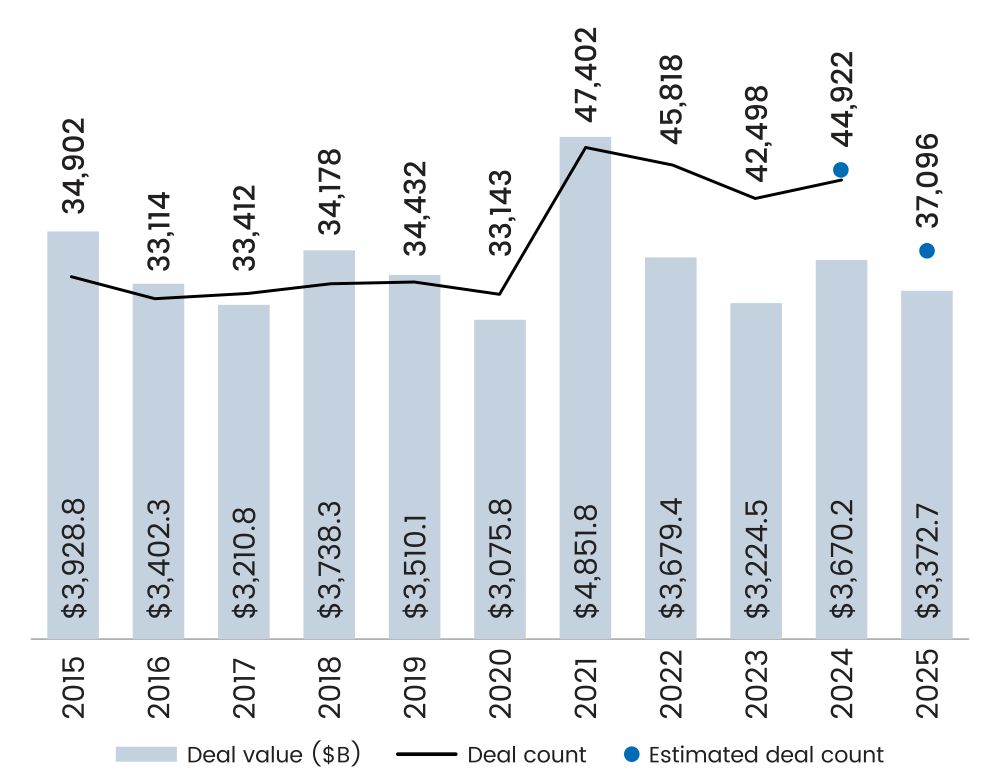

Global M&A value strengthened in 3Q25 with deal value rising 25.6% and pushing the YTD total to 3.4 trillion, driven by the return of larger transactions. YTD, there have been 435 megadeals, accounting for 54.8% of total M&A value and contributing $1.7 trillion in aggregate, as per PitchBook. This concentration reflects renewed conviction among corporates and PE sponsors to pursue scale and strategic positioning. Stabilizing rate expectations enabled deal pipelines to advance after earlier delays.

Figure 1: Global M&A Activity

Source: PitchBook, data as of September 30, 2025

The shift in activity indicates a clear move from defensive capital preservation toward proactive consolidation and operational alignment. Buyers are prioritizing resilient earnings profiles, platform integration benefits, and competitive advantage when assessing opportunities. While deal volumes remain broadly distributed across sectors, the value-weighted momentum at the top end underscores the strategic importance of market-defining combinations. The quarter’s rebound suggests improved clarity in capital allocation priorities and confidence in post-transaction performance.

Read more: Reassessing the Role of Private Markets in Defined Contribution Investing

Cross-Border M&A Returns as Valuations Normalize

Cross-border activity increased as acquirers pursued geographic diversification and valuation advantages across regions. North American buyers announced 952 European acquisitions YTD, while European acquirers deployed a net $22.6 billion into North America, reflecting selective but meaningful capital movement, as per PitchBook. Stabilizing monetary policy guidance and easier access to financing supported the reactivation of cross-border pipelines. Strong balance sheets and clearer strategic priorities encouraged corporates to revisit previously delayed international expansion plans.

