ESG is no more a mere nicety.

Assets managed under responsible investments are worth more than $25 trillion.

In a recent study by KPMG, the consulting giant found that more than 50% of the world’s biggest enterprises invest in ESG consulting or sustainability solutions that reduce future risks and help identify long-term growth opportunities.

If that isn’t convincing, in the first quarter of 2020, when the news of a deadly new virus broke out, sustainable funds reached a high of $45.6 billion. Even Morningstar reported that sustainable indices outperformed their competition.

Experts explain the meteoric rise by the fact that investors today favor long-term growth over short-term bursts, rating sustainability and resilience as their top priorities going forward.

Today, investor portfolios worldwide are crammed with findings like these. The point is that ESG is a win-win, it’s markedly the future, and it would be criminal to not allocate resources to ESG research.

“Investors today favor long-term growth over short-term bursts.”

However, we strongly advocate that in addition to studying the impact of their own business decisions on sustainability, businesses ought to study their competitor’s impact as well. In other words, they must engage in peer benchmarking, in ESG.

Here’s why.

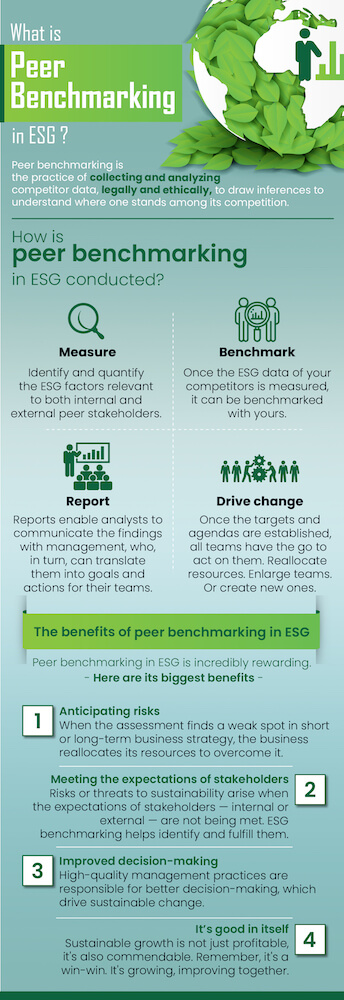

What is peer benchmarking in ESG?

Let’s first understand what it means to benchmark peer ESG.

The first bit is simple.

Peer or competitor benchmarking is one of the products of competitor research — the practice of collecting and analyzing competitor data, legally and ethically.

Peer benchmarking, then, simply is the practice of using the inferences gleaned from that research to understand where one stands among its competition.

Of course, it’s much more complicated than that. Market or competitive research analysts take great efforts to understand their clients’ positioning in depth. They measure every conceivable factor from product management to product marketing.

And therefore, peer benchmarking in ESG is just determining business standing in terms of sustainability practices.

Despite its perception of being narrower and more particular than competitor research as a whole, peer benchmarking in ESG is still highly complex. However, the rewards of carrying it out successfully far outweigh its costs. Its long-term impact on your business is likely to be massive.

Already, enterprises are saving more than $500 million, every year, by participating in key ESG practices like opting for renewable energy over non-renewable energy. One enterprise, in fact, saved more than $2 billion through sustainability achievements.

However, the key practices could not have been realized — let alone achieved — if the enterprises never benchmarked in ESG.

So, how does one do it?

Peer benchmarking in ESG: How?

Broadly, the process constitutes four distinct practices. However, note that the process is not linear — a straight path from A to D. Instead, it’s a cycle that repeats.

In other words, peer benchmarking in ESG is not a one-time exercise. It’s a never-ending process that must be embedded deep into the business DNA, incorporated into its core principles and functioning.

Here they are.

1. Measure

First, identify the ESG factors relevant to both internal and external peer stakeholders.

Comprehensive surveys can achieve this.

However, there are several other ways to gather this information, say, from press releases or customer feedback.

Enterprises are saving more than $500 million, every year, by opting for renewable energy over non-renewable energy.

The only thing peer ESG analysts must ensure is that the questions they are looking for are great in quantity and even greater in quality. The combination of the two ensures that the information collected is as diverse and granular as possible.

In any case, the exercise will produce a list of values important to peer stakeholders. Something like this.

- Fair pay

- Gender equality

- Deforestation

- Sanitation

- Animal welfare

- Data privacy

- Employee well-being

For internal peer stakeholders, the values represent the factors that most impact their business. While for external peer stakeholders — investors, customers — the values represent factors that most influence their decision-making.

