Capital is concentrating around AI-native SaaS platforms, while traditional players face sharper valuation discipline. Meanwhile, exit and funding activity reinforce investor confidence in enterprise innovation.

Enterprise SaaS venture activity in 2Q25 reflected both a structural shift in market leadership and a renewed appetite for growth. While total deal value and volume declined compared to 1Q, a deeper look reveals a bifurcated investment landscape defined by AI-native momentum, differentiated valuations, and resilient exit activity. Far from a pullback, 2Q illustrates a recalibration in investor priorities and a concentration of capital around conviction themes.

VC Activity Contracts but Market Momentum Holds

Global enterprise SaaS VC deal value dropped to $22 billion across 751 deals in 2Q25, compared to $60.3 billion across 818 deals in 1Q, as per PitchBook. However, excluding OpenAI’s $40 billion megadeal in 1Q, deal value rose by 8.4%, despite an 8.2% dip in deal count. This points to a meaningful shift in activity, away from outlier-driven distortion and toward more durable, mid- and late-stage rounds focused on real enterprise use cases.

Anduril Industries was the quarter’s largest deal, raising $2.5 billion at a $30.5 billion valuation, backed by Founders Fund. This signals that capital remains available for companies with strong thematic alignment, particularly in defense, security, and infrastructure-aligned software. AI-centric platforms solving high-stakes enterprise problems continue to dominate allocation as investors concentrate capital around conviction theses.

AI Drives a Two-Tier Valuation Landscape

According to PitchBook, AI-native SaaS startups captured 45% of total VC dollars in 2Q, extending a trend of capital migration toward companies that embed AI not just at the surface level but as a core architectural layer. These startups are being valued at 15 to 20 times ARR, reflecting investor belief in their higher margin profiles, faster go-to-market cycles, and stronger network effects. This AI premium is now entrenched and widening.

In contrast, classic SaaS companies, even those with solid retention and growth, are priced closer to 6 to 8 times ARR, as per PitchBook. These firms are facing valuation resistance unless they are able to prove material AI capability. Cosmetic upgrades are no longer sufficient. Investors are sharply differentiating between companies that simply use AI and those that are engineered around it. The bar for premium valuation has been decisively raised.

IPO Activity Signals Recovery in Venture Exits

Enterprise SaaS IPOs showed renewed strength in 2Q, led by Hinge Health’s $2.3 billion listing and MNTN’s $1.1 billion debut. These exits drove a recovery in total exit value, which rose to $9.1 billion from $4.2 billion in 1Q, as per PitchBook. Although the exit count dipped slightly to 100, the presence of large public offerings suggests investors are regaining confidence in market re-entry. Only 20% of exits had disclosed valuations, underscoring the pricing opacity that still defines this environment.

The quality and scale of IPOs this quarter signal progress. For GPs and LPs, these listings are a sign that enterprise SaaS startups, particularly those positioned as AI-native or workflow-critical, will likely find credible liquidity pathways through public markets once again. The exit environment remains selective, but public listings appear to be reemerging as a viable path for well-positioned late-stage companies.

ERP Lead Segment Momentum

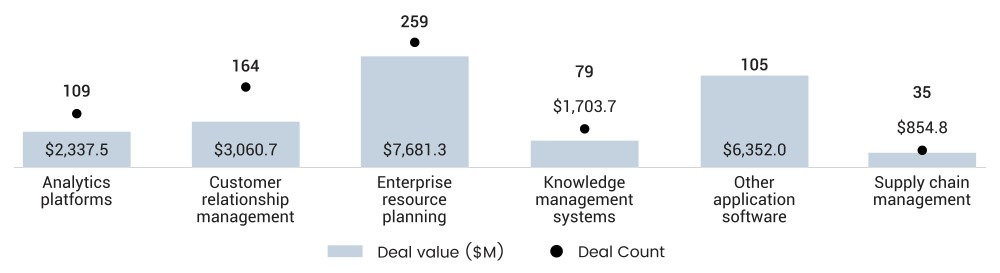

Figure 1: Global Enterprise SaaS VC Deal Activity by Segment in 2Q25

Source: PitchBook, data as of June 30, 2025

Enterprise Resource Planning (ERP) emerged as the top-funded segment in 2Q, raising $7.7 billion across 259 deals, as per PitchBook. These ERP deals included both core systems and emerging vertical solutions across manufacturing, finance, and human capital management. Analytics and knowledge management platforms also attracted significant investment, with $2.3 billion and $1.7 billion allocated to each category, respectively.

The strength of analytics platforms this quarter reflects their evolution from passive reporting tools to intelligent orchestration engines. Firms like Abridge and Muon Space highlight how these solutions are increasingly positioned to drive automated decision-making at scale. As AI becomes embedded across enterprise workflows, investors are clearly prioritizing categories that sit closest to data pipelines and enable real-time intelligence.

Stage-Level Valuations Reaffirm Investor Confidence

Late-stage and growth-stage SaaS deals saw a sharp rise in valuations, with growth-stage rounds reaching a median of $841.7 million, up from $197.7 million in 2024, and early-stage deals rising to $60 million, as per PitchBook. Deal sizes followed suit, with early and late-stage rounds averaging $15 million and growth-stage rounds exceeding $25 million. Investors are making fewer, larger bets on high-quality companies, focusing on defensible architecture, capital efficiency, and growth visibility. The sharp rebound in valuation reflects higher conviction rather than broader market exuberance.

Foundational Model Expansion Raises Competitive Stakes

OpenAI’s $6 billion acquisition of IO, a hardware firm optimized for AI workloads, suggests a move to control more of the infrastructure underpinning enterprise AI deployments. Meanwhile, although unsuccessful, its $3 billion bid for workflow automation firm Windsurf indicates a broader interest in downstream software applications. Together, these moves reflect how large model developers seek to extend their reach across the enterprise software value chain.

This raises new competitive dynamics for traditional SaaS firms, particularly those dependent on third-party AI models or infrastructure layers. Investors will likely favor startups that can build defensibility through proprietary data, domain expertise, and embedded customer workflows. In a market where capital is more concentrated and expectations are sharper, the SaaS platforms best aligned with enterprise depth and durability will drive the next phase of venture-backed growth.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.