Climate private equity (PE) has matured from a niche strategy to a strategic allocation channel, but political volatility and capital discipline are testing its staying power. While growth has slowed, structural demand and improved performance suggest long-term resilience.

The past decade has seen climate-focused PE funds evolve from a thematic idea to a substantial institutional allocation. From 2009 through 1Q25, PE funds, both generalists with partial exposure and specialists investing almost exclusively in climate-linked businesses, raised a combined $488.1 billion, as per PitchBook. This growth was fueled by decarbonization mandates, shifting consumer behavior, and maturing technologies. In 2024, however, evolving policy dynamics in key markets and broader macroeconomic instability contributed to a slowdown in fundraising, marking a recalibration for the strategy.

Specialist Funds Momentum

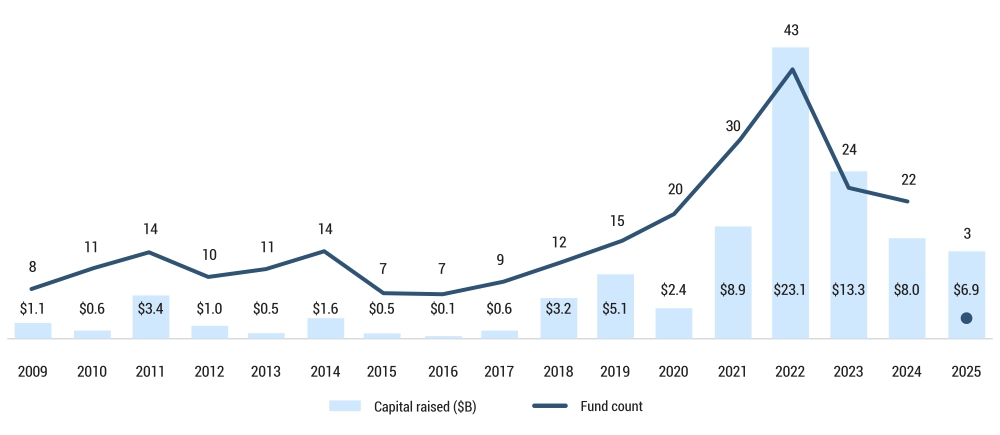

Climate PE specialists’ funds have gained significant momentum over the past five years, raising $62.6 billion from 2020 to 1Q25, as per PitchBook. These funds have benefited from limited partner (LP) demand for focused exposure, as allocators seek both financial returns and alignment with internal impact objectives. Specialists have also become more attractive as the complexity of climate technologies demands deeper domain expertise and disciplined underwriting.

Figure 1: Climate PE Specialist Fundraising Activity

Source: PitchBook, data as of March 31, 2025

This growth, however, has not been linear. While specialist fund fundraising peaked in 2022 at $23.1 billion, capital inflows dropped in 2023 and 2024, as per PitchBook. Yet 1Q25 fundraising signals renewed interest, likely driven by investor appetite for differentiated, strategy-aligned vehicles in a crowded market. Notably, firms such as TPG and Blackstone have emerged as top fundraisers, while Europe maintains an outsized share relative to its position in broader PE.

Climate PE Structures: Growth-Oriented, Venture-Heavy

Unlike traditional PE, where buyouts dominate, nearly half of all climate PE specialist fund commitments since 2009 went to growth or expansion funds, as per PitchBook. This sub-strategy has proven more suitable for climate investing, where many business models are still scaling and require capital to move from technical validation to commercial deployment.

15.7% of specialist fund deals were in pre-seed, seed, or early-stage VC, and 39.1% were in late-stage VC or venture growth, as per PitchBook. This deal mix reflects not only the maturity curve of climate startups but also a strategic effort by General Partners (GPs) to secure upstream access to high-potential platforms. The relative underrepresentation of buyouts at 24.1% signals that climate PE funds are still largely in their capital formation and scaling phase.

Return Profile: From Underperformance to Parity

Climate PE funds from the 2008 to 2015 vintages broadly underperformed both peers and benchmarks, as per PitchBook. Much of this was attributable to early exposure to immature cleantech technologies, especially renewables, which failed to achieve expected cost advantages as fossil fuel supplies expanded and oil prices declined after 2008.

Performance has improved since 2016. Funds in the 2016 to 2021 vintage cohort delivered higher median and downside returns than non-climate peers, as per PitchBook. However, when returns are measured against geography- and vintage-adjusted benchmarks, the apparent outperformance narrows. Overall, climate PE is now performing roughly on par with traditional PE strategies, suggesting that perceived return penalties are no longer warranted, but that structural outperformance has yet to materialize.

Policy, Technology, and Demand as Return Drivers

Multiple drivers have shaped the recent turnaround in performance. Technological improvements, from energy-efficient cooling systems to battery recycling and agrovoltaics, have made climate businesses more viable at scale. Policies such as the EU Green Deal and the US Inflation Reduction Act have helped derisk certain verticals, although their long-term impact will depend on consistent execution and ongoing support across jurisdictions. Robeco’s 2025 Global Climate Investing Survey finds that only 33% of investors believe their home governments understand the policies needed to support climate-aligned investment.

Consumer behavior has also evolved. A 2024 Voice of Consumer Survey by PwC found that more than 80% consumers are willing to spend more on sustainably produced or sourced goods. This trend has benefited climate PE fund segments tied directly to end-user demand, such as sustainable food, transportation, and consumer goods, while also pushing corporates to seek low-emission inputs, expanding potential exit pathways for climate-backed companies.

Recalibrating Capital Flows

After a strong 2022 and 2023, climate PE fund fundraising lost momentum in 2024, particularly among generalist funds, as per PitchBook. Contributing factors included geopolitical uncertainty, with 80% of LPs in an Adam Street Partners 2025 Survey stating it would affect their investment decisions. Other headwinds included elevated inflation and increased hesitation among some GPs to overtly market climate-focused strategies, due to perceived branding risks.

Still, early 2025 suggests the market is adjusting rather than retreating. Several fund managers have returned with narrower mandates and refined positioning, while investors have become more selective in evaluating climate allocations. This shift reflects a recalibration of how capital is being raised and deployed across the segment.

Long-Term Outlook

PitchBook projects climate PE AUM will grow from $463 billion in 2024 to $563 billion by 2029. This reflects a steady continuation of structural demand driven by fossil fuel depletion, resource constraints, and demographic shifts. If climate PE maintains returns in line with peers and GPs continue to build sector-specific capabilities, allocator support is likely to remain strong. A growing pool of experienced fund managers, combined with increased institutional engagement, reinforces the long-term viability of the strategy despite near-term challenges.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.