Enterprise SaaS M&A in 1Q25 showed a market realigning around pricing discipline, strategic intent, and long-term value. Despite lower headline deal values, activity remained steady and focused, reflecting a shift in priorities rather than a pullback in interest.

Stable Activity, Reset Valuations

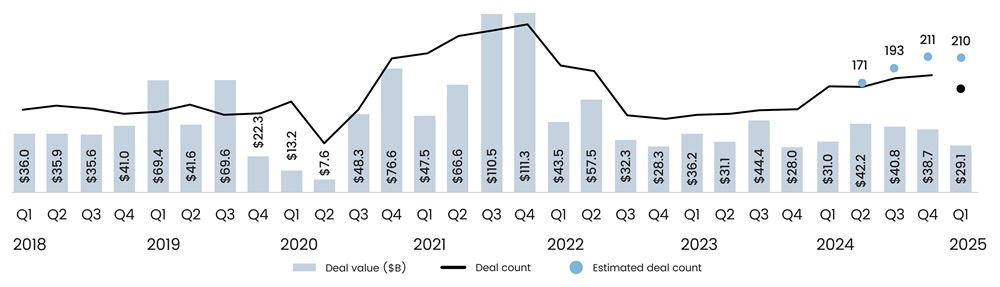

Enterprise SaaS M&A entered 2025 with a sense of stability, as the deal count held steady compared to the prior quarter and exceeded levels from early 2024. But the environment has clearly shifted. Buyers are still active yet increasingly price-sensitive, as total enterprise SaaS deal value fell by 24.8%, from $38.7 billion in 4Q24 to $29.1 billion in 1Q25, as per PitchBook. Rather than indicating weakness, the drop underscores evolving buyer expectations in response to tighter capital and shifting benchmarks.

Figure 1: Global Enterprise SaaS M&A Activity

Source: PitchBook, data as of March 31, 2025

Much of the deal value was driven by a small set of large transactions, while most activity occurred in smaller, more modestly priced acquisitions. This concentration at the top and restraint elsewhere signals a market where quality continues to command attention, but overvalued targets are losing favor. For investors, this environment suggests a shift in how opportunities are assessed and returns are pursued.

PE Demonstrates Growing Influence

Private equity (PE) sponsors played a central role in enterprise SaaS M&A during 1Q, executing a record 73 transactions and contributing $15.3 billion in deal value, a 12% increase from the prior quarter, as per PitchBook. Three of the five largest transactions were sponsor-led, underscoring the sustained appetite from financial buyers despite shifting deal dynamics. With financing conditions improving and pricing expectations adjusting, sponsors are moving decisively to acquire high-quality assets that align with long-term theses. This activity reaffirms enterprise software’s position as a core component in PE portfolio strategies.

Strategic Buyers Turn Selective Amid Volatility

Strategic acquirers completed an estimated 137 enterprise SaaS deals in the 1Q, with total deal value falling to $13.8 billion, as per PitchBook. Rather than signaling a pullback, the decline reflects a selective capital deployment strategy amid market volatility and delayed IPO timelines. According to the Bain Global M&A 2025 Report, elevated interest rates and shifting valuation benchmarks are prompting buyers to reassess how scope deals are structured, with greater emphasis on synergy realization.

Buyers concentrated their efforts on differentiated capabilities such as automation and AI enablement, as seen in ServiceNow’s acquisition of Moveworks and CoreWeave’s acquisition of Weights and Biases. The shift highlights a sharpening of intent, with corporations focusing on high-synergy targets over volume-led expansion. Against the backdrop of heightened scrutiny on pricing, these deals reflect a pragmatic view of long-term growth and integration value.

Venture-Backed Companies Attract Meaningful Exits

Venture-backed companies represented over half of the total enterprise SaaS M&A value during the quarter, generating $14.6 billion in M&A value. This puts the market on pace to surpass 2024’s full-year venture exit value of $39.5 billion by nearly 50%, as per PitchBook. Contrary to narratives of a frozen exit market, venture-backed assets with scale and relevance continue to attract interest from both financial and strategic acquirers.

For investors in growth-stage funds and secondary vehicles, this trend reinforces the viability of the enterprise SaaS exit channel. Companies with proven business models and exposure to automation, productivity, or vertical modernization themes are well-positioned to command attention. This activity suggests that the exit environment is evolving, not closing.

Valuations Adjust to New Cost of Capital

The decline in aggregate deal value this quarter reflects not a weakening of demand but a recalibration of valuations in response to stricter financing norms. Persistently elevated interest rates, inflation concerns, and uncertainty around monetary policy have raised the cost of capital and compressed revenue multiples across the software space. While these pressures are most visible in public markets, private enterprise SaaS transactions are increasingly aligning with this new pricing environment. For investors, the repricing restores discipline, narrows valuation dispersion, and creates a healthier backdrop for long-term capital deployment.

Investor Outlook and Positioning

M&A activity in Q1 was measured, but signs point to a steady pipeline of acquisition-ready companies. The May 2025 announcement of Salesforce’s $8 billion deal for Informatica, not included in Q1 data, signals continued interest in core platforms. Themes like analytics and automation are likely to drive upcoming deals. As IPO timelines stabilize and financing improves, both corporate and PE buyers are expected to stay active.

For investors, the quarter reinforced enterprise software’s role in driving long-term value. Valuation rigor and operational leverage are now more important than multiple expansions. Segments like analytics, AI, and workforce tools offer durable opportunities. Moreover, PE remains central to deal activity, and venture-backed exits provide needed liquidity. As valuations settle and execution improves, exposure to resilient themes will help investors position themselves in the next phase of growth.

About SG Analytics

SG Analytics (SGA) is a global leader in data-driven research and analytics, empowering Fortune 500 clients across BFSI, Technology, Media & Entertainment, and Healthcare. A trusted partner for lower middle market investment banks and private equity firms, SGA provides offshore analysts with seamless deal life cycle support. Our integrated back-office research ecosystem, including database access, design support, domain experts, and tech-enabled automation, helps clients win more mandates and execute deals with precision.

Founded in 2007, SGA is a Great Place to Work® certified firm with 1,600+ employees across the U.S., the UK, Switzerland, Poland, and India. Recognized by Gartner, Everest Group, and ISG and featured in the Deloitte Technology Fast 50 India 2023 and Financial Times APAC 2024 High Growth Companies, we continue to set industry benchmarks in data excellence.