Global IPO activity strengthened in 3Q25 as easing financial conditions and renewed market confidence reopened the issuance window. The US led in both capital raised and post-listing performance, while investors continued to reward profitable and scaled companies.

Equity markets stabilized in 3Q25 as volatility declined and monetary direction became clearer, improving sentiment toward new equity issuance. Moreover, investors favored companies presenting resilient fundamentals and credible financial trajectories. The US led in capital raised, while India led in volume, and China contributed to post-IPO returns. The quarter reflected a shift from sporadic issuance to a more consistently active but selective IPO environment.

Read more: Reassessing the Role of Private Markets in Defined Contribution Investing

Global IPO Momentum Rebounds as Monetary Easing Restores Confidence

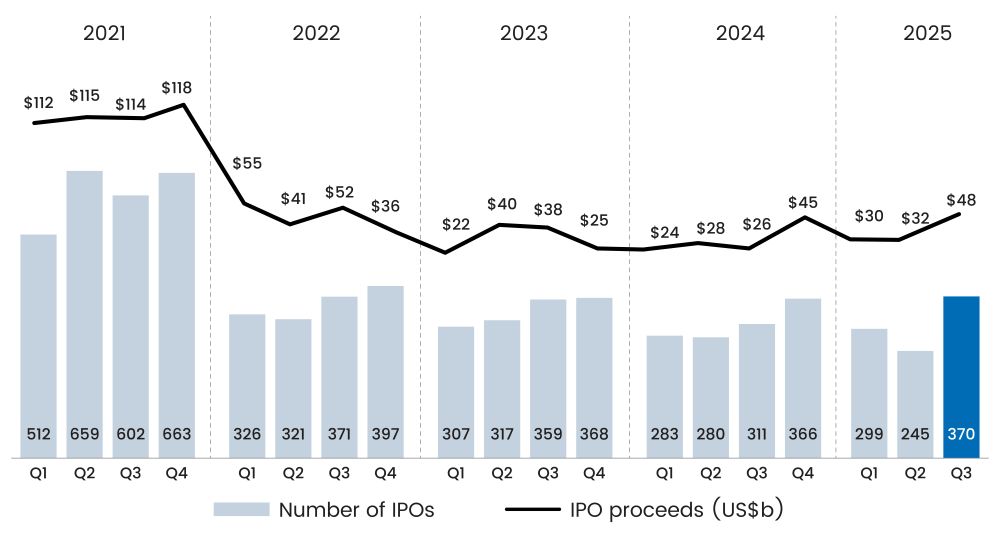

Global IPO volumes rose 19% in 3Q25, and proceeds increased 89% YoY, as per EY, driven primarily by activity in the US, China, and India. These three markets accounted for nearly 80% of the $48.2 billion raised. Improved secondary market valuations, lower funding volatility, and clearer expectations on interest rates supported renewed participation from institutional investors. India led in deal count, while the US contributed the majority of proceeds and market capitalization newly added to public markets.

Figure 1: Quarterly Global IPO Activity

Sources: EY analysis, Dealogic

The recovery, however, was defined by selectivity. Investors showed a preference for companies with consistent profitability profiles and business models aligned to longer-term growth themes such as AI, software, and digital infrastructure. Companies with less predictable cash flow or capital-intensive models experienced more cautious demand. The nature of the rebound suggests a market characterized by measured re-entry rather than broad-based risk-taking.

PE-Backed Listings Regain Traction Across Markets

Private equity (PE)-backed IPOs expanded materially, with both the number of deals and proceeds rising, reflecting alignment between sponsor valuation expectations and public market pricing. The US, Europe, and India saw the highest levels of activity, with most offerings involving companies already scaled in operations and revenue, supported by improving underwriting confidence across market participants.

Aftermarket outcomes were generally constructive. According to EY, eight of the ten largest sponsor-backed deals were trading above the offer price by late September, led by companies in technology and industrials. Public investors responded positively when issuers demonstrated stable financial performance and governance frameworks. The results indicate that IPO markets have again become a competitive exit pathway relative to secondary sales and M&A, provided companies show financial readiness.

Read more: Healthcare Fundraising in 1H25: A Realignment of Capital Across Private Markets

IPO Momentum Accelerates in the US Amid Broad Sector Strength

Traditional US IPOs raised more than $29.3 billion YTD, up 31% from the prior year, as per PwC Capital Markets Watch 3Q25. September marked the strongest month for issuance since 2021, supported by improved liquidity conditions and constructive institutional engagement. Offerings came from technology, defense, financial services, medtech, and consumer sectors, reflecting balanced sector participation.

Pricing results also supported the reopening. PwC notes that fifteen of twenty-six IPOs in 3Q25 priced at or above their expected ranges, generating an average price-to-open gain of 33% and an average first-day close up 22%. In July, the leading design software offering that rose 250% on its debut highlighted investor willingness to back companies with clearly demonstrated market leadership and efficiency in operations. This environment remains favorable for issuers with established financial reporting maturity and operational track records.

Selectivity and Valuation Discipline Define Investor Behavior

Investors remained disciplined in assessing balance sheet strength, margin stability, and exposure to regulatory risk. AI infrastructure, cybersecurity, digital payments, and enterprise software companies with established customer monetization models saw stronger pricing and sustained trading strength. Meanwhile, PE-backed issuers with elevated leverage or more cyclical business exposure faced more measured demand.

Biotech IPOs remained limited due to long commercialization pathways, and while SPAC issuance picked up, completed de-SPAC listings showed varied outcomes. Across offerings, investors prioritized transparency in financial disclosures and efficient cost structures. Companies with clear visibility into self-funded growth and stable unit economics were best positioned to maintain performance post-listing.

Read more: From ICU to IPO: How Private Equity is Reshaping Global Healthcare

High Profile Issuers Strengthen Confidence in the Forward IPO Pipeline

The strong issuance activity observed in 3Q25 has translated into broader confidence in the upcoming IPO pipeline, with 64 IPOs raising $15.3 billion, the highest level of quarterly issuance since 2021, as per Renaissance US IPO Market Review 3Q25. Twenty-four issuers raised $100 million or more, including high-profile listings such as Klarna, Figma, and StubHub, reflecting a pipeline of scaled businesses ready to access public markets. Larger offerings produced average returns of 16%, while targeted high-growth listings contributed to the overall quarterly performance of 25%.

The Renaissance IPO Index rose 11% in the quarter, outperforming the S&P 500, indicating a constructive post-listing reception. Although government funding uncertainty introduced some volatility late in the quarter, the pipeline remains broad across technology, healthcare, financial services, and industrial innovation. Issuance conditions now reflect underlying participation depth rather than temporary market optimism.

Conclusion

The 3Q25 IPO recovery reflects improving liquidity conditions, renewed institutional engagement, and valuation discipline. Issuers demonstrating proven business performance, efficient operating models, and financial transparency received stronger demand. Current market conditions represent the most supportive environment for new listings since 2021, particularly for companies prepared to meet public-market expectations.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.