Defense technology has moved from a niche frontier to a mainstream area of venture capital. Record funding levels, rising valuations, and stronger exits show that investors now view it as both a growth opportunity and a strategic hedge.

Defense tech has become a significant focus of VC, with the sector raising $19.1 billion across 165 deals in 2Q25, more than doubling the prior quarter and surpassing year-ago levels, as per PitchBook. This acceleration reflects investor recognition of defense innovation as a driver of both economic competitiveness and national security. For investors, the question is no longer whether defense tech deserves attention, but how to participate effectively in a market that is maturing at record speed.

Rising Capital Flows and Market Momentum

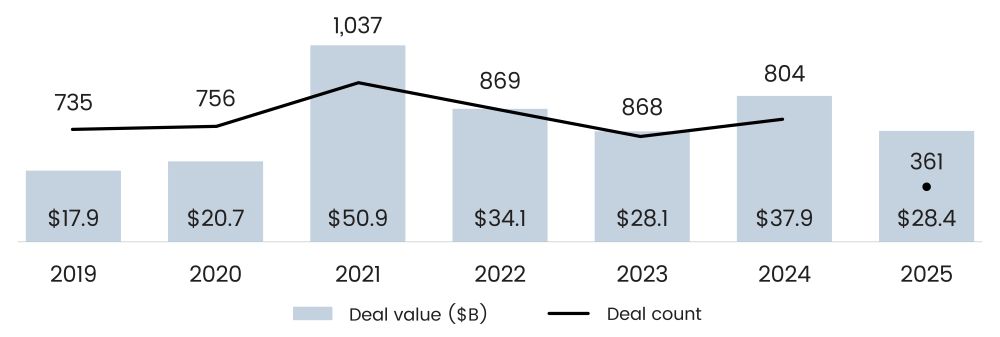

Defense tech fundraising is expanding at a rapid pace, with startups raising $28.4 billion across 361 deals in the 1H25, surpassing all of 2023 and tracking ahead of 2024’s $37.9 billion total, as per PitchBook. Median pre-money valuations doubled YoY, reaching $115 million, while median deal sizes rose from $10 million to $20 million. These trends highlight investor preference for more mature companies with established technology and commercial traction, indicating growing confidence in defense tech’s ability to deliver consistent returns.

Read more: Redefining IPO Readiness for Venture-Backed Companies

Figure 1: Global Defense Tech VC Deal Activity

Source: PitchBook, data as of June 30, 2025

This reflects a shift away from the speculative dynamics seen in other sectors. Investors increasingly view defense innovation as both a hedge against uncertainty and a pathway into government and enterprise budgets. While valuations are higher, the sector’s capital intensity and alignment with national priorities provide a supportive environment. The challenge for investors is to balance exposure to later-stage companies with selective early-stage bets for long-term upside.

Segmental Shifts in Capital Flows

Investment is concentrating on foundational technologies. Advanced computing and software attracted $16.5 billion across 95 deals, while autonomous systems raised $10.5 billion across 139 deals, as per PitchBook. These categories sit at the intersection of defense and commercial applications, powering capabilities ranging from data management to autonomous platforms. They also command the highest valuations, reinforcing investor conviction that these technologies will shape the future of defense.

According to PitchBook, autonomous systems remain the fastest-growing segment, as funding has reached $6.7 billion through mid-2025, with unmanned maritime platforms showing strong momentum. Investment in unmanned surface vessels nearly doubled in two quarters, reflecting their importance amid Indo-Pacific tensions. Counter-drone technologies and autonomous manufacturing are also expanding, indicating that diversification across operational technologies and supply chain enablers provides a more stable return profile.

Read more: Biopharma Venture Capital in 2Q25: Capital Concentrates in De-Risked Assets

Public Market Validation and Valuation Strength

Public markets are reinforcing the strength of defense tech valuations. Karman Space and Defense, which went public in early 2025, is trading at more than 60x EBITDA, supported by strong revenue and earnings growth, as per PitchBook. Voyager Technologies, Rocket Lab, and Palantir also sustain premium valuations despite profitability challenges, showing that investor sentiment remains highly supportive of defense-aligned and dual-use firms. For investors, this shows that markets continue to reward scale and strategic alignment over near-term earnings, although reliance on elevated multiples increases the risk of volatility if growth slows.

Exit Dynamics and Market Trends

Exit activity has rebounded from 2023. That year saw only 40 exits worth $2.3 billion, compared with 71 exits totaling $18.2 billion in 2024, as per PitchBook. In 2025 so far, 21 exits have generated $6.9 billion. Exit counts remain below historical peaks, but aggregate value is being driven by fewer, more substantial liquidity events. Buyers, both public and strategic, are focusing on mature assets with proven operations rather than earlier-stage companies.

For investors, this points to a selective but stronger exit market. Funds with exposure to later-stage and venture growth rounds are more likely to capture liquidity, while those concentrated in seed-stage companies will likely face longer holding periods. The current environment favors capital deployment into businesses with operational maturity and alignment with both government and commercial demand.

Read more: Cybersecurity VC in 2025: Stability Amid Strategic Reset

Strategic Implications for Investors

Defense tech has become a core allocation opportunity within venture portfolios. According to PitchBook, with nearly 8% of all VC funding now directed to the sector, investors will be unlikely to afford to treat it as peripheral. Instead, defense tech requires allocation strategies that reflect both its growth trajectory and its role in national security and global competition.

Disciplined participation will be critical. Investors should prioritize technologies that balance government contracts with commercial applications, reducing reliance on procurement cycles. They should also be mindful of higher valuations, which raise the threshold for achieving strong multiples on exit. Finally, given the bias toward larger, later-stage liquidity events, investors should back funds that combine selective early-stage exposure with the capacity to participate in expansion rounds.

Conclusion

The defense tech VC landscape is becoming a central part of venture markets, supported by record funding levels, rising valuations, and stronger exits. For investors, the opportunity is clear but requires discipline, with a focus on dual-use technologies, careful management of valuation risk, and attention to companies positioned for sustained growth. Defense tech is no longer a niche; it is a sector that will shape both innovation and security, and those with a structured strategy will be best positioned to capture durable returns.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.