While public commitments to environmental, social, and governance (ESG) have softened, sustainable investing in private markets is undergoing a strategic evolution rather than a retreat. Investors increasingly integrate material ESG considerations to enhance resilience, manage risk, and drive long-term value.

The Shift Beneath the Surface: ESG is Evolving, Not Disappearing

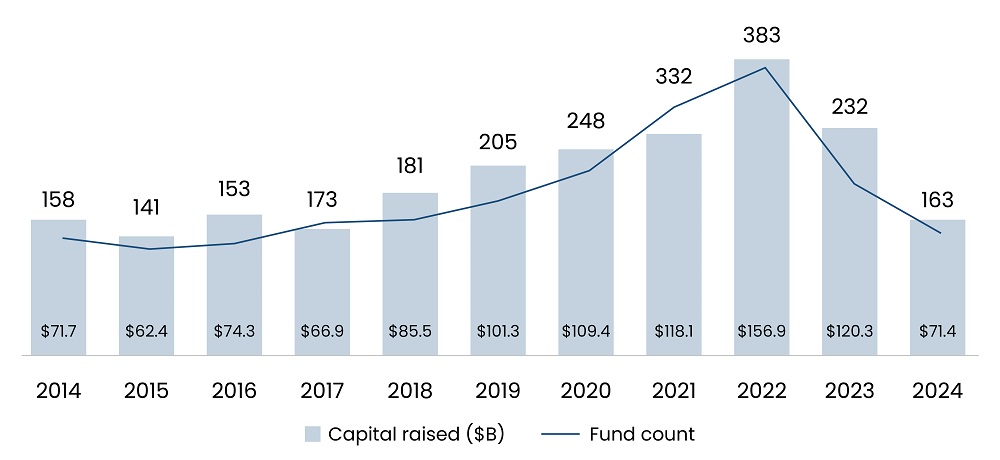

Private equity (PE) firms are recalibrating their approach to ESG amid shifting political and market dynamics. According to PitchBook, there has been a decline in fundraising for impact funds from 383 billion in 2022 to 163 billion in 2024. Despite this, ESG remains a significant factor in investment decisions, with 64% of PitchBook’s 2024 survey respondents considering ESG when making investment decisions. While public ESG commitments have waned, institutional investors continue to integrate ESG considerations into their investment processes.

Figure 1: Global Impact Fundraising Activity

Source: PitchBook, data as of December 31, 2024

Fund managers are adopting subtler terminology such as “responsible investing” or “stewardship,” reflecting a strategic rebranding rather than abandonment. This trend reflects a broader evolution in how PE approaches sustainability. Rather than treating ESG as a headline-grabbing initiative, firms are embedding it more quietly into core investment and risk management practices, focusing on materiality and long-term value creation instead of broad, marketing-driven commitments.

Performance vs. Perception: ESG Does Not Necessarily Mean Lower Returns

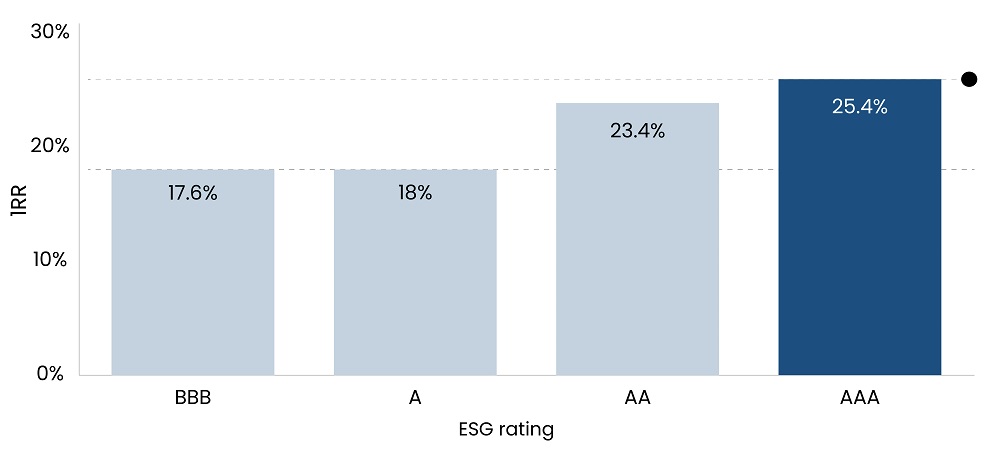

One of the central myths surrounding sustainable investing is that it compromises returns. Recent research challenges this notion. According to Morgan Stanley’s 2024 Sustainable Reality report, sustainable funds achieved a median return of 1.7% in the first half of 2024, compared to 1.1% for traditional funds, indicating modest outperformance. Furthermore, a study by EY-Parthenon found that PE funds with stronger ESG ratings achieved internal rates of return (IRRs) up to 7.8 percentage points higher than their lower-rated counterparts.

Read more: Tariffs Cloud IPO Outlook for US VC-Backed Startups

Figure 2: Net IRR based on the Fund’s average ESG Rating

Source: EY

These findings underline a critical argument that ESG strategies, when thoughtfully applied, can enhance value rather than hinder it. Investors must move past the outdated belief that impact and returns are mutually exclusive. In reality, sustainable practices increasingly align with strong financial performance, especially as stakeholder expectations around resilience, risk management, and corporate governance continue to intensify.

Regulatory Divergence: Europe Charges Ahead While the US Deregulates

While the US regulatory environment under the Trump administration moves toward significant ESG deregulation, Europe remains firmly committed. Sustainability-related disclosure rules such as the Sustainable Finance Disclosure Regulation (SFDR) and Corporate Sustainability Reporting Directive (CSRD) are increasingly shaping the European private investment landscape. Though compliance is costly, it also catalyzes better consistency and comparability across sustainable investing practices.

Interestingly, in 2024, Article 8 and Article 9 funds still captured 29% of European private capital raised despite growing regulatory fatigue, as per PitchBook. This divergence suggests a regional polarization: Europe treats sustainability as a structural investment pillar, while US investors must weigh reputational and litigation risks against political headwinds. The global private markets will likely see sustainable investing standards increasingly split by geography, with cross-border firms having to tailor their disclosures carefully to satisfy varying stakeholder demands.

Climate Investing: Opportunity Remains, but Challenges Loom

Despite political headwinds, climate-related investing continues to command significant private market attention. As per PitchBook, more than $313 billion was raised between 2022 and 2024 for energy transition infrastructure. However, the future is not without risks. In the US, waning government support, new tariffs on renewable inputs, and bureaucratic permitting hurdles will likely depress returns. Infrastructure funds, which rely heavily on public-private partnerships, are expected to face tougher operating environments.

Read more: The Structural Reset in Real Estate Fundraising Amid Volatility

Yet, investors who maintain a long-term view will likely benefit, as fossil fuel depletion and the growing need for resilient energy systems will eventually favor clean technologies. The current moment demands a more selective, data-driven approach. Investors must sharpen their diligence and back assets capable of thriving even without heavy state subsidies. Climate investing remains vital, but achieving attractive returns now requires navigating political volatility with greater precision and pragmatism.

Final Thoughts

If sustainable investing is to endure, it must prove its worth beyond glossy narratives. Measurement and benchmarking challenges plague impact investing today. According to PitchBook, 38% of surveyed investors cited unclear methods of measuring impact as a top challenge. With rising political scrutiny, particularly in the US, simply claiming “good intentions” will not be sufficient. Fund managers must develop more rigorous frameworks for tracking social and environmental outcomes alongside financial performance.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.