Biopharma venture capital (VC) dealmaking slowed sharply in 2Q25, with investment consolidating into select, larger transactions targeting lower-risk opportunities. Investors are prioritizing clinically validated assets, AI-enabled R&D models, and M&A-driven exits over speculative early-stage ventures.

Biopharma venture capital investment totaled $5.4 billion across 198 deals in 2Q, marking the lowest quarterly performance since data tracking began in 2020, as per PitchBook.

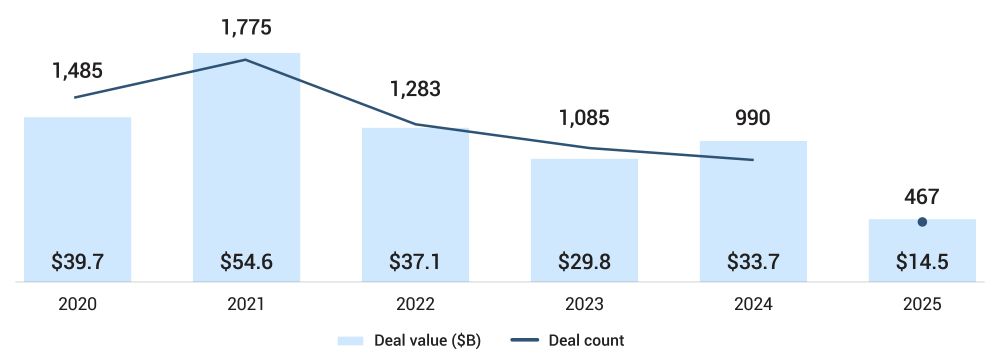

Through 1H25, the biopharma venture capital funding reached $14.5 billion across 467 deals, representing a decline of 14% in deal value and 9.7% in deal count compared with 1H24. Moreover, the median pre-money valuation climbed to $54 million from $42 million in 2024, showing investors’ willingness to pay premiums for differentiated companies with credible near-term growth prospects.

Figure: Global Biopharma VC Deal Activity

Source: PitchBook, data as of June 30, 2025

De-Risking in Action: Focus on Clinical-Stage and AI

Capital deployment is increasingly directed toward companies with proven success in clinical trials. The quarter’s largest raise was Pathos AI’s $365 million Series D at a $1.6 billion valuation, leveraging its AI-enabled precision medicine platform to advance in-licensed assets from Novo Nordisk and Prelude Therapeutics. Kardigan’s $300 million 1Q raise for AI-driven cardiovascular drug development reflects the same strategy of enhancing clinical programs with technology to improve efficiency.

Investor interest in AI-augmented development is rooted in its potential to reduce R&D costs and accelerate approval timelines. By combining validated assets with data-driven platforms, these companies will likely progress toward commercialization while mitigating traditional biotech risk. This approach is increasingly viewed as a compelling investment profile for VCs seeking both innovation and execution certainty.

The Preclinical Exception: Strength in Longevity Biotech

While most preclinical startups are experiencing reduced access to capital, the longevity segment remains a notable outlier. NewLimit’s $130 million Series B, valuing the company at $825 million, demonstrated strong investor conviction, achieving a 4.1x valuation step-up from January 2025, as per PitchBook. Its focus on epigenetic reprogramming to address aging-related disease continues to attract high-caliber backers.

Similar funding momentum from Altos Labs and Retro underscores the category’s resilience despite its inherent risks. These are high-risk investments with long commercialization timelines, but their scientific ambition and potential market impact keep them on the radar of investors willing to make selective, conviction-led preclinical commitments.

Exit Market Divergence: APAC IPOs Surpass US

Public listings in Q2 revealed a clear geographic split. APAC markets hosted six IPOs, three each in China and South Korea, raising $2.2 billion in total from companies such as DualityBio, PegBio, and TransThera Bioscience, as per PitchBook. Strong licensing demand from US and European pharma companies for Chinese assets is helping the region weather broader IPO market weakness.

The US recorded no traditional biopharma IPOs in 2Q, the first such quarter since 2020, as per PitchBook. The only new listing, Tvardi Therapeutics, entered via a reverse merger. Weak aftermarket performance of earlier 2025 US IPOs, combined with a 20% YoY drop in the Morningstar US Biotech Index, suggests continued challenges for public exits in the near term.

M&A Takes the Lead in Exits

With IPO windows limited, M&A remains the dominant liquidity route. 2Q25 saw eight M&A transactions, including AstraZeneca’s $1 billion acquisition of EsoBiotec and Eli Lilly’s $1 billion purchase of SiteOne Therapeutics. Both transactions targeted differentiated clinical-stage assets with strong therapeutic positioning.

The pending $2.1 billion acquisition of Capstan Therapeutics by AbbVie highlights growing buyer interest in in vivo cell therapy platforms, which will likely deliver genetic payloads directly to T cells while avoiding the logistical and cost burdens of ex vivo manufacturing. Such assets offer strategic and economic advantages in competitive therapeutic areas.

Capital Allocation Shifts to Mature Modalities

Mature modalities secured the largest share of funding in Q2, attracting $3.74 billion across 121 deals, compared with $1.18 billion for advanced modalities and $427 million for emerging ones, as per PitchBook. Over the past 12 months, mature modalities have drawn nearly $22 billion, benefiting from established regulatory pathways and proven therapeutic potential. This concentration underscores the current investor preference for therapeutic approaches with higher probabilities of clinical and commercial success.

Stage Dynamics: Valuation Premium for Near-Market Assets

Median valuations for late-stage and venture growth rounds have increased sharply, with venture growth transactions reaching $188.3 million in 2025, compared to $62.5 million for late-stage VC transactions, as per PitchBook. This reflects the scarcity premium placed on companies nearing pivotal trials or commercial launch. At the other end of the spectrum, pre-seed and early-stage valuations remain flat, showing limited appetite for long-horizon projects. Unless operating in high-conviction niches like longevity, such companies will find capital access more constrained in the current environment.

Read Also – Venture Capital Industry Trends 2025

Investment Outlook for 2025

The 2Q25 environment calls for selective, thesis-driven investing. Broad exposure to early-stage biotech is less compelling given ongoing funding constraints and exit uncertainty. Priority should be given to later-stage, clinically validated companies with identifiable M&A potential and efficiency gains from AI-enabled development models.

APAC public markets and strategic acquisitions remain viable liquidity channels, while preclinical investments should be reserved for sectors with clear scientific differentiation and likely buyer interest. The biopharma VC market has transitioned from expansionary capital deployment to disciplined allocation, favoring targeted investments over broad market exposure.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower-middle-market investment banks and private equity firms, SGA provides offshore analysts with seamless support throughout the deal life cycle. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work-certified firm with over 1,600 employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.