Biopharma modalities’ venture capital (VC) investments are becoming more selective, favoring proven assets over high-risk innovation. While cardiometabolic drugs and AI-driven drug discovery continue to attract capital, investors are shifting toward service-based models and later-stage deals.

Mixed Performance with More Deals and Less Funding

The biopharma modalities VC landscape saw a mixed performance in 4Q24. While the deal count rose by 14.7% QoQ to 234 deals, total funding declined by 12.7% to $7.2 billion, as per PitchBook. However, the TTM figures painted a more optimistic picture, with a 20.3% YoY increase in funding, reaching $32.1 billion. Moreover, late-stage investments remained resilient, underscoring investor confidence in companies progressing through clinical trials. Phase 2 and beyond-stage companies continued to capture the bulk of VC funding, aligning with the broader market trend of prioritizing clinical validation.

Figure 1: Biopharma Modalities VC Deal Activity

Source: Pitchbook, data as of December 31, 2024

GLP-1 Boom and Cardiometabolic Drugs Lead VC Funding

A defining trend is the growing interest in cardiometabolic disorders, with GLP-1 drug development dominating funding activity. These drugs, widely used in weight management and diabetes treatment, attracted substantial capital due to their commercial success and promising next-generation formulations. Alongside this, AI-driven drug discovery remained a focus area, but investors leaned toward service-oriented models rather than full-platform startups. The shift was evident in companies opting for licensing-based revenue models rather than outright platform exits, signaling a change in AI-driven biotech commercialization strategies.

A notable theme is the increasing role of AI in biopharma infrastructure. NVIDIA’s expansion into genomics, pathology, and clinical research automation showcased how the industry is outsourcing AI development rather than building in-house capabilities. Similarly, in January 2025, AMD invested $20 million in Absci Corp to accelerate biologics innovation through AI-backed drug discovery, positioning itself alongside Nvidia. This trend suggests that while AI remains integral to drug discovery, its application is shifting toward infrastructure and service-based solutions rather than standalone AI-driven biopharma platforms.

Read more: VC-Backed Companies Are Driving M&A as Big Tech Pulls Back

Exit Activity Recovers, but Deal Volume Remains Subdued

Exit activity in biopharma modalities also showed signs of recovery, with total exit value reaching $36.6 billion in 2024, up from $22.0 billion in 2023, as per PitchBook. However, deal volume remained subdued, with only 89 exits, compared to 103 in the previous year. IPOs continued to dominate the exit landscape, accounting for the majority of high-value transactions. The market showed signs of steady recovery from its 2022 lows. According to JP Morgan, A total of 19 biopharma IPOs collectively raised $3.8 billion in 4Q24. Notable IPOs included Onconic Therapeutics ($5.03 billion) and Upstream Bio ($617.8 million), reflecting sustained investor appetite for companies with validated clinical assets. While the IPO count remains well below the peak levels of 2021, the sector’s gradual resurgence highlights improving confidence in public offerings as an exit route.

Focus on Selective Deals Amid Market Caution

While M&A activity picked up in Q4, overall, 2024 saw a sharp decline, marking one of the sector’s weakest deal-making years in recent history. According to JP Morgan, with only 18 M&A deals in Q4 totaling $5.9 billion, which is the lowest level since early 2022, investors and industry players largely held back, weighed down by depressed public valuations and a cautious funding environment. The acquisitions remained selective, focusing on antibody-based therapies and gene editing. Major deals included AbbVie’s $1.4 billion acquisition of Aliada Therapeutics and Novartis’s $1.1 billion acquisition of Kate Therapeutics. These transactions underscore pharma companies’ growing interest in acquiring targeted assets with strong therapeutic potential rather than broad-spectrum platform plays. The selective nature of M&A also highlights the cautious approach taken by large biopharma firms in allocating capital amid regulatory uncertainties.

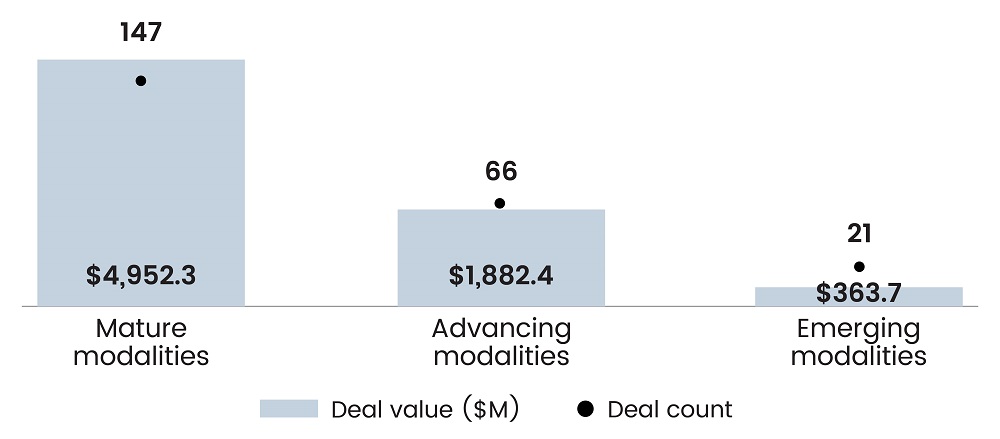

Mature Modalities Attract the Most Capital

From a segmental perspective, mature modalities dominated VC funding, securing $4.95 billion in Q4, compared to $1.88 billion for advancing modalities and $363.7 million for emerging modalities, as per PitchBook. This trend reflects investors’ preference for proven therapeutic approaches with well-defined clinical and regulatory pathways. The relative underfunding of emerging modalities indicates the heightened scrutiny surrounding novel biopharma technologies, which, despite their long-term potential, remain riskier bets in the near term.

Read more: The Rise of Private Credit: Why Investors Are Betting Big on this Asset Class

Figure 2: 4Q24 Biopharma Modalities VC Deal Activity by Segment

Source: Pitchbook, data as of December 31, 2024

Macroeconomic Pressures Shape VC Investment Strategies

The broader macroeconomic environment also influenced biopharma VC trends. Higher interest rates and market volatility led investors to focus on capital-efficient business models with shorter time horizons to commercialization. This shift was evident in the declining median deal size for pre-seed investments, which dropped from $7.5 million in 2023 to $7.0 million in 2024, while late-stage investments saw an increase in median deal size, reaching $18.2 million, as per PitchBook.

Looking ahead, biopharma VC investment patterns are likely to be shaped by regulatory shifts, scientific advancements, and macroeconomic conditions. The emphasis on later-stage assets suggests that investors will continue prioritizing companies with clear clinical progress. At the same time, AI-driven drug discovery is expected to evolve further, with service-based models gaining traction. As the sector navigates these changes, strategic capital allocation will be key in sustaining long-term innovation and commercialization in biopharma.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.