US venture capital (VC) is stabilizing in 2026 as early-stage momentum, selective late-stage activity, and improving liquidity reset the market. AI continues to dominate investment priorities, driving opportunity and sharper discipline across the ecosystem.

The US venture market enters 2026 with a measured recovery underway. Public markets remain strong, and rate cuts are expected, while the broader environment continues to reset after several years of volatility. Policy stability has improved, lowering the risk of regulatory surprises compared with 2025. Moreover, exit activity strengthened through 2025, early-stage dealmaking increased, and AI continued to capture a dominant share of VC. These trends form a backdrop in which optimism and caution will operate together as investors reassess risk, valuation discipline, and long-term positioning.

Early-Stage Momentum Accelerates Despite 2025 Fundraising Lags

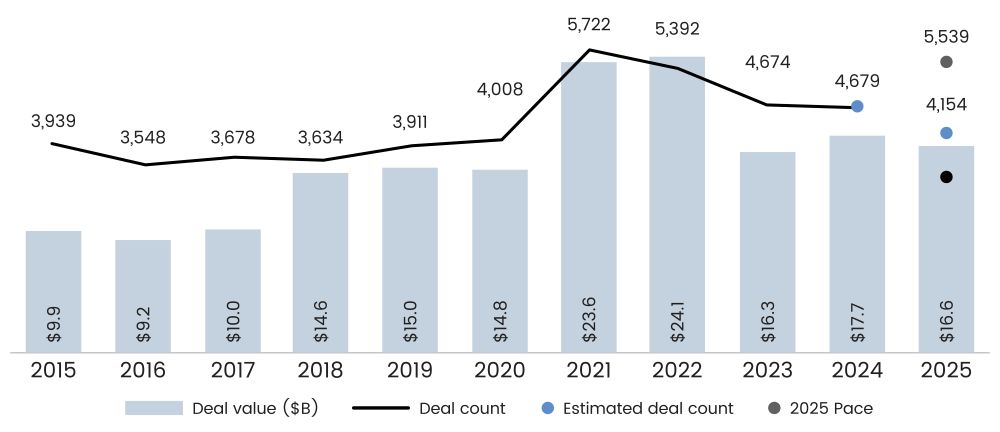

Figure 1: First-time Financing US VC Deal Activity

Source: PitchBook, data as of September 20, 2025

Early-stage activity is improving faster than expected, with seed and first-time financings through 3Q25 only about 200 deals behind 2021 levels despite weak fundraising, as per PitchBook. Down rounds have eased, markups are returning, and business formation remains strong. AI is driving much of this momentum, capturing 65% of US VC deal value and 37.1% of non-life-sciences first financings. AI startups raise capital earlier and faster, with a median age at first financing 65% lower than that of their non-AI peers, supporting a strong early-stage outlook for 2026.

Read more: Global Real Estate in 1H25: Stabilizing Market with Shifting Capital Priorities

Later-Stage Strength Persists as Valuation Gaps Widen

Later-stage activity remained resilient in 2025. Annualized late-stage deal value reached $107.6 billion across an estimated 4,459 deals, the second-highest total in a decade after 2021, as per PitchBook. Venture growth deal activity is on pace for a record year, with annualized value at $150.2 billion. This strength reflects the continued willingness of investors to support mature companies that remain private for longer, especially as the IPO window reopens selectively.

The market is becoming more uneven. Active unicorns reached 830 through 3Q25, with a post-money valuation of $3.9 trillion; however, many have slowed their growth and face tighter funding conditions. AI companies represented over 28% of late-stage deals and secured higher valuations than non-AI peers. Median pre-money valuations reached $307 million for Series C and $838.8 million for Series D+. In 2026, companies with clear traction, especially in AI, will keep raising capital while weaker ones struggle for investor attention.

Read more: US VC in 3Q25: Selective Optimism Amid AI-Fueled Growth

Selective Liquidity Recovery Shapes the Exit Landscape

Liquidity improved in 2025 but remains below historical norms. Two-thirds of unicorn IPOs were priced below their last private valuation, and the median IPO valuation relative to the last VC valuation was 0.9x, as per PitchBook. Down-round IPOs have become a normal part of the reset. The base case forecasts 68 IPOs in 2026, which matches the decade average excluding 2021 and is 44.7% higher than the projected 2025 count. Most listings remain concentrated in AI, crypto, fintech, defense, and space, consistent with 2025 trends.

Secondaries have become an important liquidity channel. Consolidation increased in 2025, including Goldman Sachs buying Industry Ventures, Morgan Stanley acquiring EquityZen, and Schwab moving for Forge Global. Secondary special purpose vehicles (SPVs) increased 682% from 2023, and capital raised increased 1,340% YTD. Leading startups have tightened transfer rules, including OpenAI, requiring consent. In 2026, secondary liquidity will expand but stay concentrated around companies with strong fundamentals and recent primary pricing.

Read more: Global IPO Market Reawakens as US Leads 3Q25 Revival

Fundraising Stabilizes as LP Discipline Remains High

Fundraising remained subdued through 2025. Only $55 billion was raised across 451 funds YTD, well below the 2021–2022 peak, as per PitchBook. LP sentiment has been held back by $169 billion in cumulative negative net cash flows since 2022. Capital has become concentrated among established managers, while emerging managers face sharp challenges. Only 33% of first-time managers from 2021 raised a second fund, and only 12% of those from 2022 did so. These conditions reduce broad-based recovery potential heading into 2026.

Momentum is beginning to improve. Better exit activity and expanding secondary markets are supporting a gradual improvement in capital flows. Fundraising is expected to reach $100 billion to $130 billion in 2026, based on the historical relationship between distribution yields and capital raised. Large managers have already returned to market, including Andreessen Horowitz, which is reportedly raising a $10 billion AI and defense-focused fund expected to close in 2026. Fundraising should improve next year, but the pace will depend on realized liquidity.

Read more: Global M&A Regains Momentum in 3Q25 as Strategic Transactions Accelerate

AI Dominates VC Allocation and Valuations

AI continues to reshape the venture market. Through 2025, AI accounted for nearly two-thirds of VC deal value and generated more than half of new unicorns, as per PitchBook. AI companies also raised capital more quickly, with shorter development cycles and broader adoption across various sectors, including biotech, enterprise productivity, climate tech, and advanced manufacturing. The rapid formation of AI startups is reflected in their lower median age at first financing and faster progression between rounds.

AI’s acceleration introduces risk. The market remains top-heavy, with valuations tied closely to expanding public-market AI multiples. Any contraction in public AI valuations would pressure private markets and weaken investor confidence. In 2026, capital will continue flowing to AI, but investors should expect growing divergence within the category, with well-capitalized leaders advancing and weaker companies facing sharper selection pressure.

Conclusion

The 2026 US venture market is stabilizing. Early-stage activity is strengthening, while later-stage markets remain active but more selective. Additionally, liquidity is returning through IPOs and secondaries at a measured pace. Fundraising appears to have bottomed and is beginning to improve as distributions recover. Moreover, AI continues to shape the market’s direction and investment priorities. Investors in 2026 will benefit from a disciplined selection process, realistic valuations, and a focus on companies with credible paths to liquidity.

How SG Analytics Assists in Private Equity Decision-Making

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.