ESG Research Empowered by Cutting-Edge Technology

Track ESG controversies affecting companies, suppliers, and stakeholders with our exclusive news product.

Features

Unmatched News Coverage

Our news aggregation covers a vast network of 235K+ sources, a continuously expanding and carefully curated list, that ensures you stay informed about critical ESG developments.

Al-Enhanced Controversy Detection and Categorization

Our proprietary ML/NLP models refine generative Al (GenAl) outputs, delivering highly accurate information for each metric.

Guided by ESG Expertise

Our team of in-house ESG experts leads the categorization and Al training processes, meticulously crafting the data that powers our models through detailed keyword analysis and data preparation.

Precision Mapping of Entities

Our proprietary company alias research and mapping techniques allow us to track both public and private companies, offering full customization to include companies based on your specific needs.

Why SGA

We deliver timely and accurate document insights, ensuring continuous availability of critical data through sophisticated techniques.

Quick Product Facts

News Sources Monitored

Media Articles Screened Daily

ESG Controversies Detected Daily

Customizable Categories for ESG Controversies

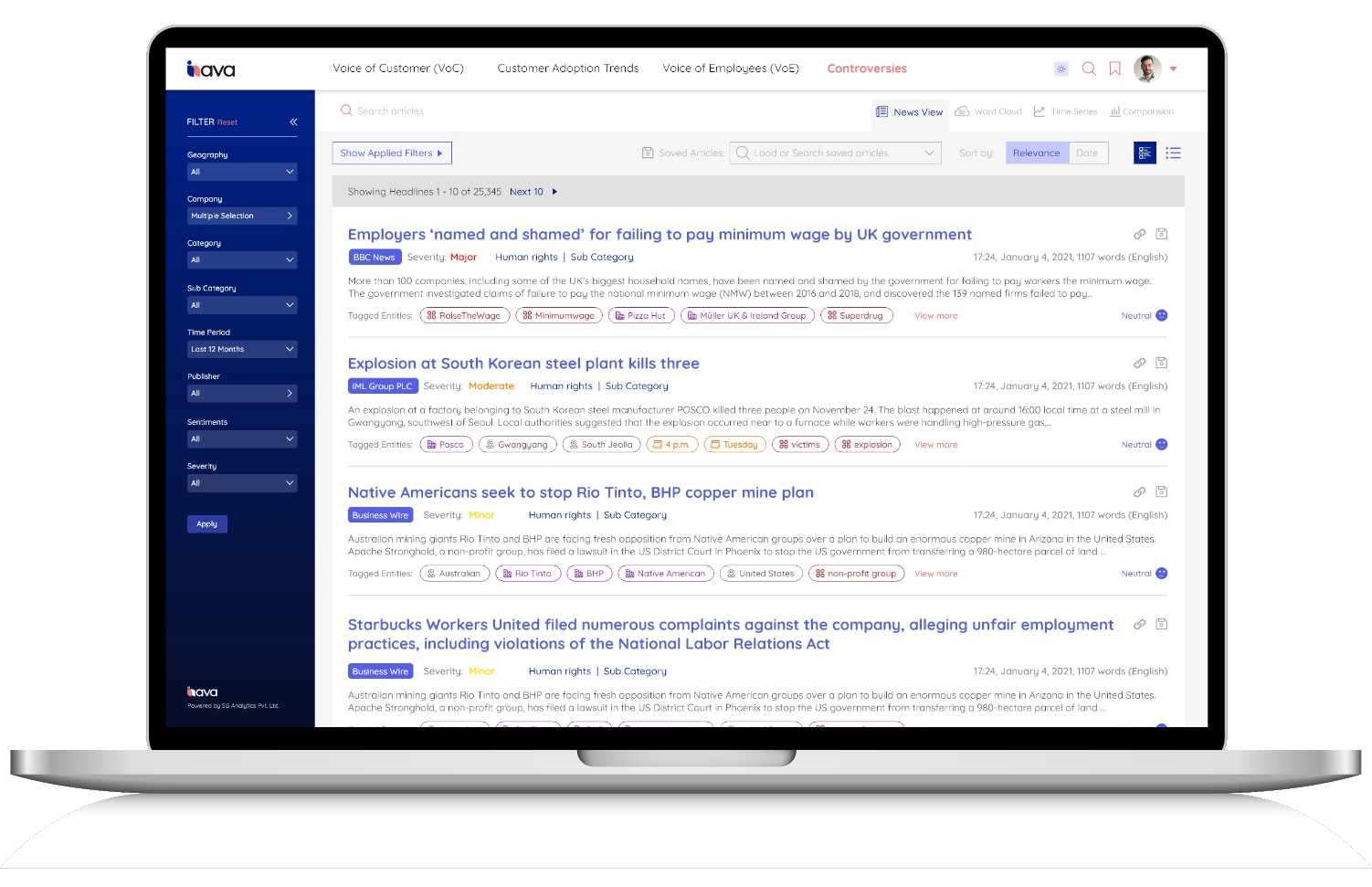

Simplify ESG Controversy Tracking With Our Intuitive Interface

Have Questions About Our Product?

Request a Demo