AI and ML VC (venture capital) investment reached record highs in 1Q25, driven by the scale of infrastructure and the breadth of applications. Yet capital remains unevenly distributed, forcing investors to navigate a widening gap between platform concentration and vertical fragmentation.

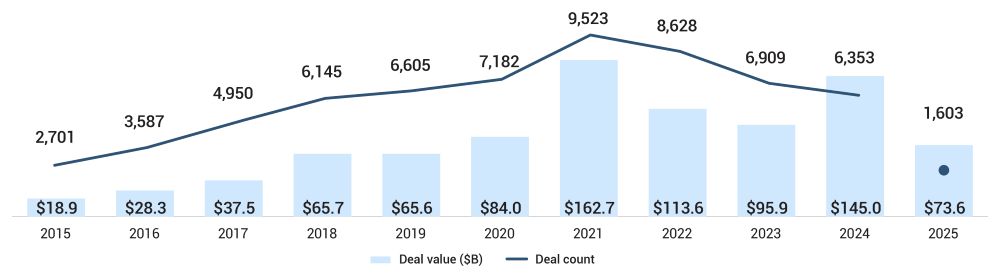

1Q25 marked a new record in AI and ML venture capital activity, with global startups raising $73.6 billion across 1,603 deals, the highest quarterly figure ever recorded by deal value, as per PitchBook. This surge reinforces AI’s dominance in VC investing, capturing over 51% of global VC capital deployed in 1Q25. Beneath the headline numbers, however, lies a growing divide between capital-heavy horizontal platforms and a crowded landscape of vertical applications. For investors, navigating this split will require sharper theses and more disciplined entry points.

Figure 1: Global AI and ML Deal Activity

Source: PitchBook, data as of March 31, 2025

Capital Flows to Platforms, Activity to Applications

The platform layer, defined by general-purpose infrastructure such as large language models, absorbed nearly $50 billion across 425 deals in 1Q, as per PitchBook. This accounted for almost 70% of the total capital raised, despite comprising just over a quarter of the deal volume. In contrast, vertical application startups, which tailor AI to specific domains, secured 60% of deals but attracted just $19.2 billion, reflecting the capital intensity required at the infrastructure level.

This imbalance reflects underlying cost dynamics. Horizontal models require substantial capital for development and computing resources, limiting participation to a few well-funded players. In contrast, vertical applications demand fewer resources and are typically simpler to develop and implement, lowering the barrier to entry. As a result, funding is highly concentrated at the platform level, while application-layer activity remains broader and more distributed.

Smaller Deals, Stronger Access Points

While vertical AI applications do not lead in cumulative deal value, they continue to remain a key focus for experimentation and commercial relevance. With over 1,000 deals this quarter, verticals are testing domain-specific integrations across healthcare, financial services, and consumer AI, as per PitchBook. Startups such as Zenmev with $140 million in financial services, Latent Labs with $39.9 million in healthcare, and Grand Games with $30 million in consumer AI illustrate the range and fragmentation of use cases.

Despite their smaller size, these deals represent potentially more efficient capital allocation. Unlike infrastructure plays that often require long runways, vertical models are closer to revenue generation and integration with enterprise workflows. They also benefit from faster feedback loops, enabling teams to iterate quickly based on customer needs. This makes them attractive for investors targeting shorter exit timelines or more grounded valuations.

Valuation Step-Ups Reveal Early-Stage Advantage

Valuation dynamics in 1Q25 point to early-stage AI companies offering the most consistent upside. Median pre-money valuations reached $12.7 million for seed, $57 million for early-stage, and $325 million for venture-growth rounds, as per PitchBook. Moreover, step-ups rose from 1.47x to 1.72x at the seed stage and from 2x to 2.08x at the early stage. From 2014 to 2025, early-stage VC recorded the fastest valuation growth, with a 17.14% compound annual rate, outpacing all other stages.

This trend reflects investor appetite for scalable, de-risked startups that show early traction without late-stage pricing pressure. In a market where investor caution is rising, early-stage bets offer better entry points and stronger return potential. The shift also signals a rebalancing of capital flows, as investors move away from late-stage excess toward fundamentals-driven deployment.

Capital Shifts Downstream Amid Venture-Growth Lead

Venture-growth rounds led in 1Q25, raising $49.4 billion, followed by $14.1 billion in late-stage deals and $7.3 billion in early-stage funding, as per PitchBook. Median venture-growth deal size reached $31.2 million, over triple early-stage VC’s $9 million median. Yet as investor priorities shift, early-stage valuations have outperformed, and attention is moving downstream. With mega-round fatigue setting in and infrastructure maturing, emerging use cases at Series A and B levels are drawing greater interest due to better pricing and broader exit flexibility.

Exits Rebound but Remain Highly Concentrated

1Q25 saw exit value rebound to $27.4 billion across 146 deals, the strongest quarter since 4Q21, as per PitchBook. This was driven largely by a few IPOs. CoreWeave’s March listing at a $14.5 billion post-money valuation made up over half the total. Other IPOs like Blocks Group and Hanshow brought public listing value to $21.5 billion, while acquisitions and buyouts contributed the remaining $5.9 billion. Of the 146 exits, 105 were acquisitions, making it the dominant route this quarter.

This underscores a strategy of acqui-hiring and capability expansion, especially in AI software, where buying proven teams and targeted IP often outweighs building in-house. Strategic buyers such as Nvidia, which acquired Gretel for $320 million, are increasingly turning to acquisitions as a faster, more efficient path to technical differentiation and product acceleration.

Semiconductors and Autonomy Signal Capital-Intensive Frontier

Beyond software, capital continues to chase hardware and autonomy plays. Semiconductors raised $2.45 billion across 65 deals, while autonomous machines attracted $2.24 billion across 91 deals, as per PitchBook. Though smaller in deal count, these sub-verticals are highly capital-intensive and often follow hardware deployment cycles that differ from typical software timelines.

NXP’s $307 million acquisition of Kinara underscores the role of edge AI chips in enabling real-time processing across automotive and IoT devices. Investing in capital-intensive sectors such as semiconductors and autonomy often requires patient capital and a risk tolerance, but exits like CoreWeaves’s IPO highlight the scale of potential upside.

Conclusion: Focus is Shifting from Frontier to Fit

AI and ML investment in 1Q25 was not just about records but shifting priorities. While horizontal platforms still absorb most capital, opportunity is moving toward verticals, early-stage deals, and enterprise use. The high cost of foundational models makes platform bets concentrated and risky. In contrast, vertical applications offer quicker monetization and clearer value. For investors, the next wave of returns lies in backing focused startups with lean funding, real use cases, and disciplined execution.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.