US venture-backed M&A is not entering a phase of exuberant recovery; it is undergoing a structural reset. As founders face depleted runways and general partners encounter growing pressure to generate liquidity, dealmaking in 2025 is increasingly defined by necessity rather than optionality. The current environment reflects not a return to the highs of 2021 but a realignment toward smaller, more urgent transactions shaped by capital constraints and exit imperatives.

Liquidity Pressure is Reshaping VC Exits

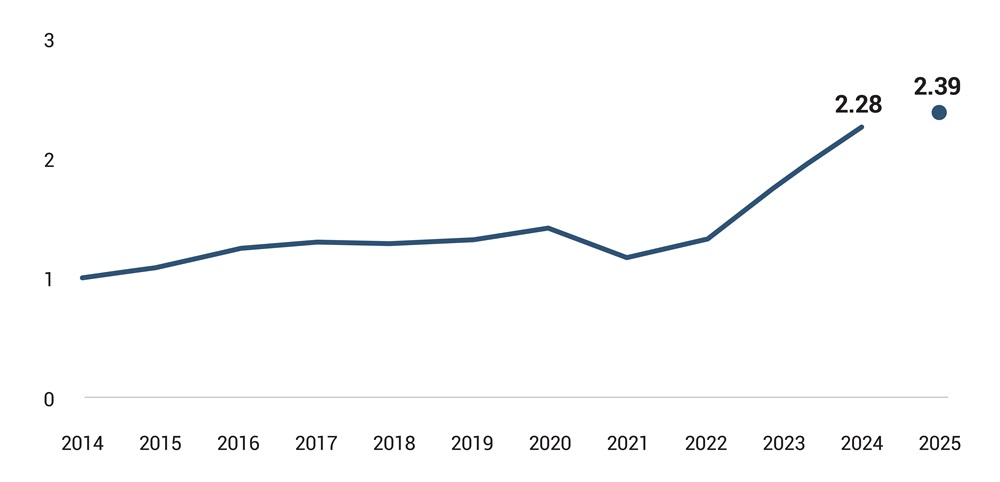

The most important driver of M&A activity in the current venture market is liquidity urgency. In 1Q25, the median time since a startup’s last funding round rose to 2.4 years, more than double the average seen in 2021, as per PitchBook. Meanwhile, the number of VC-backed private companies has reached 59,400, compared with just 4,386 public US companies. The capital overhang from the last cycle, coupled with tighter fundraising conditions, has made M&A the most viable path to liquidity for many venture-backed businesses.

Figure 1: Median Years Since Last Raise for US VC-Backed Companies

Source: PitchBook, data as of March 31, 2025

For investors, this backdrop creates a market where sellers are more flexible and willing to entertain offers at modest valuations. Founders and boards are engaging in sale discussions with fewer preconditions, and capital-efficient acquirers are well-positioned to secure deals with minimal competition. The growing urgency is compressing deal timelines and widening the opportunity for buyers with patient capital and a clear path to integration.

Stabilizing Volumes, Fewer Mega Deals

PitchBook recorded 205 VC-backed M&A deals in 1Q25, with a total disclosed value of $22.7 billion. If this pace continues, 2025 will slightly exceed 2024 in both volume and value. While this signals a stabilizing exit environment, deal values remain far below the $151 billion peak of 2021. The current level represents a new baseline, shaped more by essential liquidity needs than by aggressive growth narratives or inflated valuations.

Larger transactions, particularly those exceeding $1 billion, are rare. PitchBook highlights six key factors suppressing mega-deals, including elevated interest rates, stock-market volatility, cost inflation, and regulatory uncertainty. Even Big Tech has scaled back activity, with just nine deals worth $3.3 billion completed in 2024, compared with 73 deals totaling $33 billion a decade earlier. In this context, investors would be better served by tempering return expectations and prioritizing smaller deals with clear execution paths.

Private Buyers Gain Ground as Public Firms Retreat

Public companies are retreating from the VC-backed M&A market. The number of active public buyers fell from 1,423 in 2021 to 815 in 2024, reducing their share of all acquirers from nearly 24 percent to under 17 percent, as per PitchBook. These firms face higher borrowing costs, compressed stock multiples, and increased scrutiny from regulators, particularly when acquiring younger, growth-oriented targets.

In contrast, private acquirers are stepping in. This group includes private equity (PE) platforms, well-capitalized late-stage startups, and midsize strategic buyers that move quickly and flexibly. Their involvement is reshaping exit paths for venture-backed companies, especially those with sustainable business models and recurring revenue. Investors should prioritize buyer alignment with this cohort and ensure portfolio companies are operationally ready to meet their diligence standards and return thresholds.

Software Dominates by Volume, Biotech by Value

Software remains the most active sector in VC-backed M&A, accounting for over 51 percent of deal volume in 1Q25, as per PitchBook. Its scalability, recurring revenue, and ease of integration continue to attract buyers in a capital-constrained environment. In contrast, biotech and pharmaceutical deals, though fewer, contribute a larger share of total M&A value. These transactions often follow de-risking milestones such as trial results or regulatory approvals. Big Pharma remains active in acquiring these assets to address pipeline gaps. Together, the two sectors show how volume is led by software’s commercial appeal, while value is concentrated in life sciences.

PE’s Expanding Role in VC Exits

PE has become a major exit route for venture-backed companies. Buyouts now exceed IPOs as a share of VC exits, with sponsors especially active in software, healthcare services, and commercial solutions, where bolt-on opportunities and reliable cash flow exist. Tariff disruption and liquidity strain are prompting sponsors to reassess value-creation plans and become more selective in pricing, as per Bain & Company’s 2025 PE Midyear Report. To align with sponsor expectations, portfolio companies must demonstrate operational efficiency, margin expansion, and a path to scalable growth.

What This Means for Investors

The emerging pattern in 2025 calls for revised portfolio strategies. Investors should optimize for smaller, sub-billion-dollar exits rather than waiting for transformative deals. This includes ensuring operational readiness, managing dilution, and preparing for compressed diligence timelines. Exit planning must begin earlier in a company’s lifecycle, with attention to integration readiness and buyer requirements.

Additionally, investors should deepen relationships with private buyers, particularly PE-backed platforms and midsize strategics. These firms now represent the most active sources of liquidity. Flexible deal structures, including contingent payouts and earn-outs, may be necessary to align valuation expectations. In this market, the investors who stay close to the right buyers and move quickly when opportunities emerge will be the ones defining the next phase of venture-backed M&A.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.