Despite being diverse, the data is still vague. To make it measurable and therefore analyzable, it must be quantified.

Quantification is achieved by establishing a baseline or scale on which the values are weighted based on their importance to stakeholders.

2. Benchmark

Once the ESG data of your competitors is measured, it can be benchmarked with yours.

The large volumes of data that convey the performance of a large variety of sustainable practices across every sector are put to test.

They are fed to powerful data analytics tools that rank competitors in terms of transparency, sustainability risk, long-term performance, and other common ESG benchmarks.

Now, the quality of the data and the results of benchmarking largely depend on the factors businesses identify.

The factors listed above are virtually negligible, nowhere near the industry standard. Today, peer benchmarking in ESG involves the identification of hundreds and thousands of factors — 500, on average, and 2000 and more, at its most thorough.

And no, that’s not it.

Those 2000 factors have been utilized to develop more than 600 ratings and benchmarks!

As we said, it’s complex.

Ultimately, businesses must choose the factors, ratings, and benchmarks that serve them best. After all, the practice is also called materiality assessment — assessing issues that are material or relevant to you.

3. Report

The benchmarks are best understood in terms of a report.

Such a report enables analysts to communicate the findings with management, who, in turn, can translate them into goals and actions for their teams.

This is the beauty of a data-driven framework for peer benchmarking in ESG: quantified values lead to quantified positioning, which leads to a quantified or defined target. This target can be further broken down into smaller targets which — thanks to concrete data points — can be clearly communicated to all teams.

That’s how the best strategic decisions are made.

4. Drive change

Once the targets and agendas are established, all teams have the go to act on them.

From the point of view of strategy, resources such as the budget must be reallocated. Teams must be enlarged. Or entirely new ones must be created.

Whatever the strategy adopted or initiatives taken, this is what learning must lead to — doing.

However, the process is far from finished. In fact, it never is.

Businesses must be peer benchmarking in real-time, all the time. That is, keep measuring, benchmarking, reporting, and changing only to do it once again. And again.

The most successful and sustainable business strategy is the one that keeps evolving.

The benefits of peer benchmarking in ESG

Remember that while complex, peer benchmarking in ESG is incredibly rewarding. Here are its biggest benefits.

1. Anticipating risks

By far, its biggest benefit is risk assessment. At the end of the day, peer benchmarking can be summarized as follows: using ESG research to calculate future risks and using that data to mitigate them.

When the assessment finds a weak spot in short or long-term business strategy, the business reallocates its resources to overcome it.

Since the process is never-ending, the result is a constantly evolving strategy optimized for success.

2. Meeting the expectations of stakeholders

Risks or threats to sustainability arise when the expectations of stakeholders — internal or external — are not being met.

The compilation of sustainability reports, essentially, illustrate what those expectations are, and the act of mitigating risks is setting the desired target and hitting it, thereby fulfilling expectations.

What benchmarking in ESG helps with is identifying which businesses excel at this practice, especially in relation to sustainability. After we have learned which ones, we can proceed to leverage the data to learn how they do it.

3. Anticipating growth opportunities

The by-product of forecasting risks is forecasting new growth opportunities.

The trends learned from sustainability reports help analysts anticipate the emergence of new markets.

“Peer benchmarking can be summarized as follows: using ESG research to calculate future risks and using that data to mitigate them.”

ESG factors like customer and investor feedback incorporated into peer benchmarking also enable businesses to assess the unmet expectations of their competitor’s external stakeholders.

This knowledge informs sales and marketing decisions with the intent of targeting those stakeholders, addressing their concerns, winning their trust and confidence.

Their investors then become your investors. Their customers then become your customers.

That’s growth.

4. Improved decision-making

The primary benefits of peer benchmarking in ESG are a sustainable, minimal-risk strategy and proven growth.

But it also has additional, perhaps unexpected benefits.

Businesses can take inspiration from rival businesses with the highest sustainability performance, learning what makes them so outstanding at product development, marketing, or employee well-being, incorporating those or even better practices in their management.

In fact, one would argue that those very high-quality management practices are responsible for better decision-making, which drive sustainable change.

5. It’s good in itself

Sustainable growth is not just profitable, it’s also commendable.

Remember, it’s a win-win. It’s growing, improving together.

The objective of peer benchmarking in ESG is not determining where you stand in relation to your peers.

It’s to use that information to stand out.