Cybersecurity VC held steady in 1Q25 as investor focus narrowed toward proven platforms and fast-scaling innovation. Sector resilience remained evident despite muted exits and thinning early-stage activity.

Venture activity in cybersecurity remained stable amid broader market caution. Deal value was flat compared to the prior quarter, but capital became more concentrated, with a growing preference for late-stage companies and integrated platforms. Meanwhile, early-stage activity continued in select segments like application and endpoint security, reflecting targeted conviction despite wider risk aversion. Moreover, public listings stayed scarce, yet strategic acquisitions signaled continued consolidation of critical capabilities.

Resilient Deal Value, But Thinning Activity

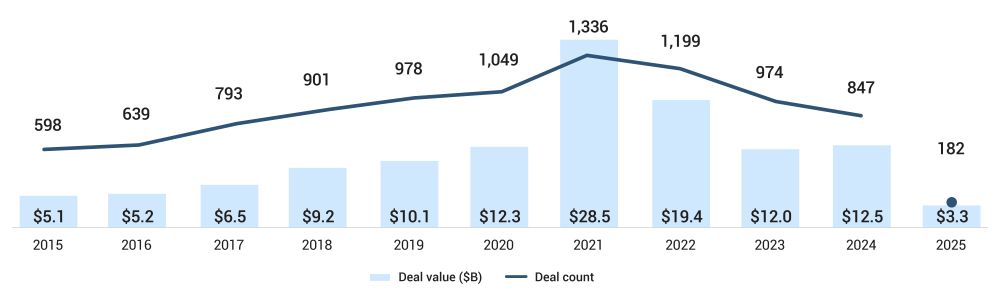

Cybersecurity startups raised $3.3 billion across 182 deals in 1Q25, as per PitchBook, matching the previous quarter in value but slightly declining in deal count from 189. Compared to 1Q24, deal value grew 6.5%, though the number of deals fell from 248. This reflects a clear investor shift toward higher-quality bets, consolidating capital into fewer, more established companies with platform potential.

Figure 1: Global Cybersecurity VC Deal Activity

Source: PitchBook, data as of March 31, 2025

Late-stage deals dominated capital deployment, accounting for nearly 50% of total deal value, as per PitchBook. Investors favored companies with proven traction and established customer bases. Further, security operations recorded the highest deal value at $922.2 million across 40 deals, followed by identity and access management at $813.3 million from 29 deals. This late-stage skew reflects the growing demand for scalable security platforms as enterprise complexity increases.

Sector Divergence Reveals Selective Appetite

Performance varied widely by segment. Application security drew the most deal volume with 47 transactions worth $555 million, as per PitchBook, underscoring investor interest in scalable solutions built for APIs, containers, and third-party integrations. Additionally, network security underperformed with only 10 deals totaling $174.7 million. Trailing 12-month data further highlights volatility. Moreover, data security led all segments with $2.7 billion in TTM deal value but dropped to $274 million in 1Q.

The sharp decline in data security deal value suggests hesitation around larger platform investments, driven by growing complexity in data residency, compliance, and deployment. Similarly, muted investor interest in network security reflects the commoditization of core functions like firewalls and intrusion detection, now increasingly embedded in cloud platforms. Together, these trends indicate a broader reassessment of near-term scalability and differentiation in both segments.

Late Stage Dominates, But Early Bets Persist

Activity skewed toward the late stage, which saw 60 deals, narrowly outpacing early-stage rounds at 58, as per PitchBook. Pre-seed and seed deals totaled 45, while venture growth lagged with 19. The concentration of funding in mature rounds is a reflection of risk sensitivity, with investors gravitating toward proven use cases and recurring revenue models in a high-stakes threat environment.

However, early-stage enthusiasm persisted in select areas. Application and endpoint security each recorded more early-stage than late-stage deals, indicating a belief in their faster innovation cycles and time to monetization. Notably, several early-stage raises in these segments drew significant capital, suggesting that disruptive potential continues to attract premium interest.

Valuation Expansion Signals Investor Confidence

Median pre-money valuations rose from $28.7 million in 2024 to $40 million in 2025, as per PitchBook. This upward movement was driven heavily by late-stage rounds, which saw valuation step-ups surge from 1.4x to 2.5x, an increase of over 80%. This marks a significant shift from the pricing caution seen during the 2022 and 2023 reset period, hinting at renewed confidence in category leaders.

Looking back to 2014, the average annual growth rate in early-stage valuations was 16.6%, while late-stage and venture growth valuations grew even faster, as per PitchBook. The sharpest long-term gains occurred at the venture growth level, which saw a 33.6% compound annual growth rate. These trends reinforce the argument that platform consolidation is pushing up pricing for proven category winners.

Exit Activity Shows Low Volume, High Intent

1Q25 saw only $800 million in cybersecurity VC exits across 34 deals, far below the long-term 1Q average of $1.8 billion, as per PitchBook. However, the deal count was above trend, suggesting ongoing consolidation even in a subdued liquidity environment. Compared to 4Q24, the number of exits was steady at 33, but the exit value dropped sharply from 3.4 billion.

Acquisitions accounted for the majority of exits in terms of both deal count and value. Only two public listings occurred. Notable strategic moves included NVIDIA’s 320 million acquisition of synthetic data company Gretel and CyberArk’s 165 million purchase of Zilla Security. Both deals reflect a clear trend of acquirers targeting AI-enhanced cybersecurity assets to fill capability gaps and enhance platform defensibility.

Public Funding Signals Durable Growth Path

Cybersecurity ranked among the top enterprise spending priorities in 4Q24, reinforcing long-term demand momentum entering 2025, as per S&P Global. The US federal government remains a strong catalyst, with the Cybersecurity and Infrastructure Security Agency receiving a record $3 billion for the fiscal year 2025, as per the US Department of Homeland Security. This continued funding reinforces long-term demand and provides strategic visibility for investors focused on public sector exposure.

The Global Cybersecurity market is projected to grow at a 12.9% CAGR over the next five years, outpacing the IT services market’s growing CAGR of 9.4%, as per Grand View Research. The expansion of hybrid and multi-cloud environments, along with a growing attack surface, ensures that demand for robust security tools remains consistent and non-cyclical.

Strategic Outlook for Investors

Cybersecurity remains one of the few VC sectors combining mission-critical demand with long-term innovation upside. However, the investment approach is evolving. Capital is consolidating into fewer deals, with a focus on larger checks for companies that have passed product-market fit and demonstrated retention. In this environment, scale and integration potential matter more than ever.

For investors seeking asymmetric upside, early-stage opportunities in application and endpoint security offer strong signals. These segments combine rapid iteration cycles with favorable adoption curves and are well-positioned to meet the security needs of next-gen software architecture. Simultaneously, late-stage consolidation plays a role in identity and security operations and will likely provide portfolio stability through platform expansion and strategic exits.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.