Moreover, valuation dynamics played a central role. European median EV/EBITDA multiples at 9.3x remain below the US at 10.6x, creating attractive entry points for investors prioritizing durable growth and cost-efficient integration. Sectors such as technology, infrastructure, and industrial automation continued to draw strategic attention due to consistent demand visibility. Pricing discipline now aligns more closely with earnings resilience rather than scale alone, supporting steadier, fundamentals-driven cross-border dealmaking through the remainder of 2025.

Read more: From ICU to IPO: How Private Equity is Reshaping Global Healthcare

Portfolio Reshaping Becomes Structural

Global spinoffs and divestitures rose 31% YoY to $915.5 billion in 9M25, as per ION Analytics. Large enterprises are simplifying operating portfolios, exiting non-core businesses, and reallocating capital toward higher-return segments. Major transactions included Cox Enterprises’ $34.5 billion sale of Cox Communications to Charter Communications and Holcim’s $30 billion spinoff of Amrize. These moves underscore a continued emphasis on margin improvement and focused capital deployment.

Many of these separation transactions had been under evaluation for multiple reporting periods and reached execution as financing markets became more predictable. The persistence of large-cap divestitures, even amid moderate macro uncertainty, suggests that portfolio optimization has become a sustained strategic priority. This trend is expected to continue into 2026 as organizations seek sharper operating identities and improved shareholder alignment.

Read more: US Leveraged Loan Market: Supportive Technicals, Moderate Returns

Private Capital Re-Enters at Scale

Global buyout value rose 38% YoY to $658.5 billion in 3Q25, as per ION Analytics. Sponsors re-engaged in competitive auction processes as valuation expectations stabilized. The $55 billion take-private of Electronic Arts demonstrates the capacity to deploy substantial capital when conviction aligns with asset fundamentals. North America led with a 51% increase in buyout value to $376 billion, while Asia-Pacific activity rose 49% to $95 billion.

Exit value rose 38% to $443 billion, supported by trade sales and secondary buyouts, as per ION Analytics. Continuation vehicles expanded in use, allowing sponsors to retain high-performing portfolio companies during uneven IPO conditions. The US rate cut and restored EBITDA-based interest deductibility improved acquisition financing metrics, supporting renewed sponsor participation. These dynamics have restarted deployment and liquidity cycles after two years of muted activity.

Read more: Redefining IPO Readiness for Venture-Backed Companies

Recovery Broadens Across Regions and Sectors

Global M&A activity increased in 3Q25, supported by improving financial conditions and clearer policy signals across major markets. America and Canada accounted for $633 billion, supported by liquidity depth and policy clarity, as per S&P Global. Europe recorded $174 billion, outpacing Asia-Pacific, which slowed to $108 billion amid weaker Chinese and Australian deal flow. The Middle East and Latin America recorded notable gains, driven by outbound strategic and sovereign investment.

Moreover, industrials led with $224 billion in transaction value, supported by consolidation such as Union Pacific’s $85 billion acquisition of Norfolk Southern. Communication Services followed at $122.6 billion through spectrum and broadband infrastructure deals. Information Technology recorded $106 billion, while Healthcare posted the highest valuation multiple of 29.8x EV/EBITDA, reflecting sustained preference for recurring revenue and scalable platforms.

Conclusion

The 3Q25 rebound signals that global M&A has moved into a more assertive strategic phase. Large-cap transactions have returned, private capital is deploying with greater clarity, and corporates are reshaping portfolios to enhance focus and scale. While macro uncertainty persists, improving credit availability and more aligned valuation expectations are sustaining deal momentum. With activity broadening across regions and sectors, dealmakers appear positioned to carry this strength into late 2025.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support.

Